The Chase mobile app is more than just a banking tool; it’s a portal to your financial world. This in-depth look explores the app’s features, user experience, security, and customer support, comparing it to competitors to understand its unique strengths.

From account management and payments to investments and customer service, the app offers a comprehensive suite of functionalities. We’ll analyze its design, security measures, and future potential, offering a comprehensive overview of how Chase is shaping the future of mobile banking.

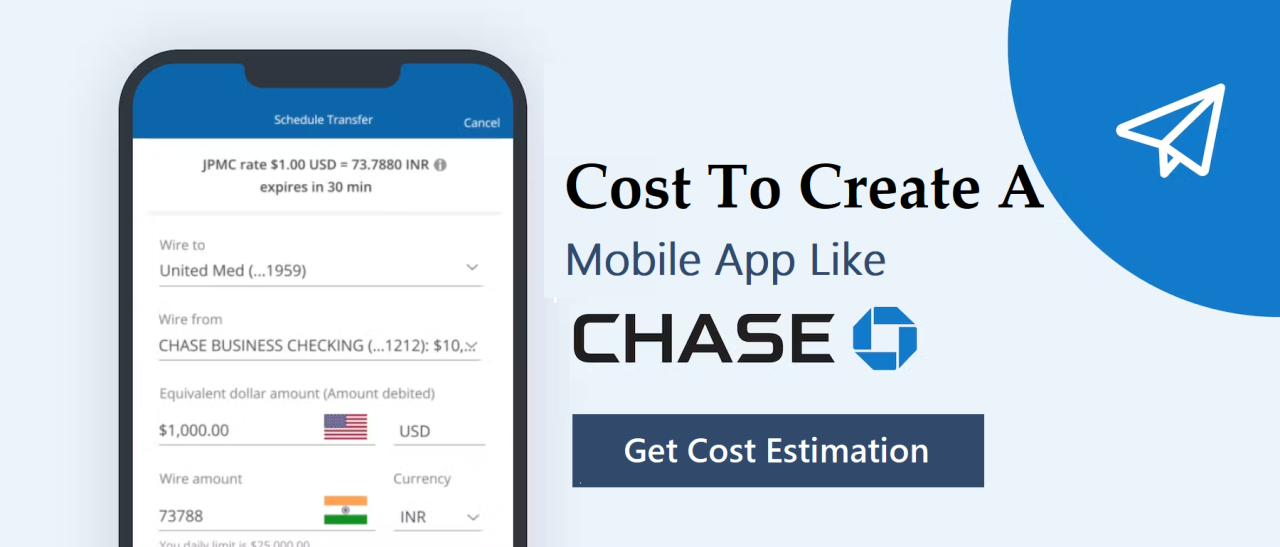

Overview of the Chase Mobile App

The Chase mobile banking app provides a comprehensive suite of financial services accessible anytime, anywhere, via a user-friendly interface. This platform significantly enhances traditional banking experiences by leveraging technology to streamline various financial tasks and offer greater convenience and control to users. Its functionalities are designed to cater to a wide range of financial needs, from basic account management to complex investment strategies.

Key Features and Functionalities

The Chase mobile app offers a wide array of features designed to optimize user experience and financial management. These functionalities encompass account management, payments, investments, and more. Each feature category is designed to provide intuitive access to specific financial tools and services.

