Welcome, esteemed readers, to a comprehensive exploration of the mobile app for Concur expense reporting. This innovative tool promises a streamlined and efficient way to manage your expense claims, from initial capture to final approval. Imagine a world where meticulous record-keeping is effortless, and reimbursement is a seamless process – this app is designed to bring that vision to reality.

This guide delves into the intricate details of this mobile app, from its user-friendly interface to its robust security features. We’ll uncover the key functionalities, explore the benefits and drawbacks, and examine the integration capabilities with various accounting systems. Get ready to embark on a journey into the future of expense reporting!

Introduction to Expense Reporting Mobile Apps

Mobile expense reporting applications have become increasingly prevalent, streamlining the process for employees to submit and manage their expenses. These apps leverage mobile technology to provide a convenient and often more efficient alternative to traditional expense report methods. The evolution of these apps reflects a shift towards greater accessibility, real-time data, and integration with corporate systems.

Modern mobile expense reporting apps address the limitations of paper-based systems and outdated software. They offer a more comprehensive solution for expense tracking, submission, and approval, often improving the overall accuracy and timeliness of the process. By integrating with accounting software and company policies, these apps aim to minimize errors and ensure compliance.

Current State of Mobile Expense Reporting Applications

Mobile expense reporting apps have rapidly evolved from basic tools for capturing receipts to sophisticated platforms that manage the entire expense lifecycle. These applications have become indispensable tools for businesses of all sizes, fostering efficiency and compliance. The growing adoption of these apps underscores the increasing demand for mobile solutions in various business functions.

Key Features and Functionalities

Mobile expense reporting apps typically offer a suite of features designed to simplify the expense reporting process. These include:

- Receipt Capture: Many apps allow users to capture receipts digitally via camera, eliminating the need for manual data entry and reducing errors. This often integrates with OCR (Optical Character Recognition) to automatically extract relevant information from receipts.

- Expense Categorization: Apps usually offer predefined expense categories to facilitate proper classification and reporting. This helps with budget management and analysis by providing structured data.

- Real-time Tracking: Employees can monitor their expense submissions and approvals in real time. This visibility provides transparency and helps with the timely processing of claims.

- Integration with Corporate Systems: These applications often integrate with company accounting software, automating data transfer and reducing manual entry errors. This integration can also include connections to company policies and expense limits.

- Policy Compliance: Apps often incorporate company expense policies, reminding employees of limits and rules. This functionality promotes compliance and reduces discrepancies.

- Reporting and Analytics: Advanced apps offer comprehensive reporting tools to track expenses by category, department, or individual. Data visualization tools can help businesses identify trends and make informed decisions.

Benefits of Using Mobile Expense Reporting Apps

The advantages of mobile expense reporting are numerous. They improve efficiency by streamlining the entire process, from receipt capture to approval.

- Improved Efficiency: Digitization and automation reduce the time needed for processing expenses. The elimination of paper forms and manual entry significantly accelerates the expense cycle.

- Increased Accuracy: Automated data entry and receipt capture minimize errors, ensuring expenses are accurately recorded and reported.

- Enhanced Compliance: Built-in policy compliance features help ensure expenses adhere to company regulations. This reduces the risk of errors and non-compliance penalties.

- Real-time Visibility: Employees can track the status of their expense reports in real time, promoting transparency and accountability.

Drawbacks of Using Mobile Expense Reporting Apps

While mobile expense reporting apps offer numerous benefits, there are some potential drawbacks.

- Dependence on Technology: A reliance on technology can pose challenges in cases of network outages or technical malfunctions. This highlights the need for backup systems and contingency plans.

- Security Concerns: The security of sensitive financial data is paramount. Apps need robust security measures to protect against unauthorized access or data breaches. This includes strong encryption and user authentication protocols.

- Initial Setup and Training: Implementing a new mobile expense reporting app can involve significant initial setup time and employee training. This requires careful planning and adequate resources to ensure smooth adoption.

