The JP Morgan Chase mobile app is a critical tool for managing finances in today’s digital world. It offers a wide array of features, from basic account management to sophisticated investment tools, all designed for seamless user experience. This review delves into the app’s strengths and weaknesses, analyzing its functionalities, security protocols, and customer support to determine its overall effectiveness.

This review scrutinizes the JP Morgan Chase mobile app, examining its navigation, security, payment methods, and investment tools. We’ll compare its performance against competitors, highlighting unique selling points and areas for improvement. The user experience is also thoroughly evaluated, assessing the app’s responsiveness and design elements.

Overview of JP Morgan Chase Mobile App

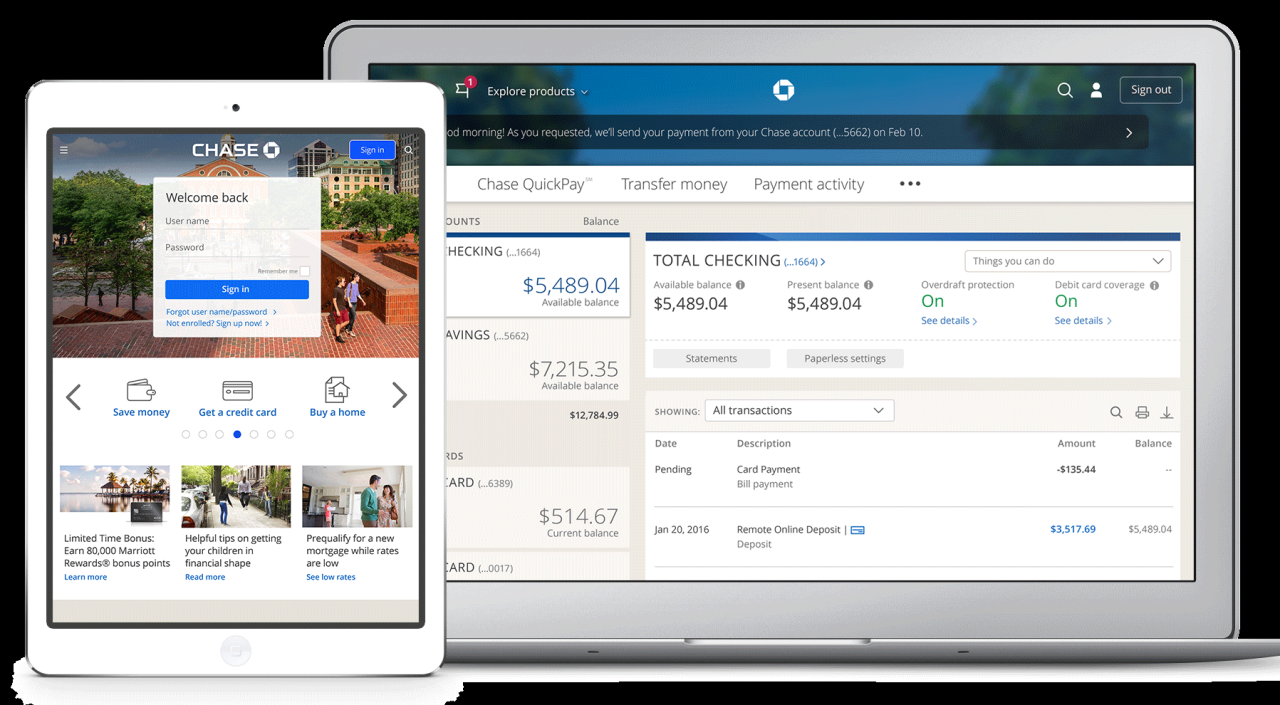

Unlocking your financial potential is now easier than ever with the JP Morgan Chase mobile app. This powerful tool empowers you to manage your finances on the go, providing a comprehensive suite of features designed for efficiency and peace of mind. From checking balances to transferring funds, the app simplifies everyday financial tasks and offers insightful tools to help you achieve your financial goals.