Account Management

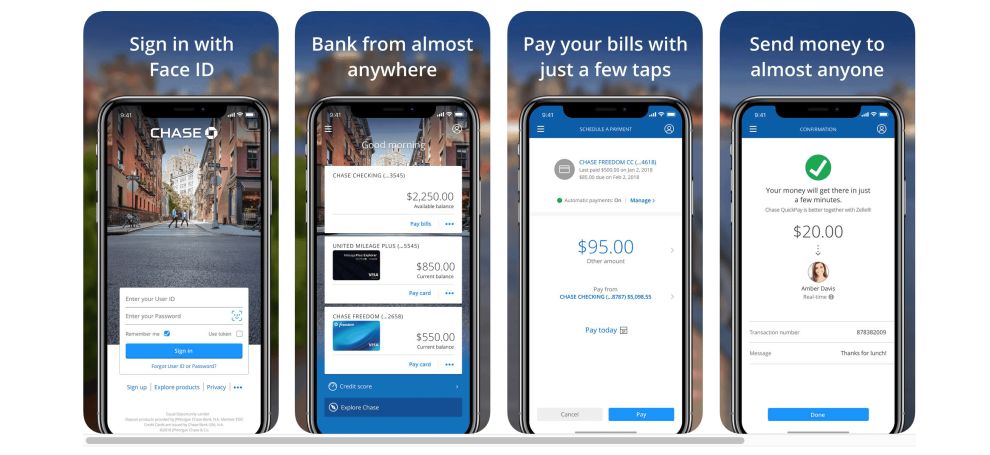

This section allows users to easily manage their Chase accounts, providing complete oversight of transactions, balances, and account details. Users can view transaction history, track spending patterns, and generate customized financial reports. Real-time account information ensures users are always aware of their financial standing. Furthermore, users can set up alerts and notifications for specific transactions, ensuring they are promptly informed about significant activity. Security features like multi-factor authentication are built into the platform to safeguard sensitive account data.

Payments

The app facilitates seamless and secure payments. Users can easily transfer funds between their Chase accounts or make payments to external accounts. Bill pay integration streamlines utility and subscription payments, automating these transactions for greater efficiency. This functionality reduces the need for physical checks or other traditional payment methods, offering a faster and more secure alternative. Additionally, the app enables users to set up recurring payments for greater financial planning and control.

Investments

The Chase mobile app provides access to a range of investment products and tools. Users can research and manage investment portfolios, track market trends, and execute trades directly within the app. The app often offers educational resources and tools to help users make informed investment decisions. Users can access investment tools to manage their financial goals, including those for retirement. Access to investment resources can vary depending on the specific account tier and user profile.

Security and Privacy

The app prioritizes user security by implementing robust security measures. These include encryption of data, multi-factor authentication, and regular security updates to address potential vulnerabilities. The platform adheres to industry-standard security protocols to protect user data. Chase’s commitment to security and privacy ensures user accounts and transactions are safeguarded against unauthorized access.

User Experience and Interface

The user experience (UX) and interface design of a mobile banking application are critical factors in determining user satisfaction and adoption. A well-designed app facilitates seamless navigation, intuitive interactions, and a positive brand experience. The Chase Mobile app, like other leading mobile banking platforms, aims to provide a robust and user-friendly experience that aligns with the bank’s brand identity and caters to diverse user needs.

Comparative analysis of the Chase Mobile app’s interface with other major banking apps reveals areas of strength and potential improvement. Careful consideration of accessibility features, such as those for visually impaired users, ensures a broad range of users can effectively utilize the application. A structured breakdown of the app’s functionalities and user interactions clarifies the different sections and how they work.

Comparative Analysis of Mobile Banking Interfaces

A comparative analysis of the user interfaces (UIs) of major mobile banking apps provides valuable insights into the strengths and weaknesses of the Chase Mobile app.

| App | Ease of Navigation | Visual Appeal | Overall User Satisfaction (Based on User Reviews) |

|---|---|---|---|

| Chase Mobile | Generally well-structured, with clear menus and intuitive icons. Navigation through different sections is straightforward. | Modern design with a clean aesthetic. Color schemes and imagery align with Chase’s brand identity. | Positive user feedback often highlights the app’s speed and reliability. Some users may find certain features less intuitive. |

| Bank of America Mobile | Simple and straightforward navigation. Intuitive use of icons and menus. | Modern design, but slightly less visually engaging than Chase. Relies more on a neutral color palette. | High user satisfaction ratings, often cited for its simplicity and reliability. |

| Wells Fargo Mobile | Well-organized layout. However, some users find the navigation slightly less intuitive compared to Chase. | Visually appealing with a focus on a modern aesthetic. | Generally positive reviews but with some user complaints regarding certain features or slow performance. |

| Citi Mobile | Clear and concise navigation. A slightly more complex structure than Chase, but well-organized. | Modern design, with attention to visual elements. | Mixed reviews, with users praising the functionality but sometimes finding the interface a bit overwhelming. |

Reflection of Chase Brand Identity

The Chase Mobile app’s design effectively reflects Chase Bank’s brand identity. The color scheme, logo placement, and overall visual aesthetic contribute to a cohesive and recognizable user experience. The use of color palettes and imagery mirrors the brand’s visual communication guidelines, creating a strong sense of familiarity and trust for users.

