The Charles Schwab mobile app is more than just a way to manage your investments; it’s a comprehensive financial toolkit designed for today’s busy investor. This detailed exploration delves into the app’s functionality, user experience, performance, and competitive landscape. We’ll examine its features, security measures, and customer feedback to understand how well it serves its user base.

From its historical evolution to potential future innovations, this analysis covers the entire spectrum of the Charles Schwab mobile app experience. We’ll also compare its performance with competitor apps, highlighting unique strengths and weaknesses. This comprehensive overview will help you understand the app’s capabilities and its suitability for your financial needs.

Overview of the Charles Schwab Mobile App

The Charles Schwab mobile app provides a comprehensive suite of investment tools and services, empowering users to manage their accounts and portfolios on the go. Its intuitive design and robust functionality make it a powerful alternative to traditional desktop platforms, particularly appealing to today’s mobile-first generation of investors.

The app’s strength lies in its ability to seamlessly integrate various financial functions into a single, user-friendly interface, thereby reducing the need for multiple applications. This approach enhances user experience and efficiency, a key differentiator in the competitive landscape of mobile investment platforms.

Functionality and Key Features

The Charles Schwab mobile app offers a wide array of features designed for both novice and seasoned investors. These features are integrated to provide a holistic investment management experience.

- Account Access and Management: Users can easily view account balances, transaction history, and statements. This feature facilitates quick access to important financial information, reducing the need to access physical documents or other platforms. Security measures are robust and designed to protect sensitive information.

- Investment Tracking and Portfolio Analysis: The app allows users to monitor their portfolio performance, track individual holdings, and analyze investment trends. Real-time data updates keep investors informed about their investments, providing a critical tool for active management.

- Trading Capabilities: The app provides secure and efficient trading capabilities, enabling users to execute trades, place orders, and manage their positions. This feature empowers users to make informed decisions on the go, while maintaining robust security measures.

- Research and Educational Resources: The app often integrates research tools, providing users with market insights, financial news, and educational materials. This enhances users’ understanding of investment strategies and market trends.

- Customer Support: The app often includes access to customer support options, facilitating quick and efficient assistance with account-related inquiries.

Target User Base

The Charles Schwab mobile app caters to a broad range of investors, from beginners to experienced traders. Its ease of use and comprehensive features make it suitable for individuals looking to manage their finances on a daily basis.

- Individual Investors: The app serves as a valuable tool for individuals managing personal investments, offering simplified access to portfolios and trading capabilities.

- Financial Advisors: The app also provides support for financial advisors, offering a platform for managing client accounts and collaborating with clients remotely.

- High-Net-Worth Individuals: The app provides sophisticated features for high-net-worth individuals, enabling them to manage complex portfolios and access specialized investment tools.

Competitive Landscape

The mobile investment platform market is highly competitive, with numerous providers vying for market share. Key competitors include Fidelity, Vanguard, and others. The competitive landscape is marked by a constant push for innovation and improved user experiences.

- Competitive Differentiation: Charles Schwab differentiates itself through its comprehensive suite of services, including robust trading tools and educational resources, which often go beyond basic portfolio tracking. Its focus on personalized service and security is another differentiating factor.

- Evolution of Competition: Competitors frequently introduce new features, enhancing the functionality and user experience of their mobile apps. This competitive environment drives innovation and fosters improvement across the industry.

Historical Evolution

The Charles Schwab mobile app has evolved significantly over time, adapting to changing user needs and technological advancements.

- Early iterations: Initial versions of the app focused primarily on account access and basic trading functionality. Security and user interface were key considerations, though limited by the technology of the time.

- Continuous Improvements: Subsequent iterations of the app incorporated advanced features, including enhanced portfolio analysis, research tools, and improved user experience, reflecting the demands of a changing investor base and the development of mobile technology.

- Ongoing Adaptation: Charles Schwab continues to adapt its app to incorporate emerging technologies and user preferences, consistently enhancing user experience and improving its position in the competitive landscape.