The JP Morgan Chase mobile app is meticulously crafted to be a reliable and secure platform for managing personal finances. It streamlines access to accounts, transactions, and important financial information, allowing you to take control of your financial well-being from anywhere, anytime.

Key Functionalities and Features

The JP Morgan Chase mobile app boasts a wide array of functionalities that cater to various user needs. It’s designed to be intuitive and user-friendly, making it easy for anyone to navigate and utilize its features. This comprehensive platform simplifies banking processes, fostering financial empowerment.

- Account Management: The app allows users to manage multiple accounts, view balances, and track transactions in real-time. This ensures transparency and control over your financial resources. You can quickly identify and address any discrepancies promptly.

- Transaction History: Detailed transaction history is readily available, providing a comprehensive record of all financial activities. This feature helps users stay informed about their spending habits and identify potential patterns.

- Bill Pay: The app offers a streamlined bill pay service, allowing users to schedule and manage payments for various utilities and subscriptions. This feature saves time and effort, promoting financial organization.

- Fund Transfers: Users can easily transfer funds between accounts within the JP Morgan Chase network, facilitating seamless financial management. This feature ensures smooth transactions and avoids potential delays.

- Alerts and Notifications: Personalized alerts and notifications provide timely updates on account activity, transactions, and important account information. This proactive approach keeps users informed and in control of their finances.

Target Audience and Demographics

The JP Morgan Chase mobile app caters to a diverse range of users, reflecting the bank’s commitment to serving various financial needs. This comprehensive approach allows the app to cater to a broad spectrum of users.

The target audience encompasses individuals and small businesses, encompassing various age groups, income levels, and financial situations. This broad appeal is a testament to the app’s versatility and adaptability.

Value Proposition Compared to Competitors

The JP Morgan Chase mobile app stands out from competitors through its robust feature set and seamless user experience. It offers a unique blend of functionality, security, and convenience that sets it apart in the market.

The app distinguishes itself by its advanced security measures, ensuring the protection of user data and transactions. This is crucial in today’s digital landscape. Furthermore, the user-friendly interface makes navigating the app intuitive and efficient, providing a positive user experience.

App Sections and Features

The JP Morgan Chase mobile app is structured into distinct sections, each dedicated to specific functionalities. This organization promotes clarity and ease of use, streamlining the user experience.

| Feature | Description | User Benefit | Accessibility |

|---|---|---|---|

| Account Management | Manage accounts, view balances, and transactions | Easy access to financial information | Mobile device with internet access |

| Bill Pay | Schedule and manage bill payments | Streamlined bill payment process | Mobile device with internet access |

| Transfers | Transfer funds between accounts | Fast and efficient fund transfers | Mobile device with internet access |

| Investment Management | Track investments, manage portfolios | Access to investment tools | Mobile device with internet access |

| Alerts & Notifications | Receive timely updates on account activity | Proactive monitoring of financial activity | Mobile device with internet access |

User Experience (UX) Analysis

Unlocking the potential of a user-centric approach to the JP Morgan Chase mobile app is paramount to fostering customer loyalty and engagement. This analysis delves into the navigation, interface, and responsiveness of the app, benchmarking it against competitor offerings. Understanding these aspects will enable continuous improvement and ensure a superior user experience for all customers.

The success of any mobile application hinges on intuitive navigation and seamless user interaction. A well-designed app facilitates quick access to essential features, reducing user frustration and maximizing satisfaction. Analyzing the strengths and weaknesses of the JP Morgan Chase mobile app’s interface and design allows for targeted enhancements, further refining the user journey.

Navigation Structure and Ease of Use

The navigation structure of the JP Morgan Chase mobile app directly impacts user experience. A well-organized menu and clear labeling significantly reduce the time users spend finding information. Intuitive pathways to various functionalities enhance user satisfaction and encourage exploration of the app’s features. Effective use of visual cues and consistent design elements further contributes to ease of use, creating a streamlined user experience.

