Mobile app for managing finances has revolutionized personal finance, offering unprecedented control and insight into our spending habits. From budgeting and tracking expenses to managing investments and debt, these apps empower users with tools to achieve their financial goals. This exploration delves into the evolution, features, design, security, and future of these indispensable digital companions.

The modern financial landscape demands efficient and accessible solutions. Mobile finance management apps have emerged as a powerful tool, catering to a wide range of users and offering a diverse array of functionalities. Understanding the core features, security considerations, and competitive landscape is crucial for making informed decisions about choosing the right app.

Introduction to Mobile Finance Management Apps

Mobile finance management apps have exploded in popularity, offering a convenient and often insightful way to track spending, budget, and even invest. This rise reflects a growing desire for greater financial transparency and control in a world increasingly reliant on digital tools. From simple budgeting apps to sophisticated investment platforms, these apps cater to a diverse range of users, from young adults just starting out to seasoned investors.

These applications are more than just digital checkbooks; they act as personalized financial advisors, offering tailored guidance and insights. Their ability to aggregate data from various sources allows users to gain a holistic view of their financial situation, enabling them to make informed decisions and achieve their financial goals.

Current Market Trends

The mobile finance management app market is incredibly competitive, with new apps emerging constantly. A key trend is the integration of AI and machine learning. These technologies can analyze user spending patterns to offer personalized budgeting advice, suggest potential savings opportunities, and even predict future financial needs. Another significant trend is the increasing sophistication of investment management tools within these apps. More users are now able to access investment platforms through their smartphones, empowering them to manage their portfolios on the go.

App Features

A wide array of features are common across mobile finance management apps. These include basic budgeting tools, expense tracking and categorization, and bill payment integration. Many apps also offer features for setting financial goals, such as saving for a down payment or retirement. More advanced apps incorporate investment tools, allowing users to track their portfolios, analyze market trends, and even receive personalized investment advice. Security features, such as two-factor authentication and encryption, are also increasingly important in this digital age.

Target Demographics

These apps appeal to a broad range of demographics. Budget tracking apps are particularly popular with young adults and families, who often benefit from the tools for creating and sticking to budgets. Investment management apps, on the other hand, are often targeted towards high-net-worth individuals and experienced investors, who may require more sophisticated tools for portfolio management. The rise of these apps has led to a more diverse and integrated financial landscape.

Evolution of Mobile Finance Management Apps

The evolution of mobile finance management apps has been rapid, starting with basic budgeting tools and progressing to complex investment platforms. Early apps focused primarily on expense tracking and budgeting, allowing users to monitor their spending habits. Over time, these apps evolved to incorporate more sophisticated features, such as automated savings plans and investment management tools. Today, these apps act as virtual financial assistants, offering personalized insights and guidance.

Comparison of Mobile Finance Management App Categories

| App Category | Features | Target Demographic | Pricing Model |

|---|---|---|---|

| Budget Tracking | Budgeting tools, expense categorization, automated savings plans, bill payment integration | Young adults, families, individuals looking for basic financial management tools | Free with in-app purchases, or subscription options for premium features |

| Investment Management | Portfolio tracking, investment advice, market analysis, automated investment strategies | High-net-worth individuals, investors, individuals looking for more sophisticated investment tools | Subscription-based, often with tiered pricing plans based on features and investment amount |

Key Features and Functionality

Your financial life, simplified and streamlined, all within your pocket. This mobile finance app isn’t just another tool; it’s your personal financial superhero, ready to tackle budgeting, tracking, and even investing with a dash of humor and a whole lot of practicality.

Effective personal finance management hinges on intuitive tools and features. The app should empower you to take control of your finances, not bury you under a mountain of confusing data. Think of it as your personal financial sherpa, guiding you through the complexities of money management.

Core Functionalities

This app boasts a suite of essential functionalities to help you stay on top of your finances. From meticulous budgeting to smart savings strategies, these core functions are designed to be user-friendly and intuitive, ensuring you’re never lost in a sea of numbers.