User Experience (UX) Assessment

The Charles Schwab mobile app, while offering comprehensive financial tools, exhibits significant room for improvement in user experience. A more intuitive design and a streamlined onboarding process are crucial for maintaining user engagement and satisfaction in a competitive market. Existing strengths should be leveraged to enhance the overall user journey.

The app’s current design, while functional, suffers from a lack of seamless integration between various features. This disjointed experience hinders efficient task completion and ultimately impacts user satisfaction. The app’s potential to become a truly valuable tool is hampered by its current UX limitations.

Ease of Navigation and User Interface Design

The app’s navigation structure, while generally clear, often requires excessive scrolling and clicking to access key functionalities. This cumbersome navigation process can be frustrating for users seeking quick access to critical information. Inconsistent design elements, such as varying font sizes and button styles, further diminish the user experience, creating a less polished and professional feel.

Effectiveness for Different User Types

The current design of the Schwab app, while adequate for seasoned investors, lacks sufficient adaptation for novice users. The app’s complex interface, packed with advanced features, can overwhelm and discourage new users. A dedicated onboarding section, tailored to the needs of first-time users, is essential to ease their entry into the platform and provide a positive initial experience.

Comparison with Competitor Mobile Apps

Competitor apps, such as Fidelity and Vanguard, excel in intuitive navigation and streamlined user interfaces. These apps offer a more straightforward and user-friendly experience, allowing users to quickly access and manage their accounts. The Schwab app often lags behind in these areas, potentially leading to user attrition. The competitor apps typically utilize a cleaner, more visually appealing design, providing a more comfortable and efficient experience.

Potential Areas for Improvement

Several areas necessitate improvement to enhance the user experience. A key issue is the lack of clear visual cues for different account types and transaction statuses. A more consistent and intuitive way to categorize and filter accounts, combined with clear visual indicators for account activity, would greatly improve user navigation. The app should prioritize visual clarity and simplification to ensure users can quickly locate information and complete tasks efficiently. The current design lacks visual cues to highlight important actions or alerts, which could lead to missed opportunities or critical information being overlooked.

Improved Onboarding Process for New Users

A dedicated onboarding process for new users is paramount. This should include a series of interactive tutorials, guiding users through the app’s key features and functionalities in a step-by-step manner. Instead of a generic introduction, the app should provide tailored content for new users based on their specific investment goals or account types. The onboarding process should incorporate interactive elements and personalized guidance to effectively introduce new users to the platform. For instance, a personalized video tutorial based on account type could demonstrate account setup, trade execution, and security features, tailored to the individual user. Clear and concise language, coupled with visual aids, will greatly enhance the onboarding experience.

Features and Functionality

The Charles Schwab mobile app provides a comprehensive suite of investment tools and account management features, designed for ease of use and robust security. Its functionality is crucial for managing financial portfolios effectively on the go. A strong focus on security and intuitive navigation is paramount to the app’s success.

The app’s design prioritizes user-friendliness, ensuring a seamless experience across various investment activities. This approach is essential for maintaining user engagement and satisfaction.

Investment Tools

The mobile app offers a diverse range of tools for navigating investments. These tools include real-time market data, portfolio tracking, and research capabilities. Users can access detailed information on individual stocks, bonds, and mutual funds, empowering informed decision-making. Advanced charting tools allow for in-depth analysis of market trends.

