Welcome to the digital frontier of financial freedom! Imagine a world where managing your prepaid card is as seamless as ordering a pizza. Our mobile app for Prepaid CardConnect aims to revolutionize how you interact with your prepaid card, offering a user-friendly interface and a plethora of features. From lightning-fast balance checks to secure fund transfers, this app is your personal financial concierge, designed to make your transactions smoother than a freshly polished coin.

This comprehensive guide explores the core functionalities, user experience design, and technical aspects of the app. We’ll dive into the nitty-gritty details, comparing it to existing apps and outlining future enhancements to keep you ahead of the curve.

Introduction to Prepaid CardConnect Mobile App

Prepaid CardConnect empowers users with a streamlined digital experience for managing their prepaid cards. This mobile application offers a secure and convenient platform for cardholders to monitor balances, make payments, and access other essential functionalities. This ease of access and control significantly enhances the user experience compared to traditional methods.

Prepaid cards, a versatile payment option, provide numerous benefits. They allow for controlled spending, often without the need for a traditional bank account. The cards can be used for various purposes, from online purchases to everyday transactions, and often offer features like mobile top-up or bill payment. A dedicated mobile application brings these functionalities to the user’s fingertips, eliminating the need for physical card handling or remembering PINs.

Key Features of a Typical Prepaid Card

Prepaid cards are distinguished by their ability to store funds, and then spend those funds. They provide a simple and secure way to manage finances. The typical features include:

- Balance Inquiry: Users can readily check their account balance anytime, anywhere, ensuring they know how much credit remains.

- Transaction History: Detailed records of all transactions, including dates, amounts, and merchant names, facilitate accountability and financial management.

- Funds Loading: The ability to load funds onto the card, typically through various methods like online banking or in-store deposits, enhances flexibility.

- Payment Options: Prepaid cards often support various payment methods, including mobile payment systems, for easy transactions.

- Security Features: Many prepaid cards incorporate security measures, like PINs or security codes, to safeguard funds and prevent unauthorized access.

Benefits of a Dedicated Mobile App for Prepaid Cards

A dedicated mobile app for prepaid cards offers numerous advantages over traditional methods. These include:

- Enhanced Convenience: Managing funds from anywhere, at any time, eliminates the need for physical interaction with the card, which enhances the overall user experience.

- Improved Security: Mobile apps often utilize advanced security protocols, such as encryption and multi-factor authentication, to safeguard sensitive information.

- Simplified Transaction Management: Users can easily track transactions, review statements, and resolve issues directly within the app.

- Real-time Updates: Mobile apps provide real-time access to account balances, transaction details, and other relevant information.

- Personalized Financial Management: Many apps offer personalized insights into spending patterns and budgeting tools.

Comparison of Prepaid Card Apps

A table comparing various prepaid card apps demonstrates the varying functionalities, features, and user interfaces:

| App Type | Functionality | Features | User Interface |

|---|---|---|---|

| Basic | Simple balance check, transaction history | Limited payment options, basic security | Easy to navigate, but potentially less visually appealing |

| Intermediate | Balance check, transaction history, fund loading, limited bill payments | Enhanced security features, more payment options | Intuitive design, with more interactive elements |

| Advanced | Full range of functionalities, including investment tools, budgeting, and financial planning | Extensive security measures, diverse payment methods, integration with other financial services | Sophisticated and visually appealing design, with many personalized features |

