Unveiling the potential of mobile credit score apps, this exploration delves into the dynamic world of personalized financial management. From the intricate features to the innovative design elements, the journey promises a comprehensive understanding of this rapidly evolving sector. We will analyze the current landscape, examining the user experience, security measures, and the future possibilities within this critical domain.

The mobile app for credit karma presents a revolutionary approach to managing one’s credit standing. This guide will illuminate the crucial elements of building such an app, covering everything from user interface design to robust security protocols and effective monetization strategies.

Introduction to Mobile Credit Score Apps

Mobile credit score apps have become increasingly popular, providing users with convenient access to their credit information on the go. These apps are revolutionizing how people manage their credit, enabling real-time monitoring and proactive steps to improve their financial health. They cater to a diverse range of users, from those just starting to build credit to seasoned borrowers seeking to maintain a strong credit profile.

This accessibility and ease of use have made mobile credit score apps a significant player in the financial technology sector. Their rise reflects the growing demand for readily available financial tools, particularly in a digital-first world. The apps offer a multitude of features designed to enhance credit literacy and promote responsible financial habits.

Typical Features and Functionalities

Mobile credit score apps typically offer a range of features designed to provide users with comprehensive credit information and tools for management. These features often include real-time credit score updates, detailed credit reports, personalized insights, and actionable steps for improvement. Many apps also integrate with other financial services, providing a holistic view of the user’s financial situation.

Current Trends and Evolving Needs

Users increasingly demand seamless integration and personalized experiences within credit score apps. They seek intuitive interfaces, comprehensive data visualizations, and actionable recommendations tailored to their individual needs and circumstances. Features like automated alerts for potential credit issues, personalized financial planning tools, and interactive educational resources are gaining popularity. The evolution of the market also involves integrating with other financial platforms to offer a more complete picture of the user’s financial profile.

Competitive Landscape

The mobile credit score app market is highly competitive, with established players and new entrants vying for market share. Prominent players often offer comprehensive features, robust data sources, and strong brand recognition. Emerging competitors frequently focus on niche markets, specialized features, or innovative user interfaces to differentiate themselves. The constant evolution of the industry involves new technologies and user expectations, driving the development of novel approaches to credit score monitoring and management.

Key Features of Top 3 Credit Monitoring Apps

This table Artikels the key features and functionalities of three prominent credit monitoring apps. Note that features and availability can vary, and apps may introduce new features or modify existing ones over time.

| Feature | App A | App B | App C |

|---|---|---|---|

| Credit Score Reporting | Real-time updates, personalized insights, detailed history | Real-time updates, customizable alerts, comprehensive reports | Real-time updates, interactive graphs, detailed credit report breakdown |

| Credit Report Access | Direct access to credit reports, detailed explanations | Secure access to credit reports, comparison to industry benchmarks | Access to credit reports, integrated dispute resolution tools |

| Financial Planning Tools | Budgeting tools, payment reminders, personalized recommendations | Debt management tools, savings calculators, financial goal setting | Investment tracking, expense analysis, personalized financial advice |

| Security Features | Two-factor authentication, data encryption | Data encryption, secure data storage, fraud detection | Data encryption, biometric authentication, secure user login |

User Experience and Interface Design

A strong user experience (UX) is crucial for a successful credit score app. It determines how users interact with the app, understand its features, and ultimately, whether they find it valuable and trustworthy. A well-designed interface, coupled with a smooth UX, leads to higher user engagement and satisfaction, encouraging continued use and positive feedback.

A mobile credit app must be intuitive and easy to navigate, even for users who aren’t tech-savvy. Clear visual cues, logical flow, and simple language contribute significantly to a positive user experience. This is particularly important because financial literacy and comfort levels vary among users.

Critical Aspects of UI Design

Effective UI design for a credit score app focuses on clarity, simplicity, and visual appeal. The layout should be clean and organized, allowing users to quickly locate and access important information. Consistent use of visual elements like colors, fonts, and icons enhances the app’s visual appeal and brand identity. Furthermore, the app should be optimized for different screen sizes and orientations to ensure a consistent experience across various devices. Important data points, like credit scores and report summaries, should be presented in a way that is easily digestible and actionable.

Impact of UX on User Engagement

User experience directly impacts user engagement and satisfaction. A positive UX fosters trust and encourages users to actively use the app to monitor and improve their credit scores. A smooth and intuitive interface will increase the likelihood of users checking their credit reports frequently, leading to a greater understanding of their financial health. This understanding, in turn, can empower users to take proactive steps to improve their creditworthiness. For instance, if a user quickly and easily sees a recent decline in their credit score, they might be motivated to understand the reason and take corrective actions.