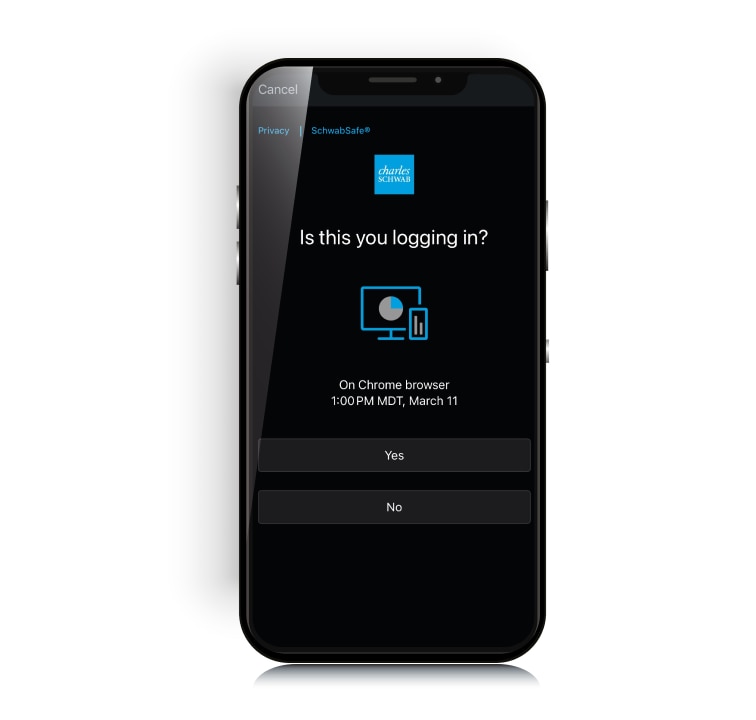

Security Measures

Robust security measures are implemented to protect user accounts and transactions. Multi-factor authentication (MFA) is a standard feature, adding an extra layer of protection against unauthorized access. Data encryption safeguards sensitive information during transmission. Regular security audits and updates maintain the app’s security posture against evolving threats.