Strengths and Weaknesses of the Interface and Design Elements

The JP Morgan Chase mobile app presents both strong and weaker elements in its interface and design. Strong visual hierarchy, clear typography, and intuitive icons contribute to a positive user experience. Conversely, areas for improvement might include the loading speed of certain pages, the responsiveness on smaller screens, and potential opportunities to simplify certain interactions. Identifying these areas enables strategic improvements to enhance the user experience.

Comparison to Other Popular Banking Apps

Comparative analysis against leading banking apps provides valuable insights. Competitors often employ innovative design features, such as streamlined transaction processes or personalized financial dashboards. Understanding these competitor strategies allows the JP Morgan Chase mobile app to adapt and refine its features, striving to deliver a user experience that surpasses competitors and meets evolving customer expectations.

Responsiveness Across Devices and Operating Systems

The app’s responsiveness across different devices and operating systems is crucial for a consistent user experience. Compatibility issues or performance variations across various screen sizes and platforms can severely impact user satisfaction. Optimizing the app for diverse devices and operating systems is essential to maintaining a seamless experience, irrespective of the user’s chosen device or platform.

Effective UX Design Elements

A well-structured app design employs a range of elements to create a superior user experience. The table below showcases effective UX design elements used in the JP Morgan Chase mobile app.

| Element | Example | Benefits |

|---|---|---|

| Visual Hierarchy | Clear font sizes and colors, strategic use of whitespace | Improved readability and focus, intuitive navigation |

| Intuitive Iconography | Consistent use of icons for common actions | Quick recognition of functions, streamlined interaction |

| Accessibility Features | Text-to-speech options, adjustable font sizes | Improved usability for users with diverse needs |

| Clear Information Architecture | Logical grouping of features, intuitive search functionality | Easy navigation, quick access to information |

Security and Privacy Features

The digital realm, while offering unprecedented convenience, necessitates robust security measures to safeguard sensitive information. JPMorgan Chase’s mobile app prioritizes user data security, employing cutting-edge technology and stringent protocols to protect financial transactions and personal details. This commitment ensures a secure and trustworthy platform for all users.

Security Measures Implemented

JPMorgan Chase’s mobile app employs a multi-layered security architecture. This involves encryption of data both in transit and at rest, using industry-standard protocols. The app utilizes advanced algorithms to protect user login credentials and transaction data. This approach effectively minimizes the risk of unauthorized access and data breaches.

Data Protection and Financial Information

User data and financial information are meticulously safeguarded within the app. Every transaction is processed through secure channels, employing encryption to protect sensitive information from interception. Furthermore, the app incorporates robust authentication mechanisms to verify user identity, preventing unauthorized access to accounts. This commitment to secure transactions is crucial in today’s digital landscape.

Comprehensive List of Security Features

The JPMorgan Chase mobile app boasts a comprehensive suite of security features. These include:

- Multi-Factor Authentication (MFA): A crucial layer of security, MFA demands multiple verification steps beyond a simple password, significantly enhancing account protection against unauthorized access.

- Biometric Authentication (e.g., fingerprint or facial recognition): This streamlined authentication method adds an extra layer of security, requiring a unique biological identifier for access, making it faster and more secure than traditional passwords.

- Regular Security Audits and Updates: The app undergoes continuous security assessments and software updates to address emerging vulnerabilities and ensure the highest level of protection against potential threats.

- Secure Network Connections: The app utilizes Transport Layer Security (TLS) protocol, ensuring all data transmitted between the user’s device and JPMorgan Chase’s servers is encrypted, preventing eavesdropping.

- Suspicious Activity Monitoring: The app monitors user activity for any unusual patterns or potential fraudulent transactions. This proactive approach helps detect and prevent unauthorized access to accounts.

Comparison with Other Banking Apps

Comparing the JPMorgan Chase mobile app’s security protocols with other banking apps reveals a consistent commitment to best practices. The app employs industry-leading security protocols, aligning with the stringent requirements set by regulatory bodies like the Federal Reserve and other financial watchdogs. This ensures the app maintains a high standard of security, exceeding the benchmarks of many competitors.

