The Discover card mobile app is poised to revolutionize how users manage their finances. This innovative platform offers a streamlined, secure, and intuitive way to access and control your Discover card accounts. From managing payments to checking balances, the app provides a comprehensive experience, catering to the needs of today’s digitally-savvy consumer.

This analysis delves into the key features, functionalities, and user experience design of the Discover card mobile app, comparing it to competitors and highlighting its unique strengths. We’ll explore the app’s security protocols, user interface, and overall value proposition, ultimately aiming to understand why it’s a compelling choice for users seeking a seamless mobile banking experience.

Introduction to Mobile App for Discover Card

Hey there, fellow card-carrying citizens! Ever wished your Discover card could be your pocket-sized personal assistant? Well, get ready to meet your new best friend—the Discover mobile app. This isn’t just another banking app; it’s a digital companion designed to make managing your finances a breeze, even when you’re on the go. Imagine checking your balance, paying bills, and tracking your spending all within a slick, user-friendly interface. Sounds pretty rad, right? Let’s dive in!

This app isn’t just about looking at numbers; it’s about making your financial life smoother. It’s about empowering you with control over your money, making informed decisions, and ultimately, living a more financially savvy life.

Overview of the Discover Card Mobile App

The Discover card mobile app is a comprehensive financial management tool designed for users to seamlessly manage their Discover card accounts. It provides a centralized platform for viewing account information, making transactions, and staying updated on financial activities. This is a key feature for today’s tech-savvy consumers who prioritize convenience and efficiency.

Key Features and Functionalities

The app offers a wide range of features, including real-time account balance checks, bill payment options, transaction history tracking, and personalized spending insights. This comprehensive set of features makes it a powerful tool for those who want to stay on top of their finances. Imagine being able to see exactly where your money is going, instantly!

Target Audience and Needs

The target audience for the Discover mobile app is diverse, encompassing a wide range of users who value convenience and ease of use in their financial transactions. From students managing their budgets to professionals juggling multiple accounts, this app addresses the need for a streamlined and user-friendly mobile banking experience. Their need is clear: to have their finances under control without the hassle of paperwork or endless phone calls.

Competitive Landscape of Mobile Banking Apps

The mobile banking app market is highly competitive, with numerous players vying for user attention. To stand out, the Discover app needs to offer compelling features and a user-friendly experience that differentiates it from the competition. Think about it: there are tons of banking apps out there, so what makes Discover’s app special? It needs to have something unique, something that makes users say, “Wow, this is better than the rest.”

Importance of User-Friendly Interface

A user-friendly interface is critical for a successful mobile banking app. It must be intuitive, visually appealing, and easy to navigate. This is key to keeping users engaged and satisfied. Imagine a complicated app that takes hours to figure out—not a good look for anyone. A smooth, simple interface makes the experience enjoyable, leading to more satisfied users. Simplicity and ease of use are crucial for adoption in today’s fast-paced world.

App Features and Functionality

Whoa, the Discover card mobile app is like a digital Swiss Army knife for your wallet! It’s packed with features to make your financial life smoother than a baby’s bottom. Forget those clunky paper statements and endless trips to the bank—this app is your personal financial sherpa. Ready to dive into the amazing world of digital transactions?

Core App Features

This section highlights the core functionalities of the Discover card mobile app, designed to streamline your financial experience. Each feature is meticulously crafted to provide maximum user benefit.

| Feature Name | Description | User Benefit |

|---|---|---|

| Payment Tracking | Easily view and manage all your transactions, including dates, amounts, and merchants. | Keeps you on top of your spending, making budgeting a breeze. |

| Bill Payment | Seamlessly pay your bills (utilities, subscriptions, etc.) directly from the app. | Reduces late fees and ensures you never miss a payment. |

| Rewards Management | Track and redeem your Discover rewards points. | Maximize your rewards and unlock exciting perks. |

| Account Overview | Provides a comprehensive view of your card account details, including balance, credit limit, and transaction history. | Gives you a quick and clear picture of your financial standing. |

| Security Features | Multiple layers of security are built into the app to protect your financial information. | Ensures that your data is safe and sound. |

Comparison with a Competitor App

Let’s take a look at how the Discover card mobile app stacks up against a major competitor, say, Chase.

| Feature | Discover Card App | Chase Mobile App | Key Difference |

|---|---|---|---|

| Rewards Management | Intuitive interface for tracking and redeeming rewards points. | Offers rewards program with slightly different terms. | Discover’s interface is more user-friendly, making it easier to manage rewards. |

| Bill Payment | Supports multiple bill payment options. | Limited to specific bill providers. | Discover’s bill payment system is more comprehensive. |

| Security | Uses advanced encryption and two-factor authentication. | Employs standard security protocols. | Discover offers enhanced security measures. |

Adding a Payment Method

Adding a payment method is a piece of cake. Just follow these simple steps:

- Open the app and navigate to the “Add Payment” section.