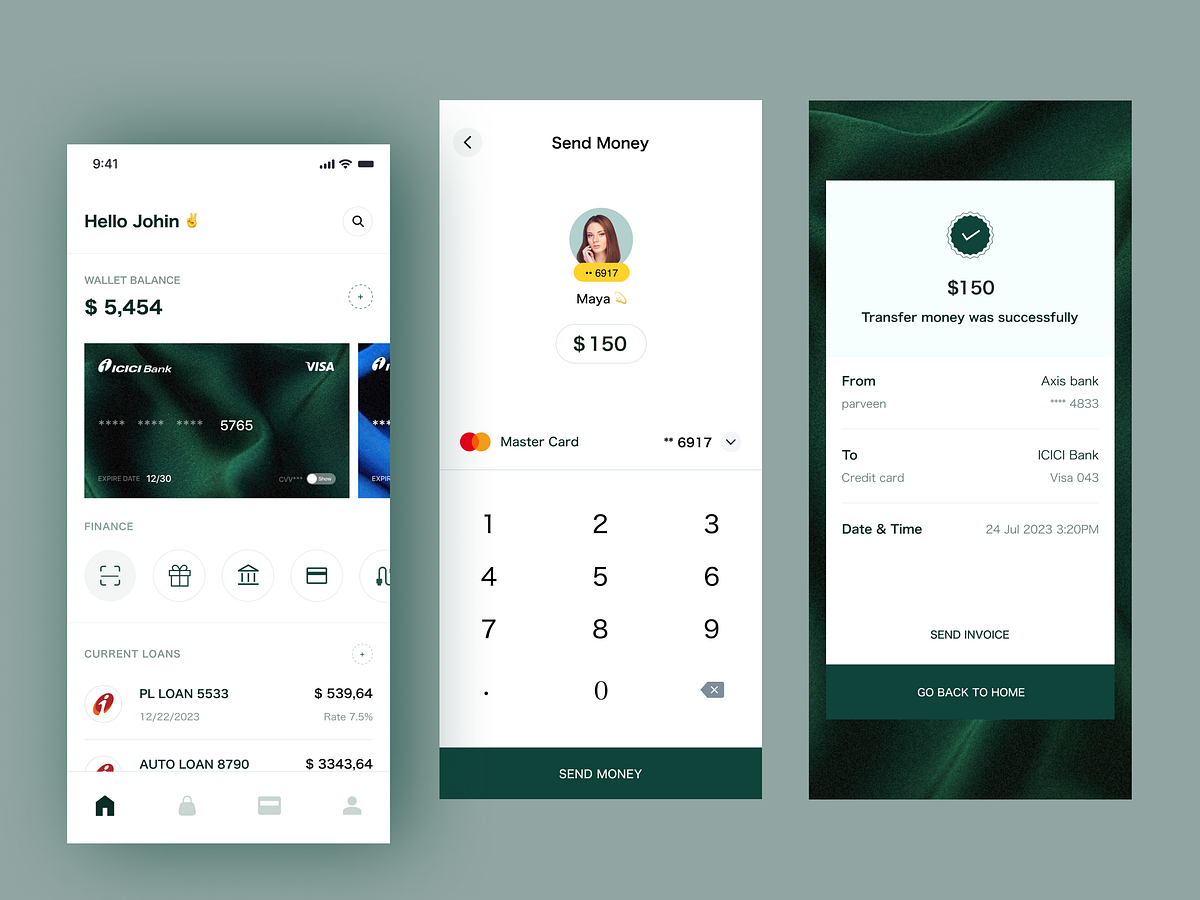

User-Friendly Interfaces

A seamless user experience is paramount. Imagine a financial app that’s as easy to navigate as your favorite social media platform, yet packed with the power to manage your entire financial world. The interface should be visually appealing, intuitive, and customizable to fit your specific needs.

Sought-After Features

Users crave features that streamline their financial processes. These include automatic categorization of transactions, personalized budgeting tools, and insightful reporting. The app should empower you to understand your spending patterns and make informed financial decisions. For instance, the ability to visualize spending across different categories in a visually engaging manner can be incredibly helpful.

Security Measures

Protecting your financial data is paramount. Robust security measures, such as encryption, two-factor authentication, and regular security updates, are essential to safeguarding your sensitive information. Think of this app as a fortress, impenetrable to prying eyes and financial fraudsters.

Integration of Third-Party Services

Seamless integration with bank accounts, credit cards, and other financial institutions is critical. This allows for automatic data synchronization and a holistic view of your financial landscape. Imagine having all your financial accounts readily available in one place, effortlessly connected and updated.