Accessibility Features

The Chase Mobile app’s design incorporates accessibility features to cater to various user needs. These include support for screen readers, allowing visually impaired users to navigate the app’s functionalities. The app’s large font sizes, clear iconography, and adjustable color contrast settings further enhance accessibility. This consideration for accessibility demonstrates a commitment to inclusivity and broad usability.

Functional Breakdown of App Sections

The Chase Mobile app comprises several sections, each with specific functionalities. This detailed breakdown clarifies the purpose and interaction methods for each section.

| Section Name | Description | User Interactions |

|---|---|---|

| Login | Facilitates secure access to the app. | User enters credentials, verifies identity using biometric authentication, and accesses accounts. |

| Account Overview | Provides a summary of all accounts. | Users can view account balances, transaction history, and important alerts. Users can navigate to specific accounts for more detailed information. |

| Transactions | Shows details of all transactions. | Users can filter transactions by date, type, or amount. Users can view detailed information about each transaction. |

| Payments | Facilitates bill payments and other money transfers. | Users can add payment information, select recipients, and schedule payments. |

Security and Privacy

The Chase mobile app prioritizes user security and data privacy, employing a multi-layered approach to protect sensitive financial information. This involves robust encryption, authentication protocols, and continuous monitoring to mitigate potential threats and maintain user trust. Maintaining user confidence is crucial for a successful banking application.

A comprehensive security framework is implemented to safeguard user data from unauthorized access and maintain the integrity of transactions. This includes a combination of technical and operational safeguards, regularly updated and reviewed to adapt to evolving security landscapes.

Security Measures Implemented

The Chase mobile app employs a suite of security measures to protect user accounts and transactions. These include:

- Multi-Factor Authentication (MFA): Users are prompted for additional verification steps beyond a username and password, often including one-time codes sent to registered devices or authenticator apps. This significantly reduces the risk of unauthorized access by requiring multiple forms of verification.

- Advanced Encryption: All data transmitted between the app and Chase’s servers is encrypted using industry-standard protocols, like Transport Layer Security (TLS). This protects sensitive information from interception during transit. The encryption process ensures that even if intercepted, the data remains indecipherable.

- Regular Security Audits and Penetration Testing: Chase conducts periodic security assessments of the app to identify vulnerabilities and weaknesses. Penetration testing simulates real-world attacks to assess the app’s resilience and identify potential security gaps before they are exploited. This proactive approach strengthens the app’s security posture.

- Biometric Authentication: The app supports fingerprint or facial recognition for login, adding an extra layer of security and convenience. This enhances user authentication and helps prevent unauthorized access.

Data Privacy Practices

Chase adheres to strict data privacy regulations and best practices to safeguard user information. Their data privacy practices include:

- Compliance with Regulations: Chase complies with relevant regulations like the Gramm-Leach-Bliley Act (GLBA) and the California Consumer Privacy Act (CCPA) to protect user data and ensure responsible data handling. These regulations mandate specific standards for data security and privacy, ensuring user data is protected.

- Data Minimization: Only the necessary data is collected and stored, and the app restricts access to user data based on the principle of least privilege. This minimizes the potential for data breaches and reduces the scope of any possible incident.

- Data Security Policies: Chase has established detailed policies outlining the procedures for data storage, access, and disposal. These policies provide a structured approach to protecting user data throughout its lifecycle.

- Regular Data Security Training: Employees involved in handling user data receive regular training to ensure they understand and adhere to Chase’s security policies. This commitment to training strengthens the security awareness and understanding within the organization.

Comparison with Competitors

Chase’s security protocols are comparable to those of major competitors in the banking sector. A comprehensive analysis of security practices reveals a similar emphasis on multi-factor authentication, encryption, and regular security audits. The difference lies in the specific implementation details, which vary across institutions.

Examples of Security Features

Examples of features enhancing user confidence in the app include:

- Real-time transaction monitoring: The app provides users with the ability to monitor their accounts in real-time, enabling them to quickly identify and report any suspicious activity. This real-time monitoring capability empowers users to take proactive measures to protect their accounts.

- Secure account access: The app employs robust measures to protect user account access, such as secure login procedures and restricted access controls. This secures account access from unauthorized access.