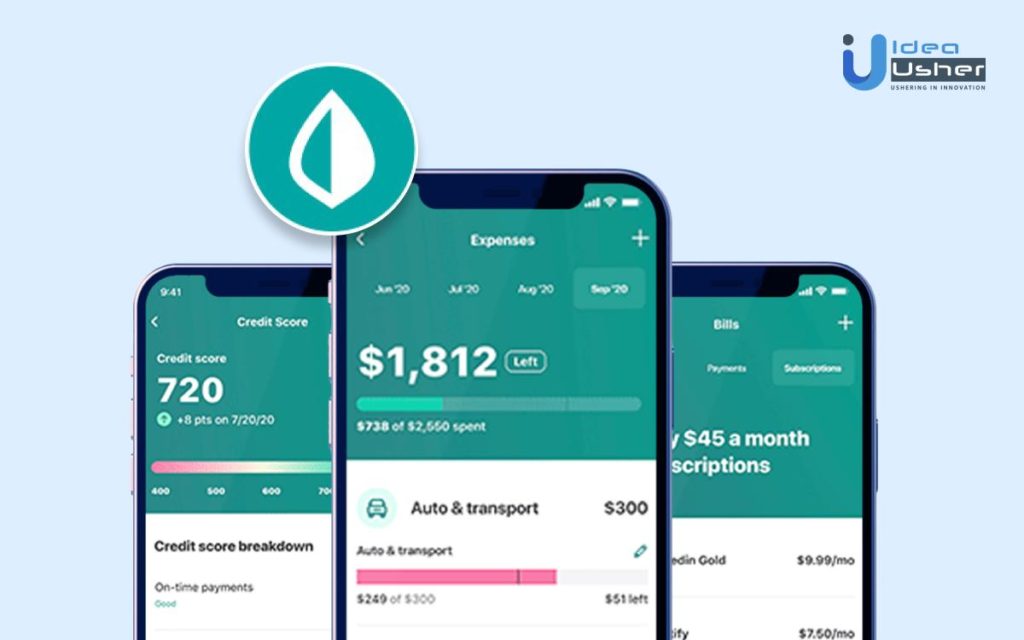

Mock-up of a User-Friendly Mobile App Interface

Imagine a Credit Karma mobile app interface with a clean, modern design. The home screen would prominently display the user’s current credit score, accompanied by a concise explanation of its components and potential areas for improvement. Sections for viewing credit reports, tracking payment history, and setting up personalized financial goals would be clearly labeled and easily accessible. Visual cues, like progress bars or color-coded indicators, would visually represent the user’s progress towards achieving their financial goals. The app would include clear and concise explanations of credit terms, which would be accessible through an “About” or “Help” section. A simple dashboard layout, featuring essential information at a glance, would be ideal. Navigation should be intuitive, using clear labels and icons to guide users through the app’s various features.

Comparison of Existing Credit Score Apps

Different credit score apps employ various UI/UX approaches. Some apps focus on a highly visual and interactive experience, using charts and graphs to present complex data in an easily understandable way. Others prioritize a more minimalist design, focusing on clarity and conciseness. There are apps that utilize gamified elements to encourage user engagement, while some apps employ personalized recommendations and financial advice. Comparing these approaches reveals the importance of tailoring the interface to specific user needs and preferences. For example, a user seeking detailed explanations might prefer an app with in-depth information, while a user simply looking to monitor their score might prefer a simpler design.

Importance of Accessibility Features

Accessibility features are essential for ensuring inclusivity. Features such as adjustable text sizes, high contrast modes, and alternative text descriptions for images should be incorporated to accommodate users with visual impairments or other disabilities. This commitment to accessibility demonstrates a responsible and user-centric approach. Clear, concise, and consistent language across the app is critical to ensure everyone can understand the information presented. Additionally, voice commands and simplified navigation can enhance usability for users with physical limitations.

Importance of Clear and Concise Information Presentation

Clear and concise information presentation is crucial for user comprehension. Technical terms should be explained simply and avoid jargon. Visual representations, such as charts and graphs, should be used effectively to convey complex data in a straightforward manner. This approach helps users quickly grasp their financial standing and understand how to improve it. The presentation should be easy to read and understand, regardless of the user’s level of financial literacy.