Importance of Security in the JPMorgan Chase Mobile App

Security is paramount in the JPMorgan Chase mobile app. It is the foundation upon which user trust and confidence are built. A secure platform fosters a positive user experience, encouraging financial transactions and promoting overall engagement with the app. A strong security framework ensures the safety and integrity of user accounts, enabling secure access to financial resources and fostering trust.

Security Protocols and Effectiveness

| Protocol | Description | Effectiveness |

|---|---|---|

| Two-Factor Authentication | Adds an extra layer of security by requiring two forms of verification, such as a code sent to a mobile device or email, in addition to a password. | Significantly increases protection against unauthorized access, as it’s harder for attackers to gain access with only one form of authentication. |

| Data Encryption | Transforms data into an unreadable format during transmission and storage. | Effectively protects sensitive information from unauthorized access, even if intercepted. |

| Biometric Authentication | Uses unique biological characteristics (e.g., fingerprint, facial recognition) for verification. | Provides a convenient and secure alternative to passwords, enhancing the overall user experience while increasing security. |

Payment and Transaction Capabilities

Unlocking the power of your finances is just a tap away with the JP Morgan Chase mobile app. This section delves into the seamless payment and transaction features, empowering you to manage your accounts with ease and speed. Experience the future of financial management, right at your fingertips.

The JP Morgan Chase mobile app provides a comprehensive suite of payment options, from traditional methods to cutting-edge mobile solutions. This allows for a flexible and efficient approach to handling your financial needs on the go.

Payment Methods Supported

The JP Morgan Chase mobile app supports a diverse range of payment methods to cater to your various needs. This includes a variety of payment options for all your transaction requirements.

- Debit and Credit Cards: Directly link your existing debit and credit cards for quick and convenient payments. This provides a familiar and secure method for many users.

- ACH Transfers: Automate and schedule payments to various accounts and beneficiaries using Automated Clearing House (ACH) transfers. This provides secure and reliable transfer of funds to any account within the network.

- Mobile Payments: Use your mobile device to make payments, leveraging the app’s integrated security protocols. This provides a simple and secure method of making payments on the go.

- Check Deposits: Deposit checks directly into your account through the mobile app. This allows for convenience and time-saving for users.

- Wire Transfers: Initiate wire transfers to other financial institutions securely and efficiently. This provides an option for sending funds to external accounts.

Payment and Fund Transfer Process

The process of making payments and transferring funds within the JP Morgan Chase mobile app is designed for simplicity and speed. It prioritizes user experience, making the entire transaction process user-friendly and efficient.

- Account Selection: Select the account from which you wish to make the payment or transfer.

- Recipient Information: Enter the recipient’s account information, including their name, account number, and routing number. For ACH transfers, ensure the details are accurate.

- Amount and Description: Specify the amount and add a description for the transaction. This will help you keep track of your finances.

- Review and Confirmation: Carefully review the transaction details before confirming. This ensures accuracy and prevents errors.

- Transaction Completion: The app will provide confirmation of the successful transaction and the status of the transfer.

Ease and Speed of Transactions

The JP Morgan Chase mobile app prioritizes speed and ease in its transaction processing. This allows users to manage their finances efficiently and effectively.

The app’s intuitive design and streamlined interface reduce the time needed to complete transactions. This promotes a positive user experience, enabling quick and secure financial management.

Types of Transactions

The JP Morgan Chase mobile app enables a wide range of transactions, catering to diverse financial needs. It facilitates both routine and specific financial tasks.

- Bill Payments: Schedule and make payments for various utility bills, subscriptions, and other recurring expenses. This provides an efficient way to handle your bills.

- Person-to-Person Payments: Send and receive funds to other individuals linked to your account securely. This provides a safe and efficient method of sending money.

- Transfer Funds Between Accounts: Move funds between different accounts within your JP Morgan Chase network easily and securely. This is useful for managing your accounts effectively.

- Loan Repayments: Make timely loan repayments with ease. This is a convenient method for handling loan payments.