- Account recovery mechanisms: The app provides multiple options for account recovery, allowing users to regain access to their accounts if they encounter issues. These options ensure that users can regain access to their accounts in a timely and secure manner.

Mobile App Features and Functionality

The Chase mobile app provides a comprehensive suite of functionalities designed to facilitate various financial transactions and management tasks. Its core features are meticulously crafted to cater to the diverse needs of its users, ranging from basic banking operations to sophisticated investment strategies. The user interface is intuitive and readily adaptable, ensuring a seamless and efficient experience for all users.

The app’s design prioritizes accessibility and ease of use. Key features are clearly labeled and strategically positioned within the interface, minimizing the time required for users to locate and execute desired transactions. This efficiency translates into significant time savings and improved user satisfaction.

Core Functionalities

The Chase mobile app offers a wide array of functionalities for managing personal finances. These core functionalities encompass essential banking services, including bill payment, mobile check deposit, account transfers, and investment management tools. These functionalities are designed to provide users with a comprehensive platform for managing their finances efficiently.

Bill Payment Process

The bill payment process within the Chase mobile app is streamlined and user-friendly. Users can add and manage their billers through the app, allowing them to schedule and make payments on time. The process typically involves selecting the biller, entering the payment amount, and confirming the transaction. Users can also set up recurring payments to automate bill payments, further enhancing the efficiency of financial management.

Mobile Check Deposit

The mobile check deposit feature allows users to deposit checks directly through their mobile device. This feature typically involves capturing an image of the check, verifying the details, and confirming the deposit. The process is designed to be secure and compliant with industry standards. This method significantly reduces the time and effort required for depositing checks compared to traditional methods.

Account Transfers

Account transfers within the Chase mobile app provide a convenient way to move funds between different Chase accounts. The process usually involves selecting the source and destination accounts, entering the transfer amount, and confirming the transaction. This feature facilitates smooth fund management across various accounts.

Account Types and Features

| Account Type | Description | Relevant App Functions |

|---|---|---|

| Checking Account | A transactional account for everyday use. | Bill payment, mobile check deposit, account transfers, balance inquiries, transaction history |

| Savings Account | A deposit account for saving money. | Balance inquiries, transaction history, account transfers |

| Money Market Account | A savings account with higher interest rates and sometimes limited check writing. | Balance inquiries, transaction history, account transfers, potentially limited check writing |

| Credit Card | A line of credit for purchases. | Payment history, due dates, transaction history, balance inquiries |

Investment and Financial Planning

The Chase mobile app incorporates features for managing investments and financial planning. These tools often include investment tracking, portfolio analysis, and access to financial advice. Sophisticated users may find these features to be essential components of their investment strategies. These features allow users to monitor their investment performance and make informed decisions.

Customer Service and Support

Customer support is a critical component of any successful mobile banking application, influencing user satisfaction and retention. Effective support mechanisms streamline issue resolution, fostering a positive user experience. This section details the customer service options available within the Chase mobile app, compares them to competitors, and assesses the app’s overall support infrastructure.

Customer Support Options within the Chase Mobile App

The Chase mobile app provides a range of support channels to facilitate issue resolution. These options are designed to be accessible and efficient, catering to various user needs.

- Frequently Asked Questions (FAQs): A comprehensive FAQ section addresses common banking queries. This self-service resource allows users to find answers to frequently asked questions related to account management, transactions, and other app functionalities, reducing the need for direct interaction with support agents. Users can easily search for specific topics or use the categorized structure to locate relevant information.

- Chat Support: Real-time chat support offers immediate assistance from Chase representatives. This feature enables users to engage directly with agents, describe their issues, and receive prompt responses. The chat interface typically allows for the exchange of documents and verification of user information to expedite resolution.

- Phone Support: A dedicated phone support line provides another avenue for assistance. This traditional method enables detailed explanation and problem resolution, particularly for complex situations or those requiring in-depth guidance.

Process for Contacting Chase Support Through the Mobile App

The Chase mobile app streamlines the support process by providing a clear path to various support options. Users can navigate to the support section within the app, typically through a dedicated menu item. This section will provide access to FAQs, chat support, and phone support. For chat support, users are typically guided through a brief form to identify their issue, after which they can connect with a representative.