Comparison of Mobile Expense Reporting App Categories

The table below Artikels the key differences between various expense reporting app categories, helping to clarify the distinctions between basic, premium, and enterprise-level solutions.

| Category | Basic | Premium | Enterprise |

|---|---|---|---|

| Features | Receipt capture, basic expense categorization, limited reporting. | Receipt capture, detailed expense categorization, basic reporting and analytics, integration with basic accounting systems. | Receipt capture, comprehensive expense categorization, advanced reporting and analytics, seamless integration with enterprise accounting systems, customizability. |

| User Access | Individual users | Multiple users, limited access controls. | Multiple users, granular access controls, role-based permissions. |

| Cost | Low | Medium | High |

| Support | Limited | Medium | Comprehensive |

User Experience (UX) Considerations

A user-friendly interface is paramount for mobile expense reporting apps. Intuitive design and streamlined processes are crucial for maximizing user engagement and minimizing frustration, leading to higher compliance rates and reduced administrative overhead. Efficient mobile expense reporting facilitates timely reimbursement and reduces the time employees spend on paperwork.

Importance of a User-Friendly Interface

A well-designed mobile expense reporting app should prioritize ease of use. Clear visual hierarchy, legible text, and appropriate use of whitespace enhance the user experience. Intuitive navigation, simplified input fields, and clear error messages contribute to a positive user experience, encouraging consistent and accurate data entry. A user-friendly interface reduces the likelihood of errors and promotes efficient data management.

Mobile-Specific Design Principles

Mobile-specific design principles are vital for ensuring usability on various screen sizes and form factors. Responsive design, optimized for touch interaction, is essential. Buttons and input fields should be large enough for easy tapping, and the app should adapt to different screen orientations. Employing concise language and minimizing unnecessary steps are key for mobile app usability. Effective use of visual cues, such as clear icons and visual feedback during input, enhances the user experience.

Streamlining the Expense Submission Process

Streamlining the expense submission process within the app is critical for user adoption. The process should be broken down into logical steps, with clear instructions at each stage. A wizard-like interface, guiding users through the process, can be beneficial. Providing pre-populated fields based on prior entries or company policies can significantly speed up the process and reduce errors. Automated calculations and summaries, allowing users to easily review and adjust expenses, are highly beneficial.

Intuitive Navigation for Mobile Expense Reporting

Intuitive navigation is key for seamless expense reporting. The app should have a clear and consistent navigation structure, using familiar patterns like tabs or a hamburger menu. A simple and logical layout with a hierarchical structure ensures easy access to all necessary features. Users should be able to easily locate and access expense categories, receipts, and submission options without difficulty. Well-placed and readily accessible support options, including FAQs or help documentation, contribute to user confidence and reduce the need for external support.

