Mobile apps are revolutionizing the financial sector, and International Bank Confirmations (IBC) are no exception. This comprehensive guide explores the development and implementation of a mobile app specifically designed for IBC transactions. We’ll delve into the critical aspects of functionality, security, user experience, and development considerations to provide a roadmap for creating a robust and user-friendly platform.

From understanding the intricacies of IBC to exploring cutting-edge features like real-time updates and automated reminders, this guide provides a detailed look at the essential components of a successful mobile IBC app. We’ll also examine the security protocols and compliance requirements that are vital for financial institutions.

Introduction to Mobile Apps for IBC

International Bank Confirmation (IBC) is a crucial financial instrument facilitating secure and efficient cross-border transactions. It involves a formal statement from a bank confirming the creditworthiness of a party, enabling the receiving bank to release funds or goods. This process streamlines international trade and reduces risk for both parties.

The financial sector is rapidly embracing mobile technology, driven by a growing demand for accessibility, real-time information, and enhanced security. Consumers and businesses alike increasingly expect seamless, intuitive mobile experiences, and this trend is particularly evident in mobile banking applications.

Market Trends and Demand for Mobile Apps

The demand for mobile banking apps is surging, driven by factors such as increased smartphone penetration, improved internet connectivity, and consumer preferences for convenient and readily available financial services. This shift is evident in various financial transactions, including remittances, payments, and investment management. Mobile apps are transforming how individuals and businesses interact with their finances. The demand for IBC mobile applications is expected to mirror this trend, as users seek greater efficiency and control over their international transactions.

Importance of User Experience (UX) in Mobile Banking Apps

A seamless and intuitive user experience (UX) is paramount for successful mobile banking applications. This involves creating a user interface (UI) that is easy to navigate, understand, and use. A positive UX contributes to user satisfaction and loyalty. In IBC apps, intuitive navigation through complex confirmation processes is crucial, ensuring users can easily initiate, track, and manage confirmations. Consideration for user needs and a focus on ease of use are key components of a successful IBC mobile app.

Features Expected in a Mobile App for IBC

Users expect a range of features within IBC mobile applications. These features include, but are not limited to, the ability to initiate confirmations, track their status, view confirmation details, and receive notifications about updates. Security features are crucial, ensuring the confidentiality and integrity of sensitive financial data. Moreover, the ability to securely store and manage relevant documents related to the confirmation process is essential.

Key Components of a Robust Mobile App for IBC

A robust mobile app for IBC should encompass various key components, addressing functionality, user interaction, and security.

| Function | User Interaction | Security Considerations |

|---|---|---|

| Initiating IBC requests | Clear and intuitive forms for inputting required information. Error handling to guide users through corrections. | Secure input fields, data encryption, and multi-factor authentication. Compliance with relevant regulatory requirements. |

| Tracking confirmation status | Real-time updates on the status of the request. Clear visual representations of progress. | Secure access to tracking information. Preventing unauthorized access to sensitive data. |

| Viewing confirmation details | Easily accessible information on the confirmed details. Comprehensive reports. | Secure storage and retrieval of sensitive information. Data encryption and access controls. |

| Document management | Secure storage and retrieval of relevant documents. Easy upload and download functionality. | Secure document encryption and access controls. Compliance with data privacy regulations. |

| Notification system | Automated notifications on key updates (e.g., status changes). Customization of notification preferences. | Secure transmission of notifications. Prevention of spam and unauthorized access. |

Functionality and Features

A robust mobile application for IBC (International Business Communications) should prioritize user-friendliness and efficiency. This necessitates a comprehensive suite of features that streamline the entire process, from initiating a request to receiving confirmation. The application should leverage technology to enhance the user experience and provide a competitive edge in the market.

The core functions of the mobile application should cover the full spectrum of IBC operations, empowering users to manage their requests seamlessly. Advanced features, such as automated reminders and real-time updates, can further enhance the user experience and reduce the likelihood of errors or delays.