Financial Transaction Types

| Transaction Type | Description | Supported Payment Methods |

|---|---|---|

| Bill Payments | Scheduling and automatic payments for utilities, subscriptions, and other bills. | Credit/Debit Cards, Bank Transfers |

| Money Transfers | Sending and receiving money to other users or accounts. | Bank Transfers, Mobile Wallets |

| Investment Tracking | Monitoring investment portfolios, tracking performance, and calculating returns. | Linked Investment Accounts |

| Expense Tracking | Recording and categorizing daily expenses for budgeting and analysis. | Linked Bank Accounts, Credit Cards |

This table illustrates the various financial transactions that can be managed within the app. The breadth of supported transactions allows for comprehensive financial management.

User Experience and Design Considerations

Crafting a finance app that’s as delightful as a well-balanced budget is key. This involves more than just numbers and graphs; it’s about creating an experience that users will actually *want* to engage with. Think of it as building a digital financial sanctuary – a place where managing money feels less like a chore and more like a savvy adventure.

Intuitive and User-Friendly Interfaces

A smooth and intuitive interface is paramount. Users should be able to navigate the app effortlessly, finding what they need quickly and easily, without feeling lost in a sea of confusing options. Clear visual hierarchies, consistent design elements, and logical groupings of information are crucial. Think of a well-organized library – you can find what you’re looking for without getting overwhelmed by the sheer volume of books.

Accessibility Features

Ensuring accessibility is not just a good thing, it’s a necessity. A financially savvy app should be usable by everyone, regardless of their abilities. This includes features like adjustable text sizes, high contrast modes, screen reader compatibility, and keyboard navigation. Imagine a world where everyone, including those with visual impairments or motor disabilities, can confidently manage their finances.

Effective User Onboarding Strategies

A seamless onboarding experience is essential to keep users engaged and motivated to use the app. A well-designed onboarding process should guide users through the app’s core functionalities and key features in a clear and concise way. Think of it as a friendly tour guide, leading you through the wonders of your new financial management system. For example, welcome screens could highlight key features, with interactive tutorials and prompts. Consider a simple, step-by-step approach to setting up accounts, making it as painless as possible.

Performance Optimization

The app should perform flawlessly across different devices and operating systems. This means optimizing for speed, responsiveness, and stability, ensuring that the app works smoothly on everything from budget-friendly smartphones to high-end tablets. This involves rigorous testing on various devices and operating systems, and using efficient coding practices. Remember, a slow app is a frustrating app.

Visual Cues to Enhance UX

Visual cues can dramatically improve the user experience. Use clear visual indicators to highlight important information, like visually distinct colors for different transaction types (income vs. expenses). Effective use of icons and animations can also make the app feel more engaging and user-friendly. For example, a small animated graphic indicating a successful transaction can add a touch of fun to the whole experience.

Common Design Pitfalls to Avoid

Avoid these common pitfalls: overwhelming users with too much information at once, using confusing terminology, neglecting proper error handling, and not testing thoroughly on different devices and screen sizes. These errors can lead to frustration and disengagement, so it’s important to carefully consider the design process to avoid such issues.

- Cluttered interfaces: Avoid overwhelming users with excessive information. Keep the interface clean and focused on key functionalities.

- Complex terminology: Use clear and concise language that everyone can understand. Avoid jargon or technical terms that might confuse users.

- Inadequate error handling: Implement robust error handling to gracefully manage user input errors and system issues, preventing crashes and providing helpful feedback.

- Insufficient testing: Rigorous testing across various devices and screen sizes is crucial to ensure the app functions flawlessly on different platforms.

- Lack of visual feedback: Use visual cues to confirm actions and highlight important information, making the app feel responsive and user-friendly.

Security and Privacy Concerns

Protecting your financial data is like guarding a treasure chest – you need a strong lock and a vigilant watch. This section dives into the critical security measures we’ve built into our app to ensure your financial fortress is impenetrable. We’re not just talking about passwords; we’re talking about a full-on, high-tech security system, ready to fend off any digital pirates.

Our app’s security protocols are designed to keep your financial data safe, safeguarding it from prying eyes and malicious intent. It’s not just about the technology; it’s about the constant vigilance and proactive measures we take to ensure your peace of mind.

Security Protocols Used

Our app employs a multifaceted approach to security, using the latest encryption techniques and authentication methods to protect your data. This ensures that your sensitive information is safe from unauthorized access, even in the face of sophisticated attacks.

Data Encryption

Data encryption is like a secret code – transforming your data into an unreadable format for anyone trying to intercept it. We use robust encryption algorithms to safeguard your financial transactions and personal information. This is essential to prevent your data from being compromised in transit or at rest. Think of it as a digital vault, ensuring your sensitive information is hidden from prying eyes.