User Flow for Submitting an Expense Report

| Step | Action | Description |

|---|---|---|

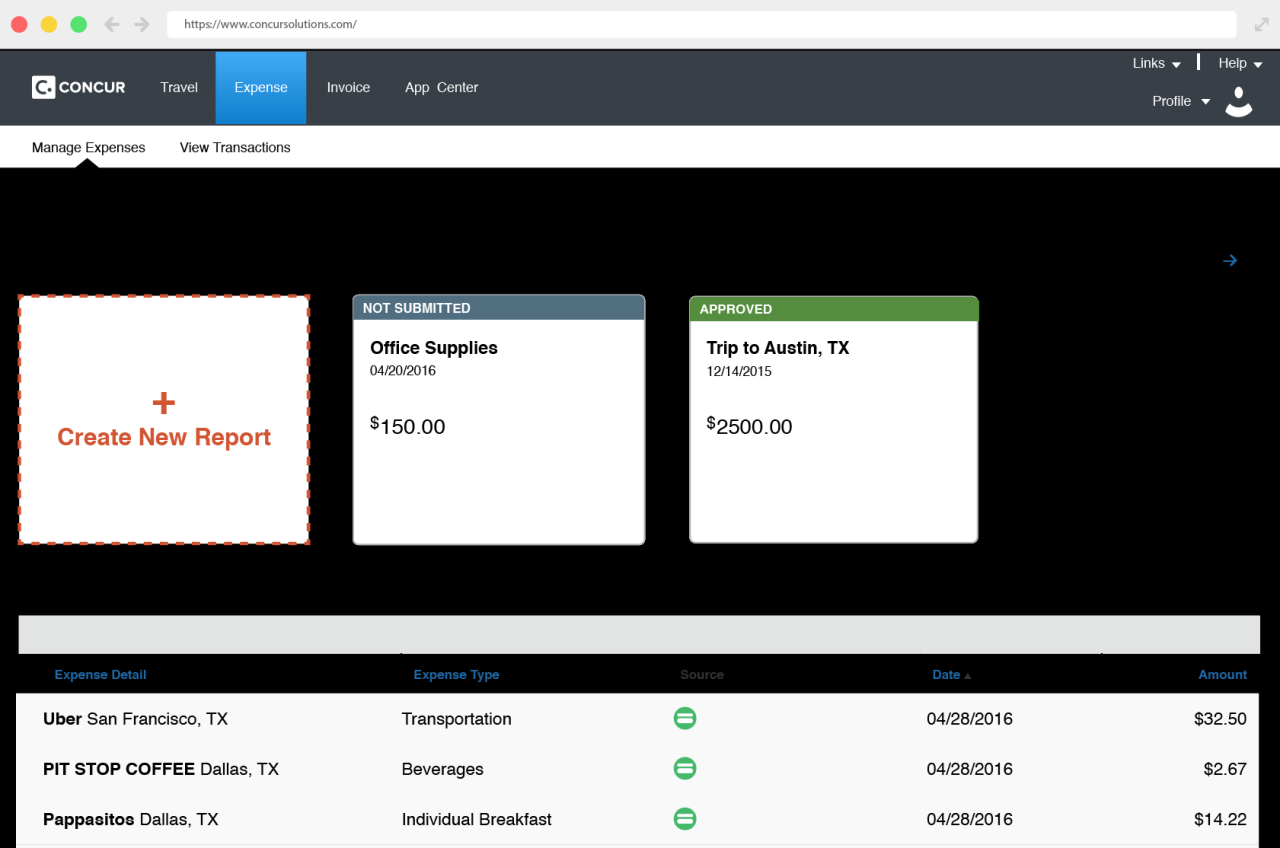

| 1 | Launch App | User opens the Concur expense reporting mobile app. |

| 2 | Select Expense Category | User navigates to the appropriate expense category (e.g., travel, meals, lodging). |

| 3 | Input Expense Details | User enters necessary information, such as date, location, amount, description, and receipt details. Pre-populated fields and automated calculations should be leveraged to streamline this process. |

| 4 | Attach Receipts | User uploads receipts or selects previously saved receipts. The app should support various file formats and provide clear feedback on upload status. |

| 5 | Review and Submit | User reviews the entered expense details and attached receipts. The app should display a clear summary of the expenses. Users should be able to easily make edits or corrections. Once satisfied, the user submits the expense report. |

| 6 | Confirmation | User receives confirmation of the submission, including a unique reference number. |

Features and Functionality

Mobile expense reporting applications offer a wide range of features designed to streamline the process of submitting, managing, and approving expenses. These features range from basic receipt capture to sophisticated integrations with accounting software, enhancing efficiency and accuracy for businesses of all sizes. The choice of features and their implementation can significantly impact user experience and overall cost savings.

Core Features

Various mobile expense reporting apps share fundamental features to facilitate the expense reporting workflow. These features are essential for capturing, validating, and processing expense data effectively.

- Image Capture: Many apps allow users to capture images of receipts directly using their mobile device’s camera. This feature ensures accurate record-keeping and simplifies the process of submitting expenses.

- Receipt Management: Effective receipt management is crucial for expense reporting. The apps provide features to organize, categorize, and store receipts securely. This includes features like digital storage, tagging, and searchable databases, facilitating easy retrieval of specific receipts.

- Location Tracking: Some apps incorporate location tracking to verify the business purpose of expenses. This feature is particularly useful for travel expenses, ensuring the accuracy and appropriateness of claimed costs.

- Expense Categorization: The ability to categorize expenses automatically or manually is a key feature. Categorization simplifies reporting, analysis, and reconciliation with accounting systems.

- Approvals: Built-in approval workflows are a standard feature. These streamline the expense approval process, often integrating with company-specific approval hierarchies. This automated system speeds up the process.