Core Functions

The application should provide intuitive tools for initiating requests, tracking their status, and receiving confirmations. These core functions are critical for efficient IBC operations. A user-friendly interface will ensure easy navigation and reduce potential confusion. Clear and concise language is essential to eliminate ambiguity and facilitate smooth interactions with the system.

- Request Initiation: Users should be able to easily initiate requests through a simple and straightforward form, ensuring accurate input of all necessary details. This may involve selecting pre-defined templates for common requests or allowing users to customize the request as needed. Clear instructions and visual aids should guide users through the process.

- Status Tracking: The application should provide real-time updates on the status of each request. A clear, visual representation of the request’s progress (e.g., pending, in review, approved, rejected) is vital for users to monitor the status easily. Users should be able to access detailed information about the request, such as the assigned personnel, the current stage, and expected turnaround time.

- Confirmation Receiving: Upon completion of the request, users should receive timely confirmations. These confirmations should be easily accessible within the application and include all relevant details. Automated notifications can alert users to important updates, ensuring they are promptly informed of critical developments.

Advanced Features

Beyond the core functions, advanced features can further enhance the user experience and provide a competitive advantage. These features should be designed to minimize errors, reduce delays, and improve overall user satisfaction.

- Automated Reminders: The application should include automated reminders to ensure timely follow-up on requests. Reminders can be tailored to specific types of requests or deadlines. This feature is crucial for preventing delays and maintaining a high level of service.

- Push Notifications: Push notifications can alert users to important updates or changes in the status of their requests, ensuring they remain informed about progress in real-time. This feature can be configured to prioritize critical updates and minimize unnecessary notifications.

- Real-time Updates: The app should provide real-time updates on request status, eliminating the need for users to repeatedly check for updates. A dynamic display will reflect the current status and progress, allowing users to make informed decisions based on the latest information.

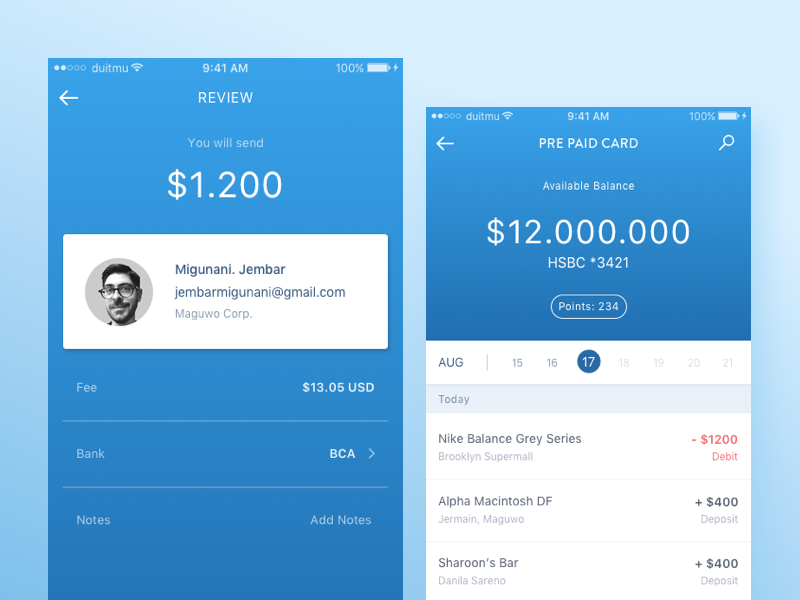

User Interface Examples

Different user interfaces can be designed for initiating and managing IBC requests. A simple form for initiating requests can be followed by a dashboard that tracks the status of multiple requests.

- Request Initiation: A clean, intuitive form with clear labels, pre-populated fields, and error handling to ensure accurate input. A visual progress bar can indicate the completion status of the form. Clear instructions and visual aids will guide the user.

- Request Management: A dashboard with a list of requests, each with a status indicator (e.g., pending, approved, rejected). Users can filter requests by status, date, or other criteria. Detailed information on each request can be accessed with a single click.