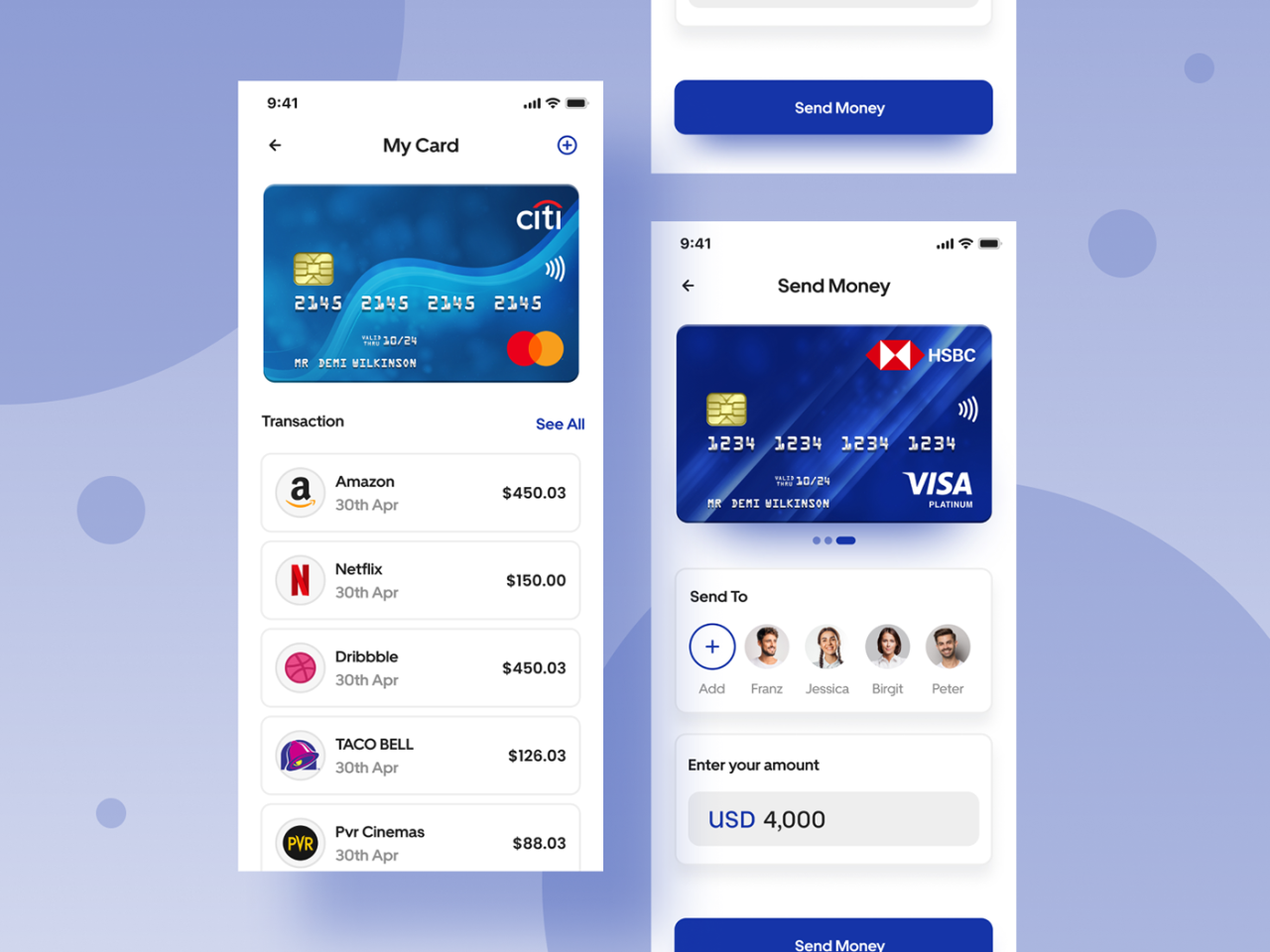

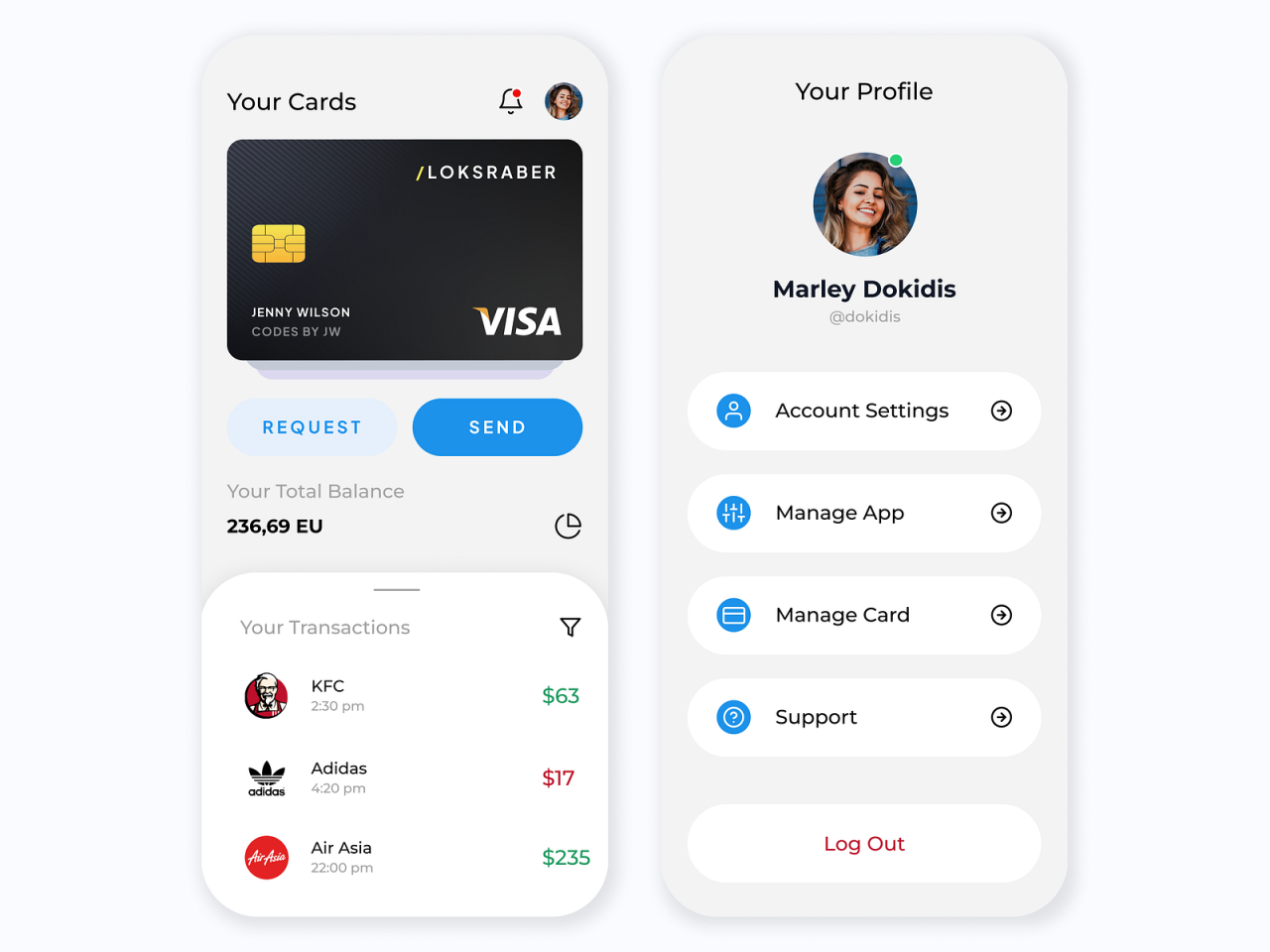

User Experience (UX) Design for the App

Prepaid CardConnect’s mobile app hinges on a seamless user experience, crucial for user adoption and satisfaction. A well-designed interface and intuitive navigation are paramount to facilitating smooth transactions and fostering user trust. This section delves into the UI design considerations, user flows, and specific user needs to create an exceptional user experience.

User Interface (UI) Design Considerations

The UI design should prioritize clarity, simplicity, and accessibility. Visual elements like color palettes and typography must be chosen with care to create a visually appealing and user-friendly experience. High-quality imagery and icons are essential for conveying information effectively and enhancing user engagement. A consistent design language across all screens and functionalities is vital for a cohesive and recognizable app. The interface should adapt seamlessly to various screen sizes and orientations, ensuring optimal viewing and usability on different mobile devices. Employing responsive design principles is critical for a positive user experience across a range of devices.

User Flow and Navigation Strategies

Navigation within the app should be intuitive and predictable, minimizing user effort and maximizing efficiency. A clear hierarchy of screens and functionalities will facilitate user comprehension and ease of use. Users should be able to easily access all key features from the main menu, with clear labels and visual cues. Implementing a search function allows users to quickly locate specific information or transactions. Effective use of breadcrumbs and back buttons is essential to enable users to navigate between screens efficiently.