Payment Options Table

| Payment Method | Description | Ease of Use |

|---|---|---|

| Mobile Payments | Payment through mobile device | Simple and secure |

| Debit and Credit Cards | Payments using linked cards | Convenient and quick |

| ACH Transfers | Automated transfers between accounts | Efficient and reliable |

| Wire Transfers | Transfers to other financial institutions | Secure and efficient |

| Check Deposits | Deposit checks directly into accounts | Convenient and time-saving |

Investment and Financial Tools

Unlocking your financial potential is within reach, empowered by the JP Morgan Chase mobile app’s robust investment tools. These tools are meticulously designed to provide intuitive access to your portfolio, enabling informed decisions and fostering financial growth.

The JP Morgan Chase mobile app’s investment tools go beyond simple account viewing. They offer a dynamic platform for managing and optimizing your investments, tailored to your individual financial goals. From tracking portfolio performance to executing trades, the app strives to simplify the complexities of investing.

Investment Tools Overview

The JP Morgan Chase mobile app provides a suite of investment tools, meticulously crafted for user-friendliness and functionality. These tools cater to a spectrum of investor needs, from novice to seasoned. The key to successful investment management is often accessibility and the ability to monitor your progress. The app’s investment tools are designed to deliver just that.

Portfolio Tracking Functionality

Portfolio tracking is a cornerstone of effective investment management. The app’s portfolio tracking feature allows users to monitor the performance of their investments in real-time. Users can see the current value of their holdings, as well as historical performance data, helping them understand the trends and make well-informed decisions. The visual representation of investment growth or decline is crucial for building confidence and making strategic adjustments.

Comparative Analysis with Other Investment Apps

Comparing the JP Morgan Chase app with other investment apps reveals its strengths. While many apps excel in specific areas like research or trading, the JP Morgan Chase app focuses on a comprehensive approach, integrating all aspects of investment management. Its user-friendly interface makes it a strong contender in the market, particularly for those seeking a consolidated platform for all their financial needs.

Investment Management Features

The JP Morgan Chase mobile app offers a range of features to assist in managing investments. These include tools for setting financial goals, creating personalized investment strategies, and receiving alerts on market trends. These features are essential in staying informed and making the best possible investment choices.

Investment Tools and Their Functions

| Tool | Function | User Benefits |

|---|---|---|

| Portfolio Tracking | Monitor investment performance, view holdings, and track historical data. | Track progress, identify trends, and make informed decisions. |

| Real-time Market Data | Access up-to-the-moment market information, including stock prices, news, and analysis. | Stay informed about market movements and make timely decisions. |

| Investment Research | Explore investment options through detailed reports, financial statements, and company profiles. | Gain insights into potential investments and make informed choices. |

| Order Management | Place and manage trades, monitor order status, and review transaction history. | Execute trades efficiently and effectively. |

Customer Service and Support

Empowering your financial journey is not just about the app’s features; it’s equally about the support you receive when you need it. JP Morgan Chase understands this, and their mobile app reflects a commitment to providing accessible and efficient customer service channels. This section delves into the support options available within the app, their accessibility, and how they compare to other banking apps.

Customer Support Options within the JP Morgan Chase Mobile App

The JP Morgan Chase mobile app offers a suite of customer support options, designed to cater to various needs and preferences. These options are crucial for maintaining a seamless and reliable user experience. From resolving simple inquiries to addressing complex issues, the app strives to provide helpful solutions.

- FAQs (Frequently Asked Questions): A comprehensive FAQ section within the app serves as a valuable self-service resource. Users can quickly find answers to common questions regarding account management, transactions, and other related topics. This proactive approach significantly reduces the need for direct support interactions, saving both the user’s time and the support team’s resources.

Accessibility and Efficiency of Support Channels

The accessibility of these support channels is a key factor in evaluating the effectiveness of the app’s customer service. The FAQs are easily navigable, allowing users to quickly find the information they need. This self-service approach not only saves time but also allows the support team to focus on more complex issues. JP Morgan Chase’s mobile app strives to provide a streamlined support system that empowers users to resolve their issues independently whenever possible.