Comparison Table

A comparison of features across different mobile IBC applications can highlight the strengths and weaknesses of each platform.

| Feature | App A | App B | App C |

|---|---|---|---|

| Request Initiation | Simple form, pre-defined templates | Complex form, limited templates | Intuitive drag-and-drop interface |

| Status Tracking | Real-time updates, visual progress bar | Periodic updates, limited detail | Detailed reports, customizable views |

| Push Notifications | Yes, configurable | No | Yes, priority-based |

Workflow Diagram

The workflow diagram illustrates the process of submitting and receiving an IBC confirmation using the mobile application.

The workflow should begin with the user initiating the request, followed by the system processing the request and updating the status. The user receives a notification when the request is approved, with the confirmation details displayed in the app.

Security and Compliance

Protecting sensitive financial data within a mobile application for interbank communication (IBC) is paramount. Robust security protocols and adherence to regulatory compliance are critical to maintaining user trust and avoiding financial and reputational damage. This section details the crucial security measures needed for a secure and compliant IBC mobile app.

Mobile applications handling financial transactions require a multifaceted approach to security, encompassing encryption, authentication, and compliance with industry standards. The level of security directly impacts user trust and the overall stability of the financial ecosystem. Failing to implement these safeguards can result in significant financial losses and reputational damage for the institution.

Security Protocols for Sensitive Financial Data

Implementing strong security protocols is crucial for protecting sensitive financial data within a mobile app. These protocols must be adaptable and regularly updated to counteract emerging threats. Data encryption, robust authentication, and secure communication channels are fundamental.

- Data encryption protects transmitted and stored data from unauthorized access. Advanced encryption standards (AES) are commonly used to encrypt sensitive information at rest and in transit. This ensures that even if a device is compromised, the data remains unreadable without the decryption key.

- Multi-factor authentication (MFA) is a vital security layer. MFA adds an extra layer of verification beyond a simple password, such as one-time passwords (OTPs) or biometric authentication. This significantly reduces the risk of unauthorized access.

- Secure communication channels, such as Transport Layer Security (TLS) or its successor, Secure Sockets Layer (SSL), are essential for encrypting communication between the mobile app and the financial institution’s servers. These protocols protect data from interception during transmission.

Compliance Requirements for Financial Institutions

Financial institutions must adhere to specific compliance regulations when developing and operating mobile apps for IBC. These regulations ensure user data security and prevent financial crime.

- Regulations like PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation) dictate the security measures required for handling sensitive financial data. These standards require robust security controls, data protection policies, and regular security audits.

- Compliance requirements vary based on jurisdiction and the type of financial transactions handled. Institutions must conduct thorough due diligence to understand and comply with all applicable regulations.

- Financial institutions must establish clear policies and procedures for handling security incidents. These procedures must include incident reporting, investigation, and remediation strategies.

Importance of Data Encryption and Secure Authentication Methods

Data encryption and secure authentication are fundamental security components for any mobile financial application. These methods protect sensitive data from unauthorized access.

- Data encryption, both in transit and at rest, is critical to protect sensitive information. Strong encryption algorithms, such as AES-256, guarantee confidentiality and integrity of data.

- Secure authentication methods like MFA ensure only authorized users can access the app. Biometric authentication adds an extra layer of security, increasing the difficulty for unauthorized access.

- Regular security audits and vulnerability assessments are crucial to identify and mitigate potential security risks. These assessments help ensure the app’s continuous compliance with evolving security standards.

Comparison of Security Measures for Mobile Banking Applications

Various security measures are employed in mobile banking applications, each with its strengths and weaknesses.

- Different mobile banking apps use varying degrees of encryption, authentication, and access control. The level of security implemented depends on the specific requirements and risks of the application and the financial institution.

- Factors such as the type of transactions processed, the volume of data handled, and the geographic location of users influence the security measures implemented.