User Personas

Understanding user needs is critical for crafting a user-friendly app. This table Artikels key user personas and their corresponding needs:

| User Persona | Needs |

|---|---|

| Budget-conscious student | Easy-to-use budgeting tools, affordable transaction fees, secure payment methods, and clear transaction history. |

| Frequent traveler | Quick and secure international money transfers, access to local payment options, and detailed transaction tracking. |

| Small business owner | Reliable and efficient payment processing for customers, secure management of funds, and detailed reporting capabilities. |

| Elderly user | Large, easy-to-read fonts, simplified transaction procedures, clear instructions, and accessible customer support options. |

Ideal User Experience for Transactions

Completing transactions, such as sending money or making payments, should be a smooth and secure process. Clear instructions, visual cues, and progress indicators will guide the user through each step. Users should be able to easily review transaction details before confirmation. Robust security measures, such as encryption and two-factor authentication, are essential to safeguard user funds and data.

Transaction Types

This table Artikels different transaction types within the mobile app, including their descriptions and associated functionalities.

| Transaction Type | Description | Functionality |

|---|---|---|

| Fund Transfer | Sending money to another user’s prepaid card. | Includes recipient’s details, transfer amount, and optional message. |

| Bill Payment | Paying utility bills, subscriptions, or other recurring payments. | Integrates with various bill payment providers, allowing users to select their bills. |

| Cash Withdrawal | Retrieving cash from an ATM linked to the prepaid card. | Displays available ATM locations, transaction fees, and withdrawal limits. |

| Balance Check | Viewing the current balance of the prepaid card. | Provides real-time access to account balance and transaction history. |

| Card Activation | Activating a new prepaid card. | Includes required verification steps to confirm the card’s ownership. |

Functional Requirements and Features

Prepaid CardConnect’s mobile app prioritizes a seamless and secure user experience. This section details the core functionalities, encompassing account management, fund loading, money transfers, payment processing, and robust security measures. A user-friendly interface, combined with intuitive navigation, is paramount for a positive user experience.

This comprehensive approach ensures that users can effectively manage their prepaid cards, send and receive funds, and make payments with ease and confidence.

Account Management Features

Account management is crucial for users to maintain control over their prepaid card accounts. These features enable users to effectively monitor their financial activities and stay informed about their account status.

- Balance Check: Real-time balance checks are essential for users to promptly ascertain the available funds in their accounts. This allows for informed spending decisions and avoids overspending.

- Transaction History: A detailed transaction history provides users with comprehensive records of all transactions, including dates, amounts, and types of transactions. This feature aids in tracking spending patterns and resolving any potential discrepancies.

- Account Information Update: Users can easily update personal information, such as addresses or contact details, to maintain accuracy and ensure smooth transactions. This is a crucial aspect of user control and security.

Fund Loading Methods

Various methods for loading funds into the prepaid card are provided to cater to diverse user preferences and needs. A diverse selection of loading options ensures that users can easily fund their prepaid card.

- Debit Card: Direct debit from a user’s linked bank account is a convenient and straightforward method for adding funds to the prepaid card. This option requires minimal steps and ensures quick fund loading.

- Credit Card: Loading funds via a credit card allows for flexibility and convenience. This method provides an alternative payment option for users who prefer this payment method.

- Bank Transfer: Funds can be transferred from a linked bank account to the prepaid card account via a secure bank transfer. This is a reliable method for adding funds, often favored for its security features.

- Cash Deposit: In-person cash deposits at designated locations (e.g., retail stores, partner banks) allow users to add funds conveniently when using this option.

Money Sending Options

Facilitating secure and efficient money transfers between users is a key feature of the app. The app supports a range of methods to send money.

- Peer-to-Peer Transfers: Users can send funds to other Prepaid CardConnect users directly within the app. This is a quick and convenient way to transfer money to contacts.

- Recipient’s Email Address: Funds can be sent to a recipient by providing their email address. This allows for convenient transfers to users who don’t have a prepaid card account, provided they have a linked email address.

- Mobile Number: Sending funds via a mobile number is a readily available method to transfer money. This option is a quick and straightforward way to transfer money.

Payment Processing

The app provides a streamlined process for users to make payments. A simple and intuitive process for making payments.