Features and Functionality

A successful mobile credit app needs to go beyond just displaying a credit score. It must offer a user-friendly and informative experience that empowers users to understand and improve their credit health. This section details essential features, their value propositions, secure data integration, and compares leading apps in the market.

Essential Features for a Mobile Credit App

Key features empower users to proactively manage their credit. Comprehensive credit score monitoring, personalized insights, and actionable steps to improve creditworthiness are crucial. Features that offer tools for budgeting, debt management, and credit report access further enhance user engagement and value.

- Credit Score Monitoring: Real-time updates on credit scores provide users with immediate feedback on their financial standing. This allows them to identify trends and potential issues early on, facilitating proactive management of their credit.

- Credit Report Access: Direct access to credit reports allows users to review their credit history, including accounts, payment history, and inquiries. This transparent access promotes informed decision-making and aids in identifying errors or inconsistencies.

- Personalized Insights and Recommendations: Analyzing credit history and providing tailored advice on improving credit scores are key to user engagement. This could include recommendations for paying down debt, building credit, or avoiding costly errors.

- Debt Management Tools: Integrated tools for tracking and managing debts, such as budgeting calculators and debt consolidation options, provide a more comprehensive financial management experience. This can help users stay on top of their finances and avoid accumulating further debt.

- Financial Literacy Resources: Educational content and articles on personal finance, credit scores, and responsible financial practices are valuable additions to the app. This enhances the user experience and empowers users with the knowledge they need to make informed decisions.

Secure and Efficient Data Integration

The security of user financial data is paramount. A robust security infrastructure, transparent data usage policies, and compliance with industry regulations are essential. Secure data encryption and multi-factor authentication are critical for safeguarding sensitive information.

- Secure Data Transmission: Employing industry-standard encryption protocols for data transmission and storage is essential. This protects user data from unauthorized access during transit and at rest.

- Data Privacy Policies: Clearly outlining data usage policies and obtaining explicit user consent for data collection are critical to building trust and transparency.

- Multi-Factor Authentication: Implementing multi-factor authentication strengthens security measures by requiring multiple verification steps beyond just a password. This adds an extra layer of protection.

Feature Comparison of Leading Credit Apps

This table compares key features across three popular credit apps.

| Feature | App 1 | App 2 | App 3 |

|---|---|---|---|

| Credit Score Monitoring | Real-time updates, detailed graphs | Real-time updates, personalized alerts | Real-time updates, interactive score breakdown |

| Credit Report Access | Direct access to Experian, TransUnion, Equifax | Direct access to Experian | Direct access to Equifax |

| Personalized Insights | Recommendations for improving credit score | Detailed analysis of credit history | Actionable steps based on credit profile |

| Debt Management Tools | Budgeting calculator, debt repayment planner | Debt consolidation calculator | Debt tracker, expense analyzer |

Data Security and Privacy

Protecting your credit information is paramount in a credit score app. User trust is built on the foundation of secure data handling. This section details the critical security measures implemented to safeguard your sensitive financial data.

Protecting user data is not just a good practice, it’s a necessity. Modern credit scoring apps must prioritize the confidentiality, integrity, and availability of user information. Robust security protocols and adherence to industry standards are crucial to maintaining user trust.

Importance of Data Security in Credit Apps

User data security is essential to maintain user trust and prevent financial harm. Compromised data can lead to identity theft, fraudulent activities, and significant financial losses. A strong security posture in a credit app ensures the safety and reliability of the service for users.

Security Measures Employed by Credit Apps

Ensuring data security requires multiple layers of protection. These include encryption, access controls, and regular security audits.

- Encryption: Data in transit and at rest is encrypted using industry-standard protocols. This protects sensitive information from unauthorized access even if intercepted. For example, HTTPS encryption is used for all communication between the app and the servers.

- Access Controls: Strict access controls limit who can access user data. Only authorized personnel with a demonstrated need-to-know have access to sensitive information. Multi-factor authentication (MFA) adds an extra layer of security, requiring users to provide multiple forms of verification.

- Regular Security Audits: Regular security assessments, vulnerability scans, and penetration testing are performed to identify and address potential weaknesses. This proactive approach ensures the app’s security posture remains strong.

User Data Privacy Concerns and How Apps Address Them

Understanding user concerns about data privacy is critical. Users want to know how their information is used and protected.