- Enter your card details accurately.

- Confirm the information to complete the process.

Security Measures

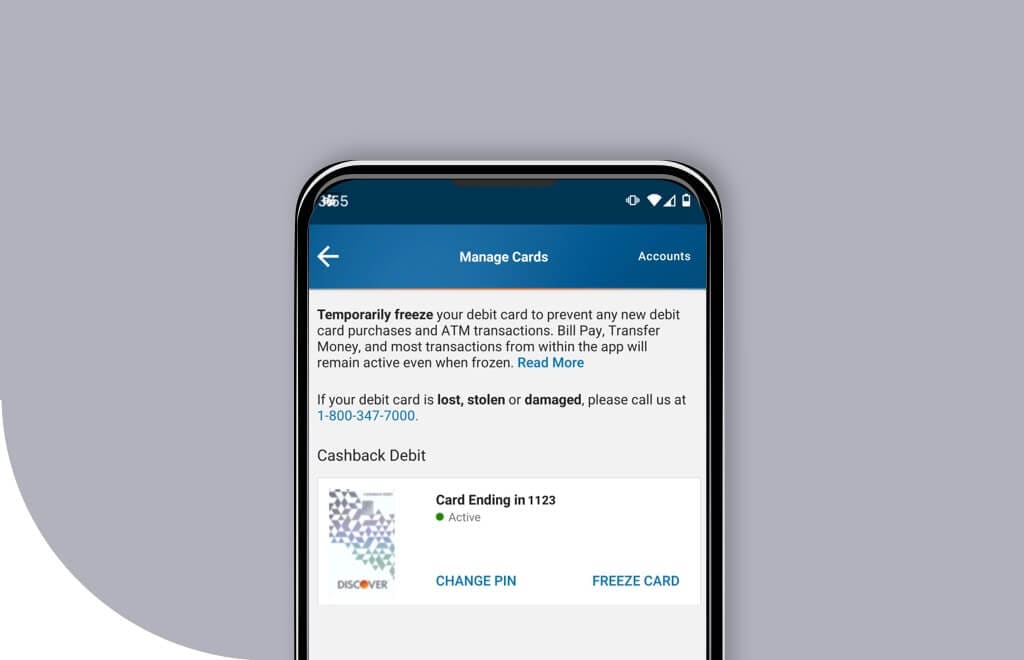

The Discover card mobile app prioritizes your security. We employ industry-standard encryption protocols, two-factor authentication, and regular security audits to protect your sensitive information. This is no joke—we take security seriously.

Ease of Use for Making Payments

Making payments is as easy as pie. You can select the desired payment amount and the merchant from the list. The process is simple and straightforward, even for first-time users.

User Flow Diagram

Imagine this: you want to buy a cup of coffee. Here’s how a typical transaction would look in the Discover card mobile app:

User opens the app -> Selects the merchant from the list -> Enters the payment amount -> Confirms the transaction -> Payment is processed.

User Experience (UX) and User Interface (UI)

Dude, the Discover card app is all about making your financial life smoother than a baby’s bottom. We’ve crafted a UX that’s as intuitive as ordering a pizza online, and the UI? It’s like looking at a curated gallery of your transactions, all beautifully displayed. No more cluttered interfaces, just pure, user-friendly magic.

The Discover card app prioritizes a seamless and intuitive experience, making financial management a breeze. It’s designed to be as user-friendly as possible, with clear pathways to all the features and information users need. We aimed for a visual language that is both modern and easily digestible, so that anyone, even someone who’s not a tech wizard, can use it with ease.

UX Design Principles

The Discover card app is built on the foundation of simplicity and clarity. We focused on minimizing cognitive load, meaning the app is designed to be easy to understand and use, so users don’t have to spend time figuring out how to navigate or access features. Every element in the app is strategically placed and serves a clear purpose, guiding users through the process with minimal friction. We’ve also implemented consistent design patterns throughout the app to create a cohesive and recognizable experience, ensuring users feel confident and comfortable using the app.