- Merchant Payments: The app allows users to make payments to merchants via the app, leveraging the prepaid card for transactions. This feature streamlines the payment process.

- Bill Payments: The app facilitates bill payments for utilities, subscriptions, and other recurring charges. This feature helps users manage their bills efficiently.

Security Measures

Protecting user accounts is paramount. Robust security measures are implemented to ensure user data safety and prevent unauthorized access.

- Strong Passwords: Users are encouraged to create strong and unique passwords to enhance account security. A strong password is essential for account security.

- Two-Factor Authentication (2FA): 2FA adds an extra layer of security by requiring a secondary verification method (e.g., code sent to a mobile device) alongside the password. This is a vital component of account security.

- Data Encryption: Sensitive data is encrypted during transmission and storage to safeguard user information from unauthorized access. Data encryption is a crucial component of safeguarding user information.

Supported Payment Methods

| Payment Method | Description |

|---|---|

| Debit Card | Funds are debited from the user’s linked bank account. |

| Credit Card | Funds are loaded using a credit card. |

| Bank Transfer | Funds are transferred from a linked bank account. |

| Cash Deposit | Funds are added through in-person cash deposits. |

Technical Specifications and Development

Crafting a robust and user-friendly mobile application necessitates meticulous planning and execution. This section delves into the technical underpinnings of Prepaid CardConnect, outlining the architectural framework, development platforms, data security, integration processes, and testing methodologies. This detailed approach ensures a seamless user experience while maintaining the highest standards of security and functionality.

Technical Architecture

The application will leverage a three-tier architecture. The presentation tier, comprising the user interface, will be optimized for various mobile devices. The application logic, including business rules and data processing, will reside in the middle tier. The data tier will encompass secure databases for storing user information and transaction details. This layered approach promotes modularity, scalability, and maintainability.

Development Technologies and Platforms

The application will be developed using a combination of cutting-edge technologies. This approach is crucial for achieving optimal performance and scalability. The chosen platforms include native development for Android and iOS, ensuring a native feel and optimized performance. Specific technologies like Java for Android and Swift/Objective-C for iOS will be employed, ensuring compatibility with respective operating systems.

Data Storage and Security

User data security is paramount. The application will utilize industry-standard encryption methods, such as AES-256, to protect sensitive information during transmission and storage. Data will be stored in a secure database, such as PostgreSQL or MySQL, with robust access controls. Regular security audits and penetration testing will be conducted to identify and mitigate potential vulnerabilities.

Payment Gateway Integration

Seamless integration with existing payment gateways is crucial. The application will utilize established APIs for secure transaction processing. This will involve rigorous testing and validation to ensure the integrity of the payment process and adherence to PCI DSS standards. Examples of compatible payment gateways include Stripe, PayPal, and Braintree.

Testing Methodologies

Comprehensive testing is essential to guarantee functionality and stability. The testing methodology will incorporate unit testing for individual components, integration testing for interactions between components, and user acceptance testing to validate the application from a user perspective. This multi-faceted approach ensures a high-quality product.

Supported Mobile Operating Systems

The app will support the most prevalent mobile operating systems. This ensures maximum user reach and accessibility.

| Operating System | Compatibility |

|---|---|

| Android | Version 8.0 (Oreo) and above |

| iOS | iOS 13 and above |

Marketing and Promotion Strategies

Prepaid CardConnect’s mobile app success hinges on effective marketing and promotion. A well-defined strategy will attract the right users, highlighting the app’s value proposition and driving adoption. This section details key strategies, target audiences, and channels to maximize user acquisition.

Marketing Strategies for App Promotion

A multifaceted approach is crucial for successful app promotion. This involves leveraging various channels to reach the target audience, emphasizing the app’s unique selling points. The strategies should be tailored to each platform and audience segment, ensuring maximum impact.

- Social Media Marketing: Platforms like Facebook, Instagram, and TikTok are ideal for engaging with potential users. Targeted advertising campaigns, interactive content, and influencer collaborations can generate significant buzz. For instance, partnering with travel influencers could be highly effective for reaching a specific audience interested in prepaid travel cards.