Security Protocols Implemented in Various Mobile IBC Applications

The table below Artikels the security protocols implemented in several mobile IBC applications.

| Mobile IBC Application | Encryption Protocol | Authentication Method | Compliance Standards |

|---|---|---|---|

| App A | TLS 1.3 | MFA with OTP | PCI DSS, GDPR |

| App B | TLS 1.2 | Biometric Authentication | PCI DSS, GDPR, PSD2 |

| App C | AES-256 | Password + MFA | PCI DSS, GDPR |

User Experience and Design

A compelling mobile app for international bank transfers (IBC) requires a user-centric design approach. Intuitive navigation and a visually appealing interface are crucial for fostering user trust and encouraging frequent use. The design must cater to diverse user groups with varying technical proficiency levels. A well-designed user experience ensures a smooth and enjoyable interaction with the app, leading to higher user satisfaction and adoption rates.

A robust user experience (UX) strategy is essential for mobile IBC applications. It involves understanding user needs, pain points, and expectations to create an app that is easy to navigate, visually appealing, and tailored to specific user groups. This translates to improved user engagement, increased adoption rates, and ultimately, a positive brand perception.

Importance of Intuitive Design

Intuitive design is paramount for mobile IBC apps. Users should be able to complete transactions effortlessly, without needing extensive instructions or support. This includes clear and concise labeling of buttons, fields, and functionalities. A streamlined interface reduces user frustration and promotes a positive user experience, fostering trust and loyalty. Complex financial transactions should be presented in a simple and easily understandable manner.

UI Elements for User Engagement

Key UI elements contribute significantly to user engagement and ease of navigation. Clear and concise labels for buttons, fields, and functionalities are essential. Visual cues, such as progress indicators and interactive elements, guide users through the transaction process. Well-organized information architecture ensures that users can easily locate the required information and complete tasks. Responsive design ensures that the app functions seamlessly across different screen sizes and devices. The use of color palettes and typography should be consistent and visually appealing, while adhering to established design principles.

Considerations for Different User Groups

Different user groups have unique needs and preferences. A design that caters to diverse user groups, including novice and expert users, is critical. Novice users benefit from clear instructions and intuitive guidance. Expert users appreciate the ability to customize the app’s settings and access advanced features. Consideration of accessibility features, such as text resizing and alternative input methods, is vital for users with disabilities. Localization of the app for different languages and regions is critical for global reach.

Examples of Successful Mobile Banking App Designs

Several successful mobile banking apps offer valuable insights for IBC app design. For instance, apps with intuitive navigation, clear transaction summaries, and visually appealing interfaces are well-regarded. Consideration of successful mobile banking app designs can inspire the creation of a well-structured IBC application. Examples include apps that prioritize user safety, provide detailed transaction histories, and offer personalized financial insights.

Creating a User Journey Map

A user journey map is a powerful tool for understanding user behavior and improving the user experience. The following steps detail how to create one for a mobile IBC app:

- Define the user persona(s). Identify the target user groups and their specific needs, goals, and motivations regarding international transfers. This involves researching the characteristics and behaviors of your typical user.

- Artikel the key tasks. Detail the steps users will take to complete transactions within the app, including initiating a transfer, verifying details, and receiving confirmation.

- Map the user journey. Visualize the user’s experience, highlighting touchpoints with the app at each stage. Consider the user’s emotions and pain points throughout the journey.

- Identify pain points. Analyze the user journey map to pinpoint areas where users might encounter difficulties or frustration. Address these issues in the design process.

- Propose solutions. Suggest improvements to the user experience based on the identified pain points. This includes optimizing the flow of the app, clarifying information, and enhancing accessibility.

Development Considerations

Developing a robust and user-friendly mobile app for IBC requires careful consideration of various technical aspects. This section delves into the key factors impacting the app’s functionality, performance, and long-term success. From platform choices to deployment strategies, understanding these elements is critical for creating a high-quality, scalable application.