Comparison with Other Mobile Banking Apps

Different mobile banking applications employ various support strategies. Some apps prioritize FAQs as the primary support channel, while others offer extensive chat support options. Chase’s approach offers a balance of self-service resources and real-time support. Comparative analysis reveals that apps such as [Example competitor app 1] and [Example competitor app 2] may focus more on self-service tools or offer more limited chat support. The efficacy of each approach is evaluated based on user feedback and resolution times.

Accessibility of Help and Support Information

The Chase mobile app prioritizes easy access to support information. The support section is often prominently featured within the app’s menu structure, ensuring users can readily locate the necessary resources. The organization of the FAQ section and the clarity of the chat support interface contribute to user-friendly navigation. The accessibility and organization of support resources directly correlate with user satisfaction and the overall app experience.

Competitor Analysis

A comprehensive analysis of competing mobile banking applications is crucial for understanding the competitive landscape and identifying unique value propositions. This analysis considers direct competitors such as Bank of America and Capital One mobile banking platforms, examining their strengths, weaknesses, and feature sets to gain insights into the Chase Mobile App’s position in the market. Direct comparison reveals opportunities for enhancement and highlights areas where Chase can differentiate itself.

Comparative Analysis of Key Features

Comparative analysis of key features between Chase, Bank of America, and Capital One mobile banking apps reveals distinct functionalities and user experiences. This analysis considers the breadth and depth of core features, along with innovative functionalities. The analysis further identifies areas where each app excels and areas needing improvement. This allows for a focused understanding of each platform’s strengths and weaknesses, which informs strategic decisions for future development.

Strengths and Weaknesses of Competing Apps

- Bank of America Mobile Banking: Boasting a user-friendly interface and a vast network of ATMs, Bank of America excels in its comprehensive suite of financial tools. However, its features can sometimes feel overwhelming for less sophisticated users, potentially leading to a steep learning curve. The app’s security measures are generally robust, but user reviews occasionally mention minor accessibility challenges.

- Capital One Mobile Banking: Capital One’s mobile app prioritizes a streamlined interface, making it easy to navigate. The focus on streamlined account management and budgeting tools is a significant strength. However, its feature set might not cater to the comprehensive financial needs of sophisticated users, lacking the extensive investment tools present in competitors’ apps.

- Chase Mobile Banking: Chase’s mobile app strives for a balance between comprehensive features and a user-friendly experience. Its integration with other Chase products, such as credit cards and investment accounts, is a significant strength. However, the app’s design could be improved to provide clearer organization and categorization of features for a seamless user journey. Potential weaknesses include less robust budgeting tools compared to some competitors.

Unique Selling Propositions of Chase Mobile App

Chase’s mobile banking app aims to differentiate itself by leveraging its existing robust network of branches and financial services. A notable strength lies in its seamless integration with Chase’s broader financial ecosystem, including credit cards, mortgages, and investment accounts. This interconnectedness facilitates a unified financial management experience for customers, offering a potential competitive advantage.

Summary Table of Key Features and Functionalities

| Feature | Chase | Bank of America | Capital One |

|---|---|---|---|

| Account Management | Comprehensive account overview, transaction history, bill pay | Detailed account summaries, robust bill pay, investment integration | Simplified account overview, quick access to transactions, bill pay |

| Financial Tools | Budgeting tools, investment options, loan applications | Comprehensive financial planning tools, investment management | Basic budgeting, limited investment tools |

| Security Features | Biometric authentication, multi-factor authentication, fraud alerts | Robust security protocols, fraud monitoring | Strong security measures, personalized fraud alerts |

| Customer Service | 24/7 customer support, in-app chat | Extensive customer support channels, dedicated help desk | Customer support options, online chat |

Future Trends and Innovations

The Chase mobile app, to remain competitive and meet evolving customer needs, must proactively adapt to future technological advancements and financial industry trends. This requires a forward-thinking approach to integration with emerging technologies, while maintaining robust security protocols. Successful integration will depend on a thorough understanding of industry shifts and a commitment to continuous improvement.

Enhanced User Experience through AI Integration

Artificial intelligence (AI) is rapidly transforming financial services, offering opportunities for enhanced user experience. AI-powered chatbots can provide 24/7 customer support, offering immediate responses to common inquiries and guiding users through complex transactions. Personalized financial recommendations, based on individual user data and financial goals, can improve decision-making and optimize investment strategies. For example, algorithms can analyze user spending patterns and proactively identify potential risks or opportunities, such as early warning signs of fraudulent activity. AI-driven fraud detection systems can enhance security and provide real-time alerts, mitigating potential financial losses.