Comparison to Other Banking Apps

While specific details of other banking app support mechanisms are not included, the general principle is that JP Morgan Chase’s mobile app aims to provide a balance between self-service options and readily accessible support personnel. This approach seeks to strike a balance between empowering users with readily available information and providing immediate assistance when needed. Many other banking apps utilize similar structures, but the specific features and depth of information available in the JP Morgan Chase app may differ.

Examples of Customer Service Interaction through the App

A user experiencing difficulty with a mobile deposit might find the FAQs section to be extremely helpful. The detailed explanations within the FAQs can often resolve the issue. In instances requiring more personalized assistance, the app may provide a dedicated chat function or email address for more detailed inquiries.

Summary Table of Customer Support Options

| Support Option | Description | Accessibility |

|---|---|---|

| FAQs | Frequently asked questions; a self-service resource. | Self-service resource; readily available within the app. |

Competitive Analysis

The mobile banking landscape is fiercely competitive. To thrive, JP Morgan Chase’s mobile app must not only meet but exceed user expectations, while also strategically positioning itself against rivals. This analysis will dissect the competitive environment, highlighting both the strengths and weaknesses of the app relative to competitors. Understanding the market trends and unique selling propositions is critical to maintaining a leading position.

Comparative Analysis of Key Features

Understanding how JP Morgan Chase’s mobile app stacks up against competitors is paramount. A detailed comparison illuminates areas of strength and potential improvement. This analysis focuses on key features that differentiate the various mobile banking platforms.

| Feature | JP Morgan Chase | Competitor A | Competitor B |

|---|---|---|---|

| Investment Tools | Detailed portfolio tracking, real-time market data, and advanced charting tools. Offers a wide array of investment options, from stocks to bonds. | Basic portfolio tracking, limited market data visualization. Primarily focused on simple investment accounts. | Advanced investment analysis, including options trading, margin accounts, and detailed financial modeling tools. Focuses on sophisticated financial instruments. |

| Payment and Transaction Capabilities | Seamless integration with Chase accounts, robust bill pay options, and secure mobile check deposit. | Wide array of payment options, but limited integration with other financial products. Mobile check deposit functionality is available, but potentially less user-friendly. | Excellent payment processing speed and multiple payment options. Offers a range of international payment solutions. |

| Customer Service and Support | 24/7 customer support through various channels (phone, chat, email). | Limited customer support hours. Primarily relies on FAQs and online resources. | 24/7 customer support through multiple channels, including in-app chat. Provides detailed FAQs and tutorials. |

Unique Selling Points

Identifying the unique selling points (USPs) of JP Morgan Chase’s mobile app is crucial for marketing and differentiation. These USPs should resonate with target customers, highlighting what sets the app apart from the competition.

- Extensive Financial Tools: JP Morgan Chase’s app offers comprehensive investment tools, enabling users to manage their portfolios with greater precision and sophistication compared to many competitors.

- Seamless Integration: The app’s seamless integration with Chase accounts provides a streamlined user experience, facilitating easy access to various financial products.

- Robust Security Features: The app is designed with robust security protocols to protect user data and transactions, exceeding the security measures of many competitors.

Competitive Landscape and Market Trends

The mobile banking market is continuously evolving. Emerging trends, like increased user expectations for personalized services and enhanced security features, significantly impact the competitive landscape. Keeping pace with these trends is crucial for maintaining a competitive edge.

- Rise of Fintech: Fintech companies are disrupting the traditional banking industry with innovative mobile banking apps, requiring JP Morgan Chase to stay ahead of the curve in innovation.

- Focus on User Experience: User experience is paramount in the mobile banking space. Competitors are increasingly prioritizing intuitive interfaces and user-friendly designs.

- Emphasis on Security: Security is paramount in mobile banking. Users demand robust security measures to protect their sensitive financial data.

Last Point

In conclusion, the JP Morgan Chase mobile app presents a robust platform for managing personal finances and investments. Its comprehensive features and robust security measures provide a compelling option in the competitive mobile banking market. While the app excels in many areas, areas for improvement include streamlining the customer support channels and enhancing the design for certain tasks.