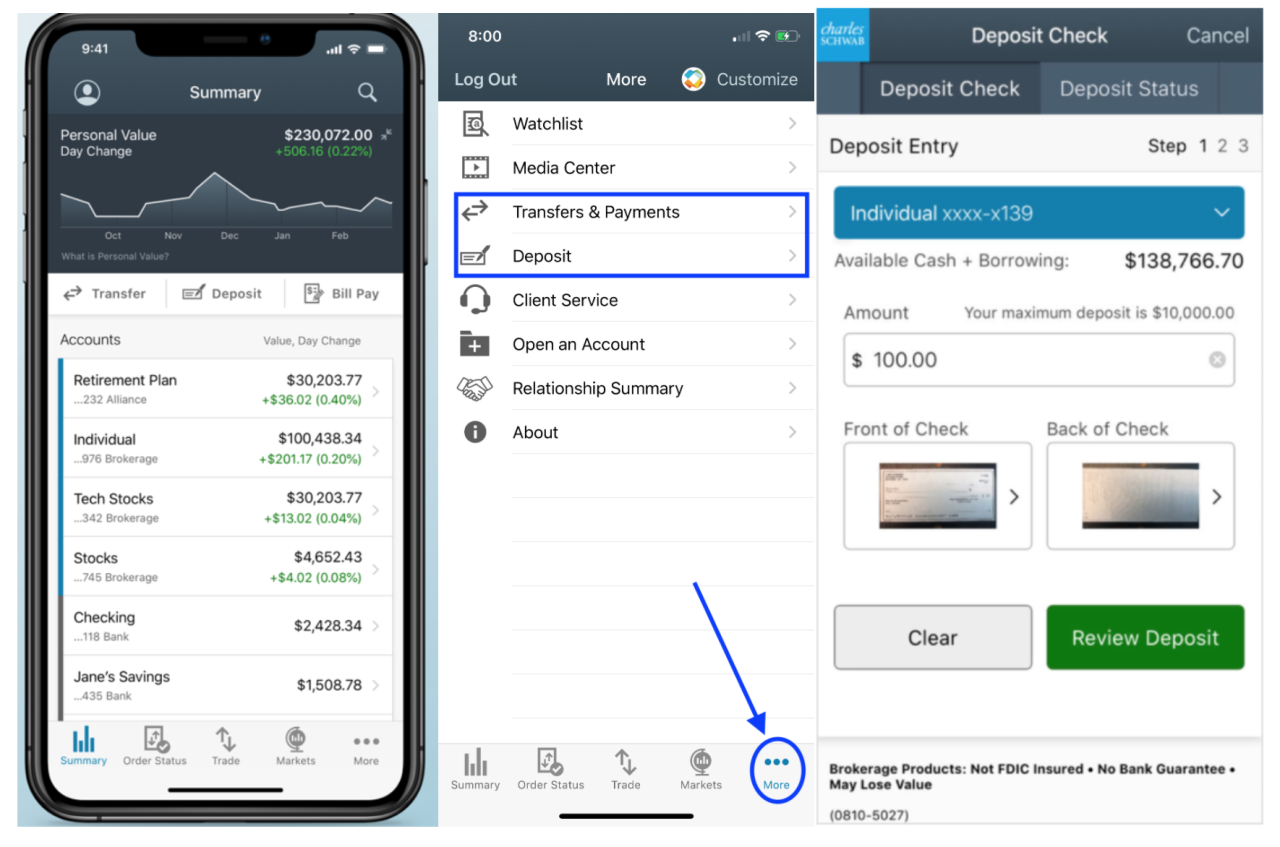

Account Management Features

The app provides a wide range of account management tools, facilitating comprehensive control over financial portfolios. These include features for viewing account balances, transaction history, and detailed statements. Users can manage their investments and accounts directly through the app, eliminating the need for separate logins or interfaces.

Transaction Initiation

Initiating transactions within the app is a straightforward process. Users can execute trades using various methods, including pre-defined orders and real-time market orders. The app guides users through each step of the process, ensuring accuracy and efficiency. Clear prompts and confirmations minimize the risk of errors.

Alert and Notification Management

The app allows users to customize alerts and notifications based on specific criteria, like price movements or account activity. This personalized approach ensures users are promptly informed about relevant events. Users can easily manage and modify these settings, maintaining control over their notification preferences.

Mobile App Performance

The Charles Schwab mobile app’s performance is crucial for user satisfaction and retention. A seamless and responsive experience is paramount to maintaining a competitive edge in the financial technology sector. This section analyzes the app’s performance metrics, addressing speed, reliability, technical issues, and compatibility across various devices.

Performance Metrics

The app’s performance is judged by metrics such as load times, response times to user actions, and overall stability. These metrics are crucial for ensuring a positive user experience. Fast loading times, quick responses, and minimal lag are essential for maintaining user engagement and preventing frustration. The app must consistently deliver a smooth, reliable experience, regardless of network conditions.

Reliability and Stability

The app’s reliability and stability under different network conditions are critical. High-speed Wi-Fi connections should result in near-instantaneous performance. The app must also function reliably with varying levels of cellular data service, from strong 5G connections to weaker 3G signals. Appropriate error handling and graceful degradation under adverse conditions are essential to avoid user frustration and data loss.

Potential Technical Issues and Solutions

Potential technical issues include slow loading times, unresponsive screens, or crashes. Solutions include optimizing the app’s code for efficiency, utilizing caching mechanisms to store frequently accessed data, and implementing robust error handling routines. Regular testing and performance monitoring are essential to proactively identify and resolve performance bottlenecks before they impact users.

Compatibility

The app’s compatibility across various mobile devices and operating systems is vital for a broad user base. It must run flawlessly on a wide range of devices and operating systems, ensuring that users on iPhones, Android phones, and other platforms can access the app without significant performance differences or functionality limitations.

Comparison with Competitors

Comparative analysis of the app’s performance against competitors is essential. Benchmarking against industry standards and competitors’ apps provides valuable insights. This comparison should include load times, response times, stability under various network conditions, and the overall user experience. Competitors’ strengths and weaknesses can inform areas for improvement in the Charles Schwab mobile app.

Customer Feedback and Reviews

Customer feedback is crucial for evaluating the effectiveness and usability of the Charles Schwab mobile app. Thorough analysis of reviews provides valuable insights into areas needing improvement and strengths that should be highlighted. A robust feedback system allows Schwab to adapt and enhance the app to better meet customer needs.

Summary of Customer Feedback

Customer feedback regarding the Charles Schwab mobile app reveals a mixed bag of opinions. Positive reviews praise the app’s intuitive design, robust features, and reliable performance. Conversely, some users express dissatisfaction with certain functionalities, navigation, and overall user experience. Neutral reviews often highlight minor issues or lack significant praise or criticism.