- Data Minimization: Credit apps collect only the necessary data for their intended purpose. Excessive data collection is avoided, reducing the risk of breaches and misuse.

- Transparency: Credit apps are transparent about their data collection practices, usage policies, and security measures. Clear and easily understandable privacy policies are provided to users.

- Compliance with Regulations: Apps adhere to relevant data privacy regulations, such as GDPR or CCPA. These regulations Artikel specific requirements for data protection and user rights.

Comprehensive Overview of Security Protocols and Compliance Standards

Robust security protocols are crucial for protecting user data.

- Data Loss Prevention (DLP): DLP systems prevent sensitive data from leaving the secured environment, mitigating the risk of unauthorized disclosure.

- Security Information and Event Management (SIEM): SIEM tools monitor system logs and events, detecting potential security threats and incidents in real-time.

- PCI DSS Compliance: For financial apps, compliance with the Payment Card Industry Data Security Standard (PCI DSS) is critical to secure payment processing.

Data Flow and Security Measures within the App

The following flowchart illustrates the data flow and security measures implemented within the credit app.

[Note: A flowchart diagram would be inserted here, showing data flow from user input to storage, including encryption and access controls at each stage. For example, user input is encrypted before transmission to servers. Data stored in the database is encrypted. Access to data is restricted using user authentication and authorization.]

Monetization Strategies

Credit score apps can generate revenue through various methods, allowing them to offer their services for free or at a reduced cost to users. Understanding these monetization models is crucial for app development and success in the competitive market. Careful selection of a monetization strategy can significantly impact user engagement and long-term profitability.

Monetization Models

Different monetization models cater to varying user needs and app functionalities. A well-chosen model can maximize revenue while maintaining user satisfaction. The key is to strike a balance between the needs of the app and the expectations of the users.

- Freemium Model: This model provides a basic version of the app for free, with premium features available for a subscription fee. This approach allows users to experience the core functionality without cost, increasing user adoption. It’s a common method in mobile apps, allowing users to test the app’s value proposition before committing to a paid version. An example is a free version of the app that displays a limited number of credit reports, and users need to pay for unlimited access or premium features like real-time credit monitoring.

- Subscription Model: Users pay a recurring fee for access to the app’s features and services. This model can provide a stable revenue stream, allowing for consistent income generation. This model is often successful when users value the ongoing access to data and tools provided by the app. An example of this is a monthly subscription for detailed credit reports and personalized financial advice.

- In-App Purchases (IAP): Users can purchase additional features, tools, or content within the app itself. This method allows for targeted upgrades and adds to the app’s perceived value. A successful example is an app that offers access to personalized credit building tools, credit score improvement strategies, or detailed reports as IAPs.

- Advertising Model: This model displays advertisements within the app to generate revenue. The key to success is to ensure that the ads don’t disrupt the user experience. A key consideration is to avoid excessive or intrusive advertising that could deter users from continuing to use the app. This method often requires a large user base to be effective.

Pros and Cons of Each Model

Each monetization model presents its own set of advantages and disadvantages.

| Monetization Model | Pros | Cons |

|---|---|---|

| Freemium | High user acquisition, potential for significant revenue with premium features, users experience the app before committing | Requires careful design to avoid losing users, can be challenging to balance free and premium features |

| Subscription | Predictable revenue stream, ongoing user engagement, potential for higher lifetime value | Can be challenging to attract and retain users, potential churn if subscription fees are too high |

| IAP | Allows for targeted upgrades, potential for significant revenue, encourages user engagement | Can be complex to implement, may not appeal to all users, needs a strong value proposition for the additional features |

| Advertising | Potentially high reach, low cost to implement, easy to scale | Can negatively impact user experience, may not be suitable for all types of apps, relies on a large user base to generate sufficient revenue |

Potential Revenue Streams

Credit score apps can generate revenue from various sources beyond the core monetization model.

- Partnerships with Financial Institutions: Collaborating with banks or credit card companies can provide access to valuable data and potentially result in referral fees. For example, a partnership with a bank might allow the app to provide more detailed information about the user’s bank accounts and credit lines.

- Data Analysis and Reporting: Analyzing user data to provide insights into financial behavior or creditworthiness can be monetized through data analysis services. This could involve selling reports on user credit behavior trends to other companies.

- Financial Products and Services: Partnering with financial institutions to offer financial products like credit building tools, loans, or insurance can generate substantial revenue. This requires careful consideration of compliance and regulatory requirements.