Security Considerations

Security is paramount in mobile expense reporting applications, especially when handling sensitive financial data. The security features protect sensitive data from unauthorized access, misuse, or breaches.

- Data Encryption: The use of robust encryption methods is critical to protect sensitive data both during transmission and storage. This protects against potential breaches and ensures compliance with relevant regulations.

- User Authentication: Secure login mechanisms, such as multi-factor authentication, are essential to prevent unauthorized access. Strong passwords and biometric authentication contribute to heightened security.

- Data Validation: Input validation and data checks are critical to ensuring the accuracy and integrity of expense data. This helps prevent errors and fraud, thereby maintaining the credibility of expense reports.

- Compliance with Regulations: Expense reporting applications should comply with relevant financial regulations and industry standards. This ensures that the application meets the necessary standards for data protection and privacy.

Advanced Features

Advanced features in mobile expense reporting apps enhance functionality and integration with other business systems.

- Integration with Accounting Software: Integration with accounting software is a valuable feature. This allows seamless data transfer between the expense reporting app and the company’s accounting system, eliminating manual data entry and improving reconciliation accuracy. This automated process also helps in the timely processing of financial reports.

- Automated Expense Classification: Sophisticated apps can automatically classify expenses based on predefined rules or machine learning algorithms. This reduces manual effort and ensures consistent categorization across expense reports.

- Real-time Reporting: Real-time expense reporting allows for immediate insights into spending patterns. This helps businesses track expenses and make informed decisions in a timely manner.

Feature Comparison Table

| Feature | App A | App B | App C |

|---|---|---|---|

| Image Capture | Yes (multiple formats) | Yes (single format) | Yes (high resolution) |

| Receipt Management | Digital storage, tagging | Digital storage, OCR | Digital storage, OCR, AI-powered categorization |

| Location Tracking | Yes | No | Yes (with GPS accuracy) |

| Expense Categorization | Manual | Semi-automatic | Automatic |

| Integration with Accounting Software | No | Yes (limited) | Yes (full integration) |

Integration and Compatibility

Seamless integration with existing accounting systems is crucial for a mobile expense reporting app. This ensures data accuracy, reduces manual effort, and streamlines the entire expense reporting process. A well-integrated app avoids data silos, allowing for real-time updates and automated reconciliation. This directly impacts the efficiency of financial operations and reporting.

Importance of Seamless Integration with Existing Accounting Systems

A robust integration with a company’s existing accounting software is essential for minimizing data entry errors and ensuring data consistency across the entire financial management system. This integration enables automated data transfer, eliminating manual reconciliation steps. This reduces the potential for errors, saving time and resources. Automated matching of expenses with accounts payable significantly improves the accuracy of financial statements.

Integration with Company Policies and Procedures

Mobile expense reporting apps should be adaptable to a company’s specific policies and procedures. This adaptability allows for the implementation of customized rules, approval workflows, and expense categories relevant to the organization’s specific needs. The app should be configurable to enforce compliance with company regulations and industry standards. Customizable expense categories and predefined approval routes facilitate adherence to company policies.

Compatible Operating Systems and Devices

The app must support a wide range of operating systems and devices to ensure accessibility for all employees. This allows employees to use the app on various platforms, including iPhones, Android phones, and tablets, regardless of their preferred device. Cross-platform compatibility ensures employees can use the app regardless of their preferred mobile device. Comprehensive compatibility allows for a more accessible and flexible expense reporting solution.

- iOS (Apple): Support for iPhones and iPads running the latest iOS versions.

- Android: Support for a wide range of Android devices, including various manufacturers and models, ensuring compatibility across the Android ecosystem.

- Other Mobile Platforms: (Optional) Consideration for other mobile operating systems like Windows Mobile or Blackberry (if applicable).

Data Security and Privacy in Mobile Expense Reporting

Data security and privacy are paramount in mobile expense reporting. Robust security measures are necessary to protect sensitive financial data from unauthorized access or breaches. Implementing encryption, secure authentication, and regular security audits is essential to ensure compliance with data privacy regulations. The app should be designed with end-to-end encryption for all data transmission.