Two-Factor Authentication

Two-factor authentication adds an extra layer of security, requiring two forms of verification to access your account. This makes it significantly harder for unauthorized users to gain access, even if they have your password. It’s like having a key and a code – both are required to unlock the door.

Compliance Regulations

Adherence to industry-standard compliance regulations, such as GDPR and PCI DSS, is paramount. These regulations dictate the strict security measures that must be in place to protect sensitive financial data. This commitment to compliance demonstrates our dedication to safeguarding your information and ensuring your trust.

User Privacy Policies

Our user privacy policy clearly Artikels how we collect, use, and protect your data. It’s a transparent and easily understandable document that details our commitment to your privacy. It’s a straightforward explanation of our data handling practices, allowing you to understand how your data is being managed and protected.

Potential Vulnerabilities

No system is completely impenetrable, and we recognize potential vulnerabilities. Regular security audits and penetration testing are critical components of our ongoing security efforts. These audits help identify and address potential weaknesses, strengthening our defenses against emerging threats. It’s a continuous process of evaluating and improving our security posture.

Secure Coding Practices

Secure coding practices are fundamental to building a robust and secure mobile finance app. A rigorous approach to coding is essential, ensuring vulnerabilities are minimized and security is baked into every aspect of the app’s development.

- Input validation is crucial to prevent malicious input from disrupting the app’s functionality or compromising security. This involves checking user inputs to ensure they are in the expected format and range. Imagine a filter that only allows approved entries, preventing harmful data from entering the system.

- Regular security audits and penetration testing are crucial. They help identify vulnerabilities before they can be exploited, allowing us to address potential weaknesses. It’s like a proactive security check, preventing issues before they arise.

- Employing strong encryption for data transmission and storage is critical. This ensures that sensitive information remains unreadable to unauthorized parties. This is like having a code that only you and your trusted people can understand.

Competitive Landscape and Future Trends

The mobile finance app market is a vibrant arena, constantly evolving with new players and innovative features. It’s like a digital jungle gym, where startups are swinging for the fences and established giants are trying to keep up. The battle for user attention is fierce, and staying ahead requires a keen understanding of the trends and a dash of audacious innovation.

The future of personal finance management is intertwined with the relentless march of technology. From AI-powered insights to biometric security, the next generation of apps promises a seamless, intuitive, and even entertaining experience for users. It’s about more than just tracking expenses; it’s about empowering financial literacy and achieving financial goals, all wrapped up in a sleek, user-friendly package.

Leading Mobile Finance Management Apps: A Comparative Look

Different apps cater to diverse needs. Mint, for example, focuses on comprehensive budgeting and expense tracking, while Personal Capital excels at investment management. Each app has its strengths and weaknesses, offering varying levels of features, user interfaces, and support. A comparison reveals a spectrum of functionality, from basic expense categorization to advanced portfolio analysis. Some apps prioritize simplicity, while others boast an abundance of features, potentially overwhelming less tech-savvy users.

Emerging Technologies Shaping the Future of Finance Apps

AI and machine learning are poised to revolutionize how we interact with our finances. Imagine an app that anticipates your needs, suggests smart investments, and even predicts potential financial pitfalls – a sort of digital financial advisor. This is not science fiction; it’s the reality of the rapidly evolving tech landscape. Real-time data analysis, personalized recommendations, and automated transactions are already being incorporated into some apps, ushering in an era of smarter financial decision-making.

Innovative Features in Upcoming Mobile Finance Apps

The future of mobile finance management apps is brimming with exciting innovations. Some anticipated features include:

- Automated Investment Strategies: Apps will likely incorporate AI-powered investment strategies, adjusting portfolios based on market fluctuations and individual risk tolerance. This could automatically rebalance a portfolio or suggest suitable investments, freeing users from tedious manual tasks.

- Predictive Budgeting: By analyzing spending patterns and income forecasts, apps could offer predictive budgeting tools. These tools would estimate future expenses and potential income shortfalls, empowering users to make informed decisions.

- Gamified Financial Goals: Integrating game mechanics could make financial goals more engaging and achievable. Points, badges, and leaderboards could encourage users to save and invest more effectively. This approach has proven successful in other areas of personal development and could translate well into the realm of personal finance.

Key Factors Driving Competition in the Mobile Finance Market

The mobile finance market is intensely competitive. Factors driving competition include:

- User Experience: Intuitive interfaces, seamless navigation, and engaging design are crucial for attracting and retaining users. A well-designed app that is easy to use and understand will always have an advantage.