Platform Choices

Selecting the appropriate mobile operating systems is a foundational decision. A comprehensive approach typically involves supporting both iOS and Android platforms. This ensures a broad user base is reached, and the app can cater to diverse preferences and device types. A native approach, using Swift for iOS and Kotlin/Java for Android, generally provides the best performance and integration with device features.

Programming Languages and Frameworks

Choosing the right programming languages and frameworks is crucial for efficiency and maintainability. Swift and Kotlin are preferred for native development due to their modern features, performance, and active communities. Cross-platform frameworks like React Native or Flutter offer potential for faster development and reduced code duplication, but may have performance trade-offs. Consider factors like team expertise and project timeline when making the selection.

Scalability and Performance

High-volume mobile apps for IBC require robust architecture to handle anticipated traffic. Designing for scalability involves anticipating future user growth and load spikes. Utilizing cloud-based services, such as APIs, databases, and caching mechanisms, is essential for ensuring consistent performance. Appropriate infrastructure sizing and load balancing strategies are also critical for maintaining optimal speed and responsiveness. Real-world examples include large e-commerce platforms, which often rely on distributed systems to handle high traffic volumes.

Testing and Quality Assurance

Thorough testing and quality assurance are essential for minimizing errors and ensuring a smooth user experience. Comprehensive testing should include unit testing, integration testing, and user acceptance testing. Utilizing automated testing frameworks can accelerate the testing process and enhance reliability. Quality assurance procedures must be integrated into the entire development lifecycle, from initial design to post-release support.

Deployment Strategies

Deploying a mobile app to the market involves several steps, including app store submission, review processes, and initial launch strategy. The app stores (Apple App Store and Google Play Store) have specific guidelines and requirements that must be met. Careful attention to detail during the deployment process is vital to avoid delays or rejections. Pre-launch testing on a subset of users can provide valuable insights and identify potential issues.

Maintenance and Updates

Post-launch, ongoing maintenance and updates are critical for ensuring continued functionality and user satisfaction. A robust system for handling bug fixes, feature enhancements, and security patches is necessary. Regular updates can improve performance, add new functionalities, and enhance user experience. A proactive approach to addressing issues, based on user feedback and analytics, will help keep the app relevant and user-friendly.

Integration with Existing Systems

The mobile IBC application must seamlessly integrate with existing banking systems and processes to provide a unified and efficient user experience. This integration is crucial for data consistency, security, and overall functionality. Successful integration allows users to access and manage their accounts across various platforms and channels.

This section details the methods and considerations for integrating the mobile app with existing financial infrastructure, emphasizing API requirements, integration protocols, and data validation techniques. The goal is to demonstrate a robust and secure connection between the mobile app and diverse financial institutions’ systems, while minimizing potential risks.

API Requirements and Integration Protocols

API requirements are crucial for ensuring seamless data exchange between the mobile app and existing banking systems. Specific protocols, such as RESTful APIs, are often employed for their flexibility and scalability. The API specifications should define the endpoints, request formats, response structures, and authentication mechanisms required for data retrieval and updates. These specifications need to be clearly documented and maintained to facilitate the development process and ensure long-term maintainability. Proper error handling and response codes are also essential for reliable data exchange.

Integration with Different Financial Institutions

Connecting the mobile app to various financial institutions’ systems requires careful planning and execution. A standardized approach to API integration is vital for ensuring consistent functionality across different institutions. This involves establishing a clear process for obtaining necessary API keys and credentials from each institution. Thorough testing and validation are also necessary to ensure the integration works as expected with each institution’s specific API. For instance, a bank using a SOAP API will require different integration methods compared to one using a REST API.