Integration Points with Accounting Software

This table Artikels potential integration points with various accounting software systems. This allows for a clear understanding of how the app can connect with existing accounting tools.

| Accounting Software | Integration Points |

|---|---|

| QuickBooks Online | Expense categorization, automatic upload of receipts, expense reconciliation |

| Xero | Expense categorization, automatic upload of receipts, expense approval workflow integration |

| Sage 50 | Expense categorization, automated expense reporting, and reconciliation. |

| Oracle NetSuite | Expense categorization, real-time expense tracking, automated expense approvals |

| SAP Concur | Seamless data exchange, automatic expense approvals, comprehensive reporting. |

Security and Privacy

Mobile expense reporting applications handle sensitive financial data, making robust security and privacy measures crucial. Compromised data can lead to significant financial losses and reputational damage for both the individual employee and the organization. Implementing strong security protocols and adhering to privacy regulations is paramount to building user trust and maintaining data integrity.

Data security is not merely a technical issue; it involves a comprehensive approach encompassing technical controls, user training, and compliance with relevant regulations. The protection of user data is a shared responsibility between the application developers and the users themselves.

Significance of Robust Security Measures

Robust security measures are essential to protect sensitive financial data from unauthorized access, use, disclosure, alteration, or destruction. This includes safeguarding against various threats, such as malware attacks, phishing attempts, and insider threats. Secure systems minimize the risk of fraudulent activities and maintain the integrity of financial records.

Data Encryption and Access Controls

Data encryption is a fundamental security technique for mobile expense reporting apps. Encrypting data at rest and in transit protects sensitive information from unauthorized access. Appropriate access controls, including multi-factor authentication (MFA) and role-based access, are critical to limit access to only authorized users and prevent unauthorized modifications. This prevents data breaches and misuse.

Best Practices for Ensuring User Privacy

Best practices for user privacy include transparent data collection policies, user consent mechanisms, and secure data storage methods. Clearly defined policies regarding data usage and retention are vital for user trust. Providing users with control over their data, such as the ability to access, correct, or delete their information, is a crucial aspect of user privacy.

Compliance Requirements for Mobile Expense Reporting

Compliance with relevant data privacy regulations, such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act), is mandatory. These regulations dictate how organizations must collect, use, and protect personal data. Adherence to these regulations ensures legal compliance and maintains user trust.

Security Protocols and Privacy Features

| Security Protocol | Privacy Feature | Description |

|---|---|---|

| Data Encryption (AES-256) | Data Confidentiality | Encrypts data both at rest and in transit using strong encryption algorithms, like AES-256. |

| Multi-Factor Authentication (MFA) | Access Control | Requires multiple forms of verification (e.g., password, security token, biometric scan) to access accounts. |

| Role-Based Access Control (RBAC) | Data Access Control | Limits access to specific data based on user roles, preventing unauthorized access. |

| Regular Security Audits | Security Monitoring | Systematic assessments of the system’s security posture to identify vulnerabilities and weaknesses. |

| Secure Storage (HTTPS/SSL) | Data Integrity | Securely stores data on servers using secure protocols like HTTPS or SSL, preventing data interception during transmission. |

| Data Deletion/Retention Policies | Data Management | Clear policies regarding the retention and deletion of user data, ensuring data is only kept for necessary periods. |

Cost and Value Proposition

Mobile expense reporting solutions offer significant advantages in terms of cost-effectiveness and efficiency. Implementing a robust mobile solution can streamline the expense reporting process, reducing administrative burdens and improving accuracy. This section explores the various facets of cost analysis and return on investment (ROI) associated with adopting a mobile expense reporting app.

Determining Cost-Effectiveness

Evaluating the cost-effectiveness of mobile expense reporting solutions requires a comprehensive assessment of both upfront and ongoing costs. This involves considering the initial software license fees, implementation costs, and potential training expenses. Recurring costs such as user support and maintenance must also be factored into the overall cost calculation. Furthermore, potential savings through reduced manual processing, improved accuracy, and reduced fraud risk should be weighed against the total cost.