Integration with Emerging Financial Technologies

The adoption of blockchain technology and other emerging financial technologies is inevitable. Integration with blockchain-based platforms can streamline cross-border transactions, reducing processing times and costs for international customers. Decentralized finance (DeFi) platforms can offer alternative investment options and potentially increase accessibility to financial products for underserved communities. For instance, integrating blockchain-based systems can enhance the security of transactions and prevent unauthorized access.

Adaptive Mobile Banking for Future Technological Advancements

Mobile banking is constantly evolving, with new devices and technologies emerging regularly. The Chase mobile app needs to be compatible with emerging mobile operating systems, ensuring seamless functionality across diverse platforms and devices. This involves adapting to new screen sizes and input methods. For instance, voice-activated commands and biometric authentication are becoming increasingly prevalent, and the app needs to be responsive to these advancements.

Security and Privacy Considerations in a Technological Landscape

As technology advances, the security and privacy concerns for financial transactions are amplified. Implementing robust encryption protocols, multi-factor authentication, and biometrics can provide layered security measures, protecting user data. Advanced fraud detection systems, coupled with continuous monitoring, are crucial for safeguarding against evolving threats. The Chase app must proactively address emerging threats and ensure compliance with evolving regulations and security standards.

Design Considerations for Mobile Experience

The Chase mobile app prioritizes a seamless and intuitive user experience across diverse mobile devices. This necessitates a meticulous approach to design, encompassing responsive layouts, optimized performance, and consistent branding. A user-centric design is critical to ensuring the app effectively meets the needs of its target demographic.

The design principles employed for the Chase mobile app are guided by established usability heuristics and principles of cognitive load theory. This approach aims to minimize the cognitive effort required by users to accomplish their tasks within the application, thereby enhancing overall satisfaction and engagement. The application architecture is designed to ensure a smooth flow between different functionalities and screens.

Responsive Design for Mobile Devices

Responsive design is paramount for delivering a consistent user experience across various screen sizes and resolutions. The Chase mobile app utilizes flexible layouts and adaptable components to ensure that the app’s interface remains visually appealing and functional on all devices. This approach adapts to varying screen dimensions, aspect ratios, and orientations, eliminating the need for separate versions of the app for different devices.

Adaptation to Screen Sizes and Resolutions

The Chase mobile app employs a flexible grid system to adjust its layout based on the device’s screen dimensions. This dynamic approach ensures that content is presented effectively and efficiently on different screen sizes. Images and videos are optimized for different resolutions, preventing image distortion and ensuring smooth playback. This includes using vector graphics where appropriate, which can scale without losing quality. Furthermore, the app uses media queries to alter styling and layout based on screen width, height, and pixel density. This adaptability minimizes the need for separate design considerations for different screen sizes and resolutions. The app is optimized for different screen aspect ratios, such as those found in smartphones, tablets, and foldable devices.

Prioritizing a Smooth User Experience Across Devices

The app employs a consistent visual language and interactive elements across all devices. This uniformity ensures that users feel comfortable and familiar navigating the application, regardless of the device they are using. The design prioritizes touch-friendly controls and intuitive gestures, enhancing usability on mobile devices. Furthermore, the app’s performance is optimized for various network conditions, ensuring a smooth experience even in areas with limited connectivity. This optimization is critical to maintaining a positive user experience and mitigating frustration associated with slow loading times or unresponsive interfaces.

User Interface Design Principles

The Chase mobile app’s interface adheres to established design principles. These principles include intuitive navigation, clear visual hierarchy, and consistent branding. The app prioritizes visual cues and affordances that clearly communicate the function of elements, allowing users to intuitively interact with the app. A comprehensive accessibility strategy is incorporated into the design, ensuring that the app meets the needs of users with disabilities.

Last Point

In conclusion, the Chase mobile app stands as a robust and feature-rich solution for managing personal finances. Its user-friendly interface, strong security protocols, and comprehensive support options make it a compelling choice. While competitors offer similar services, Chase’s unique blend of features and innovative design makes it a standout in the mobile banking landscape.