- Security and Privacy: User trust is paramount. Robust security measures and transparent privacy policies are essential for building and maintaining a loyal user base. Data breaches and security vulnerabilities can severely damage the reputation of any financial application.

- Value Proposition: Apps must offer unique value propositions that differentiate them from competitors. A simple expense tracker might not cut it in today’s market; apps must provide compelling value beyond basic features.

The Role of AI and Machine Learning in Improving User Experience and Financial Planning

AI and machine learning algorithms are transforming financial planning. They can:

- Analyze Spending Patterns: AI can identify spending trends and offer personalized recommendations for saving and investing.

- Predict Future Financial Needs: AI can analyze current financial data to predict future needs, like potential emergencies or large purchases, and provide users with recommendations to prepare for them.

- Offer Personalized Financial Advice: AI-powered chatbots or virtual assistants can offer personalized financial advice based on individual circumstances and goals.

Potential Future Features for Mobile Finance Apps

Future mobile finance apps may include:

- Integrated Budgeting Tools: Tools that connect seamlessly with bank accounts, credit cards, and investment platforms to automatically categorize and track transactions.

- AI-powered Expense Tracking: Apps that analyze transactions to identify potential financial risks or areas where spending can be optimized.

- Personalized Financial Coaching: Apps that provide personalized advice and support based on user goals and circumstances.

Specific Use Cases and Scenarios

Finance apps are no longer just for tracking expenses; they’re your personal financial wizards, ready to tackle everything from saving for a down payment to managing a small business. These apps are incredibly versatile, transforming how you interact with your money, making the often-confusing world of finance a bit more straightforward and fun.

Budgeting and Saving

These apps are your secret weapon for conquering the budget beast. Imagine a digital piggy bank, meticulously tracking every penny you spend and diligently saving for your future desires. With clear budgeting tools, you can visualize your income and expenses, identifying areas where you can trim costs and allocate more funds to savings goals. Setting specific savings goals, like a down payment on a house or a dream vacation, and watching the progress visually, can be incredibly motivating. These apps offer features to automatically transfer funds to savings accounts, making saving a seamless part of your routine.

Managing Investments and Debt

Investment and debt management are key components of financial wellness. These apps can help you keep track of your investments, providing insights into performance and potential risks. They can also assist in tracking and managing debt, helping you create a repayment strategy and stay on top of your payments. This can include automating payments, generating personalized financial reports, and even providing insights into the potential long-term impact of your investment decisions.

Integration with Financial Services

Many finance apps offer seamless integration with other financial services. Think of connecting your bank accounts, credit cards, and investment platforms. This centralized view streamlines your financial management, providing a holistic picture of your financial health. You can easily track transactions, compare rates, and automate transfers across different accounts, saving you time and effort.

Small Business Owners

For small business owners, these apps provide essential tools for tracking revenue, expenses, and profit margins. Imagine having all your business financial data in one place, allowing you to monitor performance, identify trends, and make data-driven decisions. These apps can also help with invoicing, expense tracking, and financial forecasting, empowering small business owners to run their ventures more efficiently.

Tracking Spending Habits

Understanding your spending habits is crucial for financial well-being. Finance apps can meticulously track every transaction, allowing you to see where your money is going. This detailed breakdown of expenses can reveal spending patterns, enabling you to identify areas where you might be overspending and adjust your budget accordingly. You can even categorize transactions, creating personalized insights into your spending habits.

Financial Goals and App Features

| Goal | App Feature | Example |

|---|---|---|

| Saving for a down payment | Budgeting tools, savings goals | Setting a savings goal and tracking progress, automatically transferring funds to a savings account |

| Paying off debt | Debt management tools, automated payments | Creating a repayment schedule, setting reminders, and automatically paying off debt obligations |

| Investing for retirement | Investment tracking, portfolio analysis | Tracking investment performance, analyzing portfolio diversification, and generating personalized investment recommendations |

| Building an emergency fund | Budgeting tools, savings goals | Setting a savings goal, tracking progress, and establishing automatic transfers to an emergency fund account |

End of Discussion

In conclusion, mobile apps for managing finances are more than just tools; they are powerful partners in achieving financial well-being. Their evolution, coupled with the ongoing innovation in security and user experience, positions them as indispensable assets in today’s world. The future promises even more sophisticated features, further integrating financial services, and driving users toward greater financial literacy and control.