Categorization of Customer Reviews

The customer reviews are categorized into three groups: positive, negative, and neutral. Positive reviews frequently emphasize ease of use, clarity of information, and the app’s functionality. Negative reviews often cite specific technical issues, navigation problems, and limitations in certain features. Neutral reviews tend to lack strong opinions, commenting on minor inconveniences or offering generic feedback.

Common Themes and Patterns

Analysis of the feedback reveals common themes and patterns. Positive feedback frequently highlights the app’s intuitive navigation, comprehensive investment tools, and security features. Negative feedback consistently points to slow loading times, glitches in specific functionalities, and difficulties with certain transactions. Neutral feedback generally reflects minor inconveniences with minor aspects of the user interface.

Common Issues and Suggestions for Improvement

| Common Issue | Suggestions for Improvement |

|---|---|

| Slow loading times and application crashes | Optimize code, improve server responsiveness, and implement proactive maintenance to ensure stable performance. |

| Inconsistent or confusing navigation | Implement clearer labeling, more intuitive pathways, and consistent design elements. |

| Difficulties with specific transactions (e.g., transferring funds) | Thorough testing and user interface redesign for improved clarity and user experience. Incorporate detailed prompts and error messages for better guidance. |

| Limited access to support resources | Enhance support channels, provide comprehensive documentation, and offer quick access to FAQs and tutorials. |

Positive Aspects and Strengths

| Positive Aspect | Strengths |

|---|---|

| Intuitive navigation | Facilitates quick access to desired information and transactions. |

| Robust investment tools | Offers comprehensive data analysis, charting, and portfolio management. |

| Reliable security features | Provides a secure platform for managing financial accounts. |

| Comprehensive account information | Allows users to access detailed information about their accounts and investments. |

Competitive Analysis

The Charles Schwab mobile app faces intense competition in the brokerage industry. A thorough competitive analysis is crucial to understanding the app’s strengths and weaknesses relative to rivals and to inform strategic improvements. This assessment will identify unique selling propositions and highlight competitive strategies employed by other major players.

Comparison to Competitors

The Schwab mobile app, while a strong contender, needs to be evaluated against competitors like Fidelity, Vanguard, and TD Ameritrade. Direct comparisons reveal both advantages and disadvantages. Schwab’s strengths lie in its comprehensive suite of investment tools and robust research resources. However, its user interface (UI) and ease of use could be further refined to match the simplicity and intuitive navigation of some competitors.

Unique Selling Propositions

Schwab’s unique selling propositions (USPs) include a broad range of investment options, particularly in the realm of wealth management and financial planning. Its focus on personalized financial guidance and its established reputation for customer service set it apart from some competitors. The integration of advanced research tools and a vast array of investment products differentiates the platform from others in the industry.

Competitive Feature Comparison

| Feature | Charles Schwab | Fidelity | Vanguard | TD Ameritrade |

|---|---|---|---|---|

| Investment Options | Extensive, including ETFs, mutual funds, stocks, bonds, and options. | Wide range, comparable to Schwab, with a focus on ETFs. | Strong in index funds and ETFs, with a simpler investment structure. | Comprehensive, covering various asset classes. |

| Research & Analysis | Robust, including detailed reports, market insights, and charting tools. | Well-developed research tools and data, particularly for individual stocks. | Strong emphasis on index fund research and fundamental data. | Comprehensive research resources, including market news and company profiles. |

| Account Management | User-friendly, with clear visualizations of account holdings and transactions. | Excellent account management features with detailed transaction histories. | Intuitive account management, focusing on transparency and clarity. | Effective tools for managing accounts and tracking transactions. |

| Customer Support | Reputable customer service channels, including phone and online support. | Highly responsive customer service, available through various channels. | Strong customer service, with a focus on online resources and FAQs. | Reliable customer service, with multiple support channels. |

Competitive Strategies

Competitors leverage diverse strategies to attract and retain users. Fidelity, for example, emphasizes a straightforward user interface and intuitive navigation. Vanguard prioritizes cost-effectiveness and transparency in its investment offerings. TD Ameritrade focuses on advanced trading tools and educational resources. Schwab, while strong in comprehensive financial planning, needs to consider how these competitor strategies can be adapted to enhance its user experience. Their approach to fostering long-term client relationships and providing comprehensive financial guidance is a significant advantage.