Examples of Successful Strategies

Many successful credit score apps leverage a combination of monetization strategies. For instance, some apps use a freemium model with IAPs for advanced features or detailed reports.

Potential Strategy for a New App

A new mobile credit app could leverage a freemium model with limited core features available for free. A subscription model could be introduced for premium features like personalized credit score improvement strategies and tools. IAPs could be offered for access to credit reports, tools for budgeting and financial management, or specialized credit-building courses.

Marketing and Promotion

Attracting and retaining users for a credit score app requires a multifaceted marketing strategy. Effective campaigns will resonate with target demographics, leverage relevant channels, and build trust in the app’s value proposition. A successful promotional strategy should include clear messaging, consistent branding, and measurable results.

Target Audience Segmentation

Understanding the diverse needs and motivations of potential users is crucial for effective marketing. Identifying distinct segments based on factors like age, income, financial literacy, and existing credit habits will allow for tailored messaging and channel selection. For example, younger users might be more receptive to social media campaigns emphasizing ease of use and free features, while established users might prioritize detailed credit reports and personalized insights.

Marketing Campaign Examples

Successful campaigns for similar apps often involve limited-time offers, educational content, and social proof. For instance, some apps have used targeted social media ads featuring testimonials from satisfied users or offered introductory discounts for new sign-ups. Other campaigns focused on partnerships with financial institutions or credit counseling organizations to enhance credibility. These strategies effectively communicate the app’s benefits and build trust.

Marketing Channels and Effectiveness

A comprehensive marketing strategy should utilize a combination of online and offline channels. The effectiveness of each channel varies depending on the target audience. For instance, social media platforms like Facebook and Instagram can reach broad audiences, while targeted online advertising can reach specific demographics. Email marketing can nurture leads and promote specific features. Partnerships with financial institutions can enhance credibility and attract a specific user segment. Content marketing through blog posts or articles about credit scores can build brand awareness and establish the app as a credible resource.

Promotional Strategy for Attraction and Retention

To attract new users, the app should highlight its key features, such as the ability to track credit score progress, personalized insights, and educational content. For retaining users, a focus on ongoing engagement is vital. This could include regular updates, proactive customer support, and exclusive content. For example, a loyalty program rewarding consistent use or offering discounts on credit monitoring services can encourage long-term engagement.

Summary of Marketing Channels

| Channel | Description | Target Audience | Effectiveness |

|---|---|---|---|

| Social Media (Facebook, Instagram, TikTok) | Targeted ads, user-generated content, influencer collaborations | Broad audience, particularly younger demographics | High effectiveness, but requires continuous optimization |

| Search Engine Optimization () | Optimizing website and app content for relevant s | Users actively searching for credit score information | Long-term effectiveness, builds organic traffic |

| Paid Search Advertising (Google Ads) | Targeted ads on search engines | Users actively seeking credit-related solutions | High ROI potential with precise targeting |

| Email Marketing | Targeted email campaigns to existing and potential users | Existing users, leads | Effective for nurturing leads and promoting new features |

| Partnerships (Financial Institutions, Credit Counseling) | Collaborations to offer joint promotions or educational resources | Users seeking financial support or credible information | Builds trust and credibility, reaches a specific audience |

Technical Considerations

Building a mobile credit score app requires careful consideration of technical aspects, from choosing the right technologies to ensuring a smooth user experience. This involves understanding the complexities of data handling, security protocols, and the mobile development process. Thorough planning is crucial for a successful launch and ongoing maintenance.

The technical architecture of the app needs to support a robust and secure platform. This involves careful selection of technologies, considering scalability, maintainability, and performance. The chosen framework should be compatible with the specific needs of the app, such as handling large datasets and ensuring fast response times.

Technologies and Frameworks

Selecting appropriate technologies and frameworks is critical for the app’s performance, scalability, and maintainability. Several options exist, each with its strengths and weaknesses. Popular choices include React Native, Flutter, and native development (Swift for iOS, Kotlin for Android). Each has advantages: React Native allows for faster development through shared codebases, Flutter offers a streamlined development experience with a consistent user interface across platforms, and native development provides the best performance but requires separate codebases for each platform.

Development Process

The development process for a mobile app typically follows a series of steps. First, a detailed design is created, outlining the app’s features, functionality, and user interface. Then, the development phase begins, where the app’s core components are built and tested. This is followed by rigorous testing to identify and resolve any bugs or usability issues. Finally, the app is deployed to app stores for public release. This process often involves iterations and adjustments based on feedback and testing results.