Return on Investment (ROI)

The ROI of a mobile expense reporting app is often realized through various channels. Reduced administrative overhead from streamlined processes and improved data accuracy contribute to a higher ROI. By automating expense reporting, companies can free up valuable employee time, enabling them to focus on core business functions. This, in turn, can lead to increased productivity and potentially higher revenue generation. Furthermore, reduced fraud risk and improved compliance through automated controls contribute to the ROI. A well-designed app can mitigate risks associated with manual expense reporting.

Pricing Models

Mobile expense reporting apps employ diverse pricing models. Some solutions offer a per-user pricing structure, where the cost is determined by the number of employees using the app. Others use a tiered pricing model, providing different packages with varying features and user limits. Software-as-a-service (SaaS) models are also common, charging a subscription fee based on usage or features utilized. Subscription-based pricing models often include support and maintenance, making them attractive for organizations with fluctuating reporting needs. It’s crucial to evaluate the features included in each pricing model to ensure alignment with the organization’s specific requirements.

Cost Savings and Efficiency

Adopting mobile expense reporting can translate into significant cost savings and increased efficiency. Automating the expense reporting process minimizes manual data entry, reducing errors and processing time. Improved accuracy reduces the need for costly corrections and audits. This streamlined process leads to faster reimbursement cycles, reducing the time employees spend waiting for expense approvals. Furthermore, the use of mobile apps often facilitates real-time expense tracking, providing employees and managers with up-to-date insights.

Cost Comparison

| App Name | Pricing Model | Features | Estimated Monthly Cost (per user) |

|---|---|---|---|

| App A | Per-user, tiered | Basic expense tracking, reporting, and approvals | $5-$15 |

| App B | SaaS, subscription | Comprehensive features, including expense categorization, automatic receipts, and integration with accounting systems | $10-$30 |

| App C | Per-user, tiered | Advanced features, robust reporting, and real-time tracking | $15-$35 |

This table provides a basic comparison of hypothetical expense reporting apps. Actual pricing and features may vary significantly based on the chosen plan and provider. Organizations should conduct thorough research and compare specific features and functionalities to determine the most suitable solution. It is essential to consider the specific needs and requirements of the organization when making a choice.

Mobile App Design Considerations

Mobile expense reporting apps require careful consideration of design elements to ensure a seamless and efficient user experience across various devices. A well-designed app will streamline the expense submission process, improve data accuracy, and reduce the likelihood of errors. Optimizing the design for different screen sizes and touch interactions is crucial for a positive user experience.

Optimal Screen Size and Layout

The optimal screen size and layout for a mobile expense reporting app must accommodate the diverse range of mobile devices. Users should be able to easily access and input all necessary information without difficulty. A well-structured layout ensures that essential elements, such as expense details, image uploads, and approval flows, are readily available and accessible. The layout should prioritize clear visual hierarchy and intuitive navigation.

Responsive Design for Different Devices

Responsive design is paramount for a mobile expense reporting app. It ensures that the app functions correctly and looks visually appealing on various screen sizes, from smartphones to tablets. This includes adjusting the layout, font sizes, and image sizes dynamically to maintain a consistent user experience. The app should adapt seamlessly to different screen orientations, providing optimal usability whether the device is held in portrait or landscape mode.

Touch-Friendly Controls and Gestures

Touch-friendly controls are essential for mobile expense reporting apps. Users should be able to easily select fields, navigate through menus, and submit expenses with minimal effort. Using intuitive gestures, such as swiping or tapping, enhances the user experience. Buttons and input fields should be appropriately sized and spaced for easy selection with fingers. Consideration should also be given to touch targets, ensuring that they are large enough to be easily selected with a fingertip.

Appropriate Visuals and Icons

Visuals and icons play a crucial role in guiding users through the app. Clear and concise icons should be used to represent actions, such as adding expenses, uploading receipts, or requesting approvals. Consistent color schemes and imagery enhance the app’s overall aesthetic and create a cohesive experience. The visual design should adhere to the brand guidelines for consistency.