- Search Engine Optimization (): Optimizing the app’s online presence, including the app store listing and website, ensures visibility in search results. This increases organic reach, bringing in users actively seeking prepaid card solutions.

- Content Marketing: Creating informative and engaging content, such as blog posts, articles, and videos about prepaid cards and financial literacy, can establish authority and attract a wider audience. This builds trust and positions the app as a valuable resource.

- Paid Advertising: Targeted ads on social media, search engines, and other relevant platforms can reach a specific demographic. This strategy can accelerate user acquisition and drive immediate results.

- Partnerships and Collaborations: Collaborating with financial institutions, travel agencies, or other businesses that cater to a similar audience can broaden the app’s reach and expose it to a wider user base. For example, partnerships with banks could offer bundled services to existing customers.

Target Audiences and Their Preferences

Understanding the target audience is paramount for effective marketing. Different user groups have varying needs and preferences. Therefore, a segmented approach, catering to specific demographics, is essential for maximum impact.

- Budget-conscious travelers: They prioritize low transaction fees and easy-to-use features for international travel.

- Students and young professionals: They need secure and convenient ways to manage their finances, including budgeting tools and features for splitting expenses.

- Business travelers: They require reliable and secure platforms for expense tracking and international transactions. They might appreciate features like automatic currency conversion and expense reporting.

- People relocating internationally: They need a platform to manage multiple currencies and bank accounts. Features like multiple account integration are crucial.

Marketing Channels for Reaching the Target Audience

Identifying the optimal channels to reach the target audience is crucial for maximizing campaign effectiveness.

- App Store Optimization (ASO): Improving the app store listing by using relevant s, attractive screenshots, and compelling descriptions is essential for driving organic downloads. This increases visibility and discoverability for potential users.

- Email Marketing: Nurturing leads and promoting app features through targeted email campaigns is a valuable strategy. It helps maintain consistent communication and drives conversions.

- Affiliate Marketing: Partnering with relevant websites and influencers to promote the app can generate significant interest and traffic.

Key Selling Points of the Mobile App

Highlighting the app’s key advantages is vital for attracting and retaining users. This includes emphasizing its unique features and benefits.

- User-friendly interface: A simple and intuitive design ensures a positive user experience, encouraging adoption and engagement.

- Secure transactions: Ensuring the security of user data and transactions builds trust and confidence.

- Multiple payment options: Providing diverse payment options enhances flexibility and caters to various user needs.

- Low transaction fees: Competitive fees are a key driver for user adoption, particularly for budget-conscious users.

- Real-time transaction tracking: Provides users with complete visibility into their spending, empowering them to manage their finances effectively.

Customer Support and Feedback

Actively soliciting and responding to user feedback is crucial for app development and improvement. Proactive customer support is vital for maintaining a positive user experience.

- Dedicated support channels: Providing multiple avenues for user support, including email, phone, and in-app chat, enhances user experience.

- Prompt response times: Responding to user queries and concerns quickly and efficiently fosters a sense of support and reliability.

- Feedback mechanisms: Implementing mechanisms for collecting user feedback, such as in-app surveys or feedback forms, allows for continuous improvement.

Comparison of Marketing Strategies

| Marketing Strategy | Description | Effectiveness |

|---|---|---|

| Social Media Marketing | Engaging with users on social media platforms | High, particularly for reaching younger audiences |

| Optimizing online presence for search engines | High, driving organic traffic and visibility | |

| Content Marketing | Creating informative and engaging content | Medium to High, establishing authority and trust |

| Paid Advertising | Targeted ads on various platforms | High, allowing for rapid user acquisition |

| Partnerships | Collaborating with relevant businesses | High, expanding reach and introducing the app to new audiences |

Security and Compliance

Prepaid CardConnect’s mobile app prioritizes user data security and adheres to stringent financial transaction regulations. Robust security protocols are implemented throughout the application’s lifecycle, from development to deployment and maintenance, to ensure a secure and compliant platform for users. This commitment extends to the prevention of fraud and abuse, upholding the highest standards of legal and regulatory compliance in the prepaid card industry.