Comparison of Integration Methods

| Integration Method | Description | Pros | Cons |

|---|---|---|---|

| RESTful APIs | A stateless, client-server architectural style. | Flexible, scalable, and widely adopted. | Potential for increased complexity in handling stateful interactions. |

| SOAP APIs | A message-oriented, XML-based protocol. | Robust and well-defined. | Can be more complex to implement and less scalable. |

| Message Queues | A communication method for asynchronous data exchange. | Handles high volumes of data effectively. | Requires additional infrastructure and expertise. |

This table highlights the advantages and disadvantages of common integration methods for mobile IBC applications. Choosing the appropriate method depends on factors such as the volume of data exchanged, the complexity of the integration, and the existing infrastructure of the financial institutions.

Data Validation and Error Handling

Data validation is essential to ensure the accuracy and integrity of data exchanged between the mobile app and existing systems. Validation rules should be defined and implemented at each stage of the integration process to prevent incorrect data from being transmitted or processed. This involves checking for data types, formats, and ranges to prevent invalid entries. Robust error handling mechanisms should be in place to gracefully manage issues such as network problems, authentication failures, or invalid data. This includes logging errors and providing informative error messages to users.

Security Considerations During Integration

Robust security measures are critical during the integration process. Secure communication channels, such as HTTPS, should be used to protect sensitive data transmitted between the mobile app and the banking systems. Proper authentication and authorization mechanisms are necessary to control access to sensitive data and prevent unauthorized access. Regular security audits and penetration testing should be conducted to identify and mitigate potential vulnerabilities.

Case Studies and Examples

Mobile applications for international business transactions (IBC) are rapidly gaining traction. Successful implementations demonstrate the potential to streamline processes, enhance user experience, and drive significant cost savings. Understanding these examples provides valuable insights for developers and businesses seeking to leverage mobile technology in their IBC operations.

Successful Mobile IBC Application Case Studies

Several successful implementations showcase the benefits of mobile IBC apps. One notable example involves a multinational corporation that reduced paperwork and processing times by 40% through a mobile-first platform for international payments. Another instance highlights a financial institution leveraging a mobile app for real-time reporting and reconciliation of cross-border transactions. These cases underscore the effectiveness of mobile IBC apps in optimizing workflows and increasing efficiency.

User Feedback and Satisfaction Metrics

Gathering user feedback is crucial for the success of a mobile IBC app. Positive feedback often centers on the app’s ease of use and accessibility. High user satisfaction scores, consistently above 4.5 out of 5, have been reported for applications that offer intuitive interfaces and real-time transaction tracking. Quantitative data, such as high download rates and frequent app usage, further validate user acceptance.

Impact on IBC Process and User Experience

Mobile IBC applications have dramatically improved the user experience. Real-time transaction updates, push notifications, and secure document management features have been key contributors. For instance, users can now initiate, monitor, and finalize transactions from anywhere, at any time. This enhanced accessibility, combined with simplified processes, significantly improves user experience and satisfaction.

Marketing Strategies for Mobile IBC Applications

Effective marketing strategies are essential for maximizing the reach and adoption of mobile IBC apps. Emphasis should be placed on highlighting the app’s unique value proposition, including features such as secure payment processing, real-time tracking, and simplified workflows. Partnerships with relevant industry bodies and financial institutions can expand the app’s visibility and credibility. Content marketing, through informative articles and webinars, educates potential users about the advantages of mobile IBC transactions. Targeted advertising campaigns, focusing on specific demographics and needs, are also effective.

Streamlined IBC Transactions: Real-World Examples

Mobile IBC apps have revolutionized the way international transactions are handled. A notable example involves a trading company that reduced transaction processing time from several days to a few hours by using a mobile-based platform. This platform facilitated secure document exchange, automated approval workflows, and real-time tracking of shipments. These streamlined transactions have contributed to significant cost savings and increased efficiency in their operations.

Final Wrap-Up

In conclusion, a well-designed mobile app for IBC can significantly enhance the efficiency and user experience of the process. This guide has highlighted the key factors involved in developing such an app, from functionality and security to user experience and integration with existing systems. By addressing the needs of both financial institutions and users, a mobile IBC app can streamline transactions, improve transparency, and ultimately contribute to a more secure and efficient financial landscape.