Technical Challenges and Solutions

Several technical challenges can arise during app development. One significant challenge is maintaining data security and privacy, especially when handling sensitive financial information. Solutions include implementing robust encryption protocols, adhering to industry security standards (like PCI DSS), and regularly auditing the system for vulnerabilities. Another challenge is ensuring seamless performance across various devices and operating systems. This can be addressed by optimizing code for different hardware configurations and utilizing responsive design principles. Scalability is another concern, as user growth can significantly impact app performance. Scalable architecture and cloud-based solutions can address this concern.

Building and Deploying the App

Building a mobile credit app involves several key steps. First, the development team needs to create a robust development environment, including setting up the necessary tools and technologies. Next, the app needs to be thoroughly tested on various devices and operating systems to ensure compatibility and identify any bugs. This testing should cover different use cases and edge scenarios. Once testing is complete, the app can be submitted to app stores for review and approval. Finally, the team needs to have a deployment strategy in place to manage updates and address any post-launch issues.

Data Handling and Security

Handling and securing credit score data is paramount. Robust data encryption, secure storage solutions, and adherence to data privacy regulations are critical. This includes features like end-to-end encryption and secure API calls to protect user data. Implementing data validation at every stage can further enhance security and prevent unauthorized access or manipulation. A detailed security audit and regular vulnerability assessments are also crucial.

Future Trends and Innovations

The mobile credit app landscape is constantly evolving, driven by technological advancements and user demands. Staying ahead of the curve in this dynamic environment is crucial for continued success. This section explores emerging trends, the future of mobile credit monitoring, and the impact of new technologies on the industry.

Emerging Trends in Mobile Credit Apps

The mobile credit app market is witnessing several key trends. These include a greater emphasis on personalized experiences, leveraging AI and machine learning for enhanced credit insights, and a focus on seamless integration with other financial tools. Users are increasingly seeking tools that go beyond basic score monitoring, demanding features that provide actionable advice and personalized financial planning.

The Future of Mobile Credit Score Monitoring

Mobile credit score monitoring is expected to become even more integrated into users’ daily financial lives. Imagine a future where credit scores are proactively monitored and updated in real-time, providing users with instant feedback on their financial health. This proactive approach would empower users to make informed decisions about their spending and borrowing habits. Additionally, advanced features will predict potential risks and offer tailored solutions, ultimately making financial planning more intuitive and accessible.

Potential Impact of New Technologies on the Industry

New technologies are poised to significantly impact the mobile credit app industry. For example, blockchain technology could enhance data security and transparency, while augmented reality (AR) could create immersive and interactive experiences for users. AI-driven insights will provide more personalized and proactive recommendations, allowing users to address potential credit issues before they escalate. This integration will provide users with actionable steps to enhance their financial well-being.

Potential Innovations and Improvements in the Field

Several potential innovations could transform the mobile credit app experience. These include the integration of biometric authentication for enhanced security, personalized financial planning tools tailored to individual user needs, and predictive analytics for early identification of potential credit problems. These developments will offer a richer and more proactive experience, empowering users to take control of their financial futures.

Potential Future Developments

- Real-time Credit Monitoring: Apps will continuously track and update credit scores, providing users with immediate feedback on their financial health as transactions occur. This will allow users to react swiftly to potential issues.

- AI-Powered Financial Advice: Sophisticated AI algorithms will provide personalized recommendations and actionable advice based on individual financial situations and goals. This will go beyond basic score monitoring to offer a proactive financial planning tool.

- Integration with Other Financial Services: Mobile credit apps will integrate seamlessly with banking apps, investment platforms, and other financial tools, creating a unified financial management experience. This will create a one-stop-shop for all financial needs.

- Enhanced Data Security and Privacy: Robust security measures and transparent privacy policies will be paramount, building user trust in the app’s handling of sensitive financial information. This will be vital to building user trust and encouraging continued usage.

- Predictive Analytics for Credit Risks: Sophisticated algorithms will identify potential credit risks early on, empowering users to address problems before they impact their scores. This could involve identifying unusual spending patterns or potential debt accumulation.

Summary

In conclusion, the mobile app for credit karma has the potential to reshape personal finance. By integrating advanced features with a user-friendly interface, while prioritizing data security, this innovative platform could revolutionize how users interact with their credit scores. The future of credit management appears promising, and this exploration provides a roadmap for understanding and potentially contributing to this transformation.