Security Protocols for User Data

The app employs industry-standard encryption techniques, including Transport Layer Security (TLS), to safeguard sensitive user data during transmission. Data at rest is encrypted using robust algorithms. Access to user accounts is protected by multi-factor authentication (MFA), requiring users to provide multiple verification methods. Regular security audits and penetration testing are conducted to identify and address vulnerabilities. Furthermore, access controls are meticulously implemented to limit data access only to authorized personnel.

Compliance Requirements for Financial Transactions

The app adheres to all relevant financial regulations, including PCI DSS (Payment Card Industry Data Security Standard), ensuring secure handling of financial transactions. Compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations is crucial for maintaining the app’s operational integrity. These compliance measures minimize the risk of financial fraud and ensure responsible use of the platform.

Measures to Prevent Fraud and Abuse

Sophisticated fraud detection systems are implemented to identify and flag suspicious transactions. Real-time monitoring of user activity helps prevent fraudulent behavior. These systems incorporate machine learning algorithms to identify patterns indicative of potential fraud, allowing for swift intervention and preventing unauthorized access or transactions. The system actively monitors transaction volumes and locations to flag anomalies and alert administrators to potential abuse.

Legal and Regulatory Aspects of Prepaid Card Operations

Prepaid CardConnect adheres to all applicable laws and regulations governing prepaid card operations in various jurisdictions. This includes compliance with local laws and regulations for money transmission, consumer protection, and data privacy. The app’s development and deployment follow strict legal guidelines to ensure compliance with evolving regulations and standards.

Potential Security Risks and Mitigation Strategies

| Potential Security Risk | Mitigation Strategy |

|---|---|

| Unauthorized access to user accounts | Implement strong password policies, multi-factor authentication, and regular security audits. |

| Phishing attacks targeting users | Educate users about phishing tactics and provide clear warnings on suspicious emails or messages. |

| Data breaches during transmission | Employ industry-standard encryption protocols (TLS) for all data transmissions. |

| Malware infection on user devices | Encourage the use of up-to-date antivirus software and provide clear warnings about suspicious downloads. |

| Insider threats | Implement strict access controls and background checks for personnel with access to sensitive data. |

Competitive Analysis

Navigating the prepaid card mobile app landscape requires a keen understanding of the competition. This analysis delves into the key players, comparing their features and functionalities, and evaluating their strengths and weaknesses to inform the strategic positioning of Prepaid CardConnect’s mobile app. Understanding the competitive landscape is crucial for developing a product that not only meets but exceeds user expectations.

The mobile prepaid card market is experiencing rapid growth, fueled by increasing consumer demand for convenient and secure financial solutions. A robust competitive analysis is essential to differentiate Prepaid CardConnect’s mobile app and capitalize on market opportunities.

Key Competitors

Prepaid card mobile apps are proliferating. Identifying and analyzing competitors is crucial for understanding the current market landscape and positioning Prepaid CardConnect effectively. Key competitors in this space include established financial institutions and innovative fintech companies offering similar services. Examples include major banks with prepaid card offerings, dedicated prepaid card platforms, and mobile wallet services integrated with prepaid functionalities.

Feature Comparison

Examining the features offered by competing apps provides valuable insights into the current market standard and opportunities for differentiation. The table below Artikels a comparison of key features, providing a comprehensive overview of competitor functionalities.

| Feature | Competitor A | Competitor B | Competitor C | Prepaid CardConnect |

|---|---|---|---|---|

| Fund Transfer | Yes, with limited options | Yes, multiple options including peer-to-peer | Yes, integrated with bank accounts | Yes, seamless fund transfer, including peer-to-peer and bank account integration |

| Bill Payment | Yes, for select providers | Yes, for most providers | Yes, comprehensive bill payment platform | Yes, integrated with multiple bill payment platforms |

| Rewards Program | Basic rewards | Tiered rewards program | Extensive rewards program tied to spending | Tiered rewards program with exclusive partner benefits |

| Security Features | Standard security measures | Advanced fraud detection | Biometric authentication | Multi-layered security including biometrics, two-factor authentication, and advanced fraud detection |

| Customer Support | Limited options | 24/7 customer support | In-app chat support | 24/7 customer support via multiple channels |

Strengths and Weaknesses of Competitors

Understanding competitor strengths and weaknesses is crucial for identifying opportunities and developing a strategic advantage. Competitor A excels in user interface design, making navigation intuitive. However, its customer support is limited. Competitor B has a strong rewards program, but its integration with other financial services is limited. Competitor C offers robust security features, but its user experience can be complex. These insights are valuable in tailoring Prepaid CardConnect’s app to address unmet needs and leverage strengths.