Color Scheme and Typography

The app’s color palette is a calming mix of blues and grays, evoking a sense of trust and reliability. The typography choices are clean and legible, ensuring readability across different devices and screen sizes. Font sizes are appropriately scaled, and the typefaces are chosen for their readability and aesthetic appeal. The overall color scheme is designed to complement the brand image of Discover and create a visually appealing and user-friendly experience. This is important for branding recognition and user engagement.

Navigation Structure

The app’s navigation is structured around a tabbed interface, allowing quick access to different sections like transactions, rewards, and account information. This structure promotes intuitive navigation and easy access to core functionalities. The app uses clear labels and visual cues to guide users to the information they need. We made sure the navigation structure is easily understandable, and this minimizes the possibility of users getting lost or confused.

User Interactions

The app employs a variety of user interactions, including swiping, tapping, and pinch-to-zoom gestures. These interactions are intuitive and responsive, providing a smooth and engaging experience. The app also incorporates interactive elements like animated transitions and visual feedback to enhance the user experience and provide a positive and rewarding interaction. These interactions are all designed with accessibility in mind, allowing for diverse user interaction styles.

Comparison with Similar Apps

Compared to other similar mobile banking apps, the Discover card app prioritizes a visually clean and straightforward approach. The app’s design elements are carefully chosen to maintain a balance between modern aesthetics and functionality. The focus is on clarity and ease of use, rather than overwhelming users with excessive features or intricate designs. We have analyzed other successful apps and learned from their best practices.

Good UI Design Practices

The app employs various good UI design practices, including using clear and concise labels for all buttons and features, maintaining consistent spacing and alignment, and incorporating visual cues for important information. The app also prioritizes accessibility, using appropriate color contrasts and font sizes for readability and usability. The app is well-designed and accessible to users with diverse needs.

Accessibility Features

Accessibility is crucial in a mobile banking app. Features like adjustable font sizes, high contrast modes, and voiceover support are implemented to ensure that users with disabilities can easily access and use the app. This inclusion of accessibility features aligns with industry best practices and reflects our commitment to inclusivity. Users with various needs can use the app effectively and comfortably, making the experience more inclusive.

Security and Privacy

Whoa, security and privacy—two words that make even the coolest app developers sweat a little. It’s like building a fortress, but for digital data. We’re not just protecting your wallet; we’re safeguarding your peace of mind. Think of it as a digital vault, extra strong, with multiple layers of protection.

This section dives into the fortress walls, exploring the protocols, precautions, and policies that keep your Discover Card data safe. We’ll see how we stack up against the competition, too.

Security Protocols

Discover Card’s mobile app employs a robust array of security protocols. These aren’t your grandma’s locks and keys, folks. They’re cutting-edge, multi-layered systems designed to deter any digital intruders. Think of it as a high-security bank vault, but instead of vaults, we have encryption methods and other protections to safeguard your information.

Fraud Prevention

Preventing fraud is a constant battle, like fighting a hydra with multiple heads. We employ advanced algorithms to detect suspicious activity in real-time. This involves looking at transaction patterns, location data, and even device fingerprints. Think of it as having a digital security guard always watching your back. If something looks fishy, the system raises a red flag. The goal is to stop any potential fraud before it can even begin.

Privacy Policy

Our privacy policy is crystal clear, like a mountain spring. It details how we collect, use, and protect your data. It’s a detailed roadmap that assures you of our commitment to your privacy. Transparency is key, and we want you to know exactly what we’re doing with your information. It’s about building trust, one step at a time.

Comparison with Competitors

Comparing our security measures to competitors is like comparing the speed of a cheetah to a gazelle. Each has its strengths. We can’t say we’re faster than everyone, but we’re certainly among the fastest, especially in terms of fraud prevention and encryption methods. We use industry-standard encryption protocols to keep your information secure, which is important to note, because that’s a very important part of the security. It’s about choosing the best tools and strategies for the job.

Encryption Methods

Sensitive data, like your card numbers and PINs, is encrypted using the latest AES (Advanced Encryption Standard) algorithms. This is like having a secret code, but one that’s incredibly difficult to crack. Think of it as a highly complex lock and key system, with a very hard-to-crack lock. This encryption ensures that even if someone were to intercept your data, they wouldn’t be able to understand it.