Screen Layouts Optimized for Various Screen Sizes

A well-structured app considers different screen sizes. The following table demonstrates potential screen layouts for various screen sizes:

| Screen Size | Layout |

|---|---|

| Small (e.g., iPhone 6, Android entry-level) | Single-column layout; prioritize essential fields; use collapsible sections for less critical data. |

| Medium (e.g., iPhone 8, Android mid-range) | Two-column layout; balance essential fields and secondary information; use expandable sections for more data. |

| Large (e.g., iPhone X, Android flagship, tablets) | Multi-column layout; provide ample space for details; include additional functionalities like receipt previews or detailed expense descriptions. |

Future Trends and Innovations

Mobile expense reporting is rapidly evolving, driven by advancements in technology and the increasing need for efficiency and automation. This evolution is marked by a shift towards more intelligent, predictive, and user-friendly solutions. The future of mobile expense reporting will likely be characterized by seamless integration with other business systems and a greater focus on real-time data analysis.

Future mobile expense reporting platforms will incorporate advanced technologies to improve accuracy, reduce manual effort, and provide valuable insights into business spending patterns. This will enhance both the user experience and the overall value of the expense reporting process for businesses.

Potential Advancements in Mobile Expense Reporting Technology

Mobile expense reporting systems will increasingly leverage machine learning and artificial intelligence to automate tasks and provide more sophisticated insights. This includes features like automatic categorization of expenses, intelligent expense policy compliance checks, and personalized recommendations for cost-saving opportunities. The integration of biometric authentication will further enhance security and streamline the approval process.

Emerging Trends and Innovations

Several emerging trends are shaping the future of mobile expense reporting. These include:

- Predictive Analytics for Expense Forecasting and Optimization: AI-powered predictive analytics can analyze historical expense data to forecast future spending. This capability allows businesses to proactively identify potential cost overruns and adjust budgets accordingly. For example, a system might predict increased travel expenses during peak seasons and automatically adjust budget allocations, or flag unusual spending patterns that might indicate fraud or misuse.

- Integration with other business systems: Future expense reporting solutions will likely integrate seamlessly with other business applications, such as accounting software, project management tools, and CRM systems. This integrated approach will provide a holistic view of business operations and spending, making data analysis and reporting more efficient.

- Enhanced User Experience (UX): Mobile expense reporting applications will prioritize intuitive design and user experience. Features like automated expense categorization, personalized dashboards, and simplified approval workflows will further streamline the process.

- Real-time Data Analysis and Reporting: The ability to access and analyze expense data in real-time will be crucial. This will empower businesses to make informed decisions regarding spending, identify trends, and optimize operational efficiency.

Artificial Intelligence and Machine Learning in Expense Reporting

AI and machine learning can significantly enhance mobile expense reporting in several ways. These include:

- Automated Expense Categorization: AI algorithms can analyze expense descriptions and receipts to automatically categorize expenses, reducing manual effort and improving data accuracy.

- Intelligent Expense Policy Compliance Checks: AI can be used to identify and flag potential violations of expense policies in real-time, ensuring compliance with company guidelines.

- Personalized Recommendations for Cost Savings: By analyzing historical spending patterns, AI can provide personalized recommendations to users for potential cost-saving opportunities.

- Fraud Detection and Prevention: AI can identify unusual or suspicious spending patterns, helping to detect and prevent fraudulent activities.

Examples of Innovative Features Under Development

Several innovative features are currently being developed for mobile expense reporting applications. These include:

- Automated Receipt Capture and Processing: Mobile apps may soon incorporate image recognition technology to automatically capture and process expense receipts from images, eliminating the need for manual data entry.

- Natural Language Processing (NLP) for Expense Reporting: NLP-powered systems can interpret and categorize expenses based on natural language descriptions, making expense reporting more intuitive and less prone to errors.

- Integration with Mobile Payment Systems: Mobile expense reporting solutions will likely integrate with mobile payment systems, streamlining the process of expense reimbursement.

Conclusion

In conclusion, the mobile app for Concur expense reporting represents a significant advancement in how businesses manage their expenses. Its intuitive design, powerful features, and seamless integration with existing systems make it a valuable asset for organizations seeking to optimize their expense management processes. Embrace the efficiency and convenience that this technology offers, and experience a new era of expense reporting.

The future of expense reporting is here, and it’s mobile. We’ve covered the essentials, from initial setup to future trends, empowering you to make informed decisions about adopting this technology.