Successful Mobile App Designs

Examining successful prepaid card mobile app designs provides inspiration and insights into user preferences and effective design principles. Examples of successful apps often prioritize intuitive navigation, clear information architecture, and a visually appealing design. The app design should be intuitive, ensuring users can quickly find the information they need. Successful designs often employ clear visual cues and simple language to guide users.

Competitive Landscape Summary

This table summarizes the competitive landscape, highlighting key differentiators for Prepaid CardConnect.

| Competitor | Strengths | Weaknesses | Differentiation Strategy |

|---|---|---|---|

| Competitor A | Intuitive UI | Limited support | Enhance customer support and integrate with more payment gateways |

| Competitor B | Rewards Program | Limited integration | Expand integration options and enhance rewards program with exclusive partner benefits |

| Competitor C | Robust security | Complex UI | Simplify the UI while maintaining robust security |

| Prepaid CardConnect | Seamless fund transfer, multiple bill payment platforms, tiered rewards, and multi-layered security | N/A | Focus on exceptional user experience, comprehensive features, and superior security |

Future Considerations and Enhancements

The Prepaid CardConnect mobile app, in its current iteration, provides a robust platform for managing prepaid cards. However, anticipating the evolving needs of users and the ever-changing financial landscape, proactive planning for future updates and enhancements is crucial. This section details potential future updates, integrations, and improvements to ensure the app remains a valuable and relevant tool for users.

Potential Future Updates and Features

The app’s functionality will be continuously refined to meet the needs of a dynamic user base. Enhancements will address issues such as improved navigation, more intuitive interfaces, and enhanced security features. User feedback will be instrumental in shaping future development priorities. Examples of potential updates include:

- Enhanced Reporting and Analytics: Introducing detailed transaction history breakdowns, allowing users to filter and analyze spending patterns more effectively. This will empower users to manage their budgets and track financial progress more accurately, similar to budgeting tools found in other financial apps.

- Personalized Recommendations: Implementing algorithms to provide personalized recommendations for deals, offers, and relevant financial products based on user spending habits. This can leverage data analysis to suggest optimal spending strategies.

- Offline Functionality: Enabling users to access essential account information and perform limited transactions even without an active internet connection. This is a common feature in mobile banking apps, providing users with flexibility and accessibility.

Potential Integrations with Other Financial Services

Integrating with other financial services will expand the app’s utility and value proposition. This integration can facilitate seamless transactions and provide a comprehensive financial management experience.

- Linking with Bank Accounts: Allowing users to link their bank accounts for automated bill payments, facilitating easier management of recurring expenses, akin to features found in popular mobile banking apps.

- Investment Integration: Potentially offering basic investment tools or integration with brokerage platforms. This would allow users to diversify their financial portfolio within the app itself, leveraging the platform’s established user base.

- Insurance Integration: Allowing users to access and manage insurance policies within the app. This comprehensive approach can create a one-stop financial management solution.

Implementing New Payment Methods

Staying abreast of emerging payment trends is vital for maintaining the app’s relevance. Adapting to user preferences and the evolving payment landscape is paramount.

- Mobile Wallets: Integrating support for popular mobile payment platforms, like Apple Pay and Google Pay. This will allow users to make payments seamlessly using their mobile devices.

- Cryptocurrency Integration: Considering the growing popularity of cryptocurrencies, explore the possibility of adding support for crypto-related transactions or tokenization. This may involve partnerships with cryptocurrency exchanges.

- Buy Now, Pay Later (BNPL): Adding support for BNPL options. This feature could increase user engagement by offering more flexible payment options.

Potential Features for International Transactions

Facilitating international transactions will broaden the app’s appeal to a wider user base.

- Currency Conversion and Exchange: Implementing real-time currency conversion and exchange options to simplify international transactions. This will enable users to make informed decisions about transactions involving different currencies.

- International Payment Options: Supporting various international payment gateways and methods to