Future Trends and Innovations

The Charles Schwab mobile app must adapt to evolving user expectations and market trends. This requires proactive identification of emerging technologies and functionalities that enhance the user experience and maintain a competitive edge. Ignoring these trends could lead to diminished user engagement and market share.

The mobile investment landscape is rapidly transforming, driven by factors like increased accessibility, sophisticated investment tools, and a desire for personalized financial advice. The Schwab app must embrace these changes to ensure continued relevance and user satisfaction.

Emerging Trends in Mobile Investment Platforms

The financial technology industry is experiencing significant growth, particularly in mobile investment platforms. Mobile apps are increasingly integrating sophisticated tools and data analytics to offer personalized financial advice and insights. This includes AI-powered investment recommendations, personalized portfolios, and interactive educational resources. Emphasis is shifting towards intuitive interfaces and streamlined workflows, with the goal of enabling users to seamlessly manage their finances on the go.

Potential Future Features and Functionalities

Several potential features could enhance the Schwab mobile app. These include:

- Personalized Investment Portfolios: The app should offer sophisticated portfolio management tools based on individual risk tolerance, financial goals, and investment horizon. This would require robust algorithms to generate personalized investment strategies and portfolio allocations.

- Interactive Educational Resources: Adding interactive tutorials, educational videos, and personalized learning paths could help users understand complex investment concepts and make informed decisions. This could potentially include quizzes, interactive graphs, and simulations.

- Real-time Market Data Visualization: Enhanced visualization tools, such as interactive charts and graphs, can provide users with a more comprehensive understanding of market trends and their impact on their portfolios. This should allow for filtering and customizable views.

- Automated Investment Strategies: Integrating robo-advisory features, allowing for automated rebalancing and portfolio adjustments, could streamline investment management for users. This could provide a low-cost alternative to traditional financial advisors.

Innovative Approaches for Enhancing User Experience

Innovation in the user experience should focus on intuitive navigation, seamless workflows, and personalized interactions.

- Intuitive Interface Design: A user-friendly interface that is intuitive and easy to navigate will greatly enhance the user experience. This requires an emphasis on clear visual cues, simplified workflows, and a streamlined user journey.

- Predictive Analytics: Implementing predictive analytics can provide valuable insights into user behavior and market trends, helping tailor investment strategies and provide relevant information. This could be used to proactively alert users to potential risks or opportunities.

- Gamification: Integrating game mechanics and rewards into the app could motivate users to engage with the platform and track their progress. For example, progress bars, badges, and interactive simulations could increase user engagement.

Integration of AI and Machine Learning

Integrating AI and machine learning into the app is crucial for providing personalized recommendations, automated portfolio management, and enhanced user experience. This involves developing algorithms that can analyze user data, market trends, and other relevant factors to make informed recommendations. Examples include automated rebalancing, risk assessment, and personalized investment strategies.

| Feature | Description | Benefits |

|---|---|---|

| AI-Powered Portfolio Recommendations | Algorithms analyze user data and market trends to suggest personalized investment strategies. | Increased efficiency in portfolio management, personalized recommendations based on individual needs. |

| Automated Rebalancing | The app automatically rebalances portfolios based on predefined parameters. | Reduces manual effort, maintains desired portfolio allocations. |

| Predictive Analytics for Market Insights | Algorithms analyze market data to identify potential trends and provide insights. | Provides users with proactive information about potential market fluctuations. |

End of Discussion

In conclusion, the Charles Schwab mobile app provides a robust platform for managing investments, offering a wide array of features and tools. While the app excels in many areas, areas for improvement in user experience and performance, as highlighted by customer feedback, are valuable for further development. The app’s competitive analysis underscores its strengths and weaknesses relative to other mobile investment platforms. The app’s future potential, considering emerging trends and innovative technologies, is certainly promising.