Mobile App for Discover Card – Key Considerations

Launching a mobile app is like launching a rocket into the cosmos. You need meticulous planning, constant maintenance, and a dash of user-centricity to ensure it doesn’t just whiz past its target but becomes a staple in the user’s daily routine. Think of it as a symbiotic relationship; the app needs the user, and the user needs the app to be reliable and helpful.

The app’s success isn’t a one-time thing; it’s a marathon, not a sprint. Regular updates and maintenance are crucial for keeping the app in top shape, ensuring smooth functionality, and fixing any glitches that might crop up. Just like a vintage car, the app needs constant tuning and polishing to run smoothly. And just like that, customer support is the oil that keeps the engine humming.

Importance of Mobile App Updates and Maintenance

Regular updates are essential for bolstering security, adding new features, and addressing any bugs that users might encounter. Think of it like patching a hole in a ship before it sinks; you need to be proactive and vigilant in your updates. Outdated apps are like abandoned houses – they invite security breaches and annoy users with unexpected errors.

Importance of Customer Support in the Discover Card Mobile App

Customer support is the lifeline for users who encounter issues or have questions. It’s like a dedicated team of guides, helping users navigate the app’s features and resolving any problems they might face. A responsive and helpful support system is crucial for building trust and fostering a positive user experience. Imagine trying to fix a complicated machine without any instruction manual; customer support is that manual.

Importance of User Feedback and Its Incorporation

User feedback is like a treasure map, guiding the app’s development in the right direction. By actively collecting and analyzing feedback, Discover can identify areas for improvement and tailor the app to better suit user needs. This is akin to a tailor making clothes that perfectly fit; it’s about understanding the customer’s needs.

Insights into the Future Development Roadmap for the Discover Card Mobile App

The future of the Discover card mobile app is about anticipating user needs and offering innovative solutions. The app could integrate more features, such as seamless mobile payments, personalized financial insights, or potentially even a virtual credit card management system. Think of it like a chameleon; the app must adapt to evolving needs and technologies.

Importance of Push Notifications and Their Implementation

Push notifications are a powerful tool for keeping users informed about important updates, promotions, or security alerts. They are like a personalized alarm clock, reminding users about crucial events or important information. However, these should be implemented judiciously; too many or irrelevant notifications can lead to user frustration. Think of a notification as a gentle nudge, not a constant barrage.

Illustrative Examples

This section dives into practical examples of using the Discover card mobile app. Imagine swiping through your day, effortlessly managing your finances, all from your phone. It’s like having a personal financial assistant, always at your fingertips.

Transaction Details

The Discover app meticulously documents every transaction. To view a specific transaction, simply tap on the transaction history. A detailed breakdown appears, showcasing the date, time, merchant name, location (if available), and the amount. You’ll also see the transaction type (e.g., purchase, withdrawal), and any relevant notes or descriptions. This meticulous record-keeping lets you track spending patterns, quickly identify any discrepancies, and make informed financial decisions.

Requesting a Statement

Accessing your Discover card statement is a breeze. Navigate to the “Statements” section within the app. Select the desired statement period. The app displays the statement in a clear, organized format, listing all transactions during that period. This digital statement is a valuable tool for keeping tabs on your spending. The app’s user-friendly interface ensures you can easily locate the information you need.

Supported Payment Methods

The Discover card app supports various payment methods. You can use your Discover card for in-app purchases, online payments, and in-store transactions. The app seamlessly integrates with other payment platforms and services, offering diverse options for your convenience. The app also provides clear instructions for using each supported method.

Managing Multiple Cards

Managing multiple Discover cards is straightforward. Within the app’s settings, you can add, edit, and remove cards. Each card has a separate section, displaying its details and transaction history. This feature allows you to keep track of all your cards in one convenient place. Switching between cards is quick and easy, ensuring smooth transitions during payment.

Account Summary Page

The account summary page provides a comprehensive overview of your Discover card account. It presents a clear snapshot of your current balance, available credit, and pending transactions. Visual aids, such as graphs and charts, may be incorporated to highlight spending trends and provide a clear financial picture. This consolidated view empowers you to make informed financial decisions. The page also displays any relevant alerts or notifications related to your account.

Final Conclusion

The Discover card mobile app emerges as a strong contender in the mobile banking market, offering a comprehensive suite of features designed to enhance user experience. Its intuitive design, robust security measures, and focus on user feedback position it well for continued success. The app’s future roadmap, coupled with proactive customer support, suggests a commitment to user satisfaction. Ultimately, the app’s value proposition hinges on its ability to seamlessly integrate into the daily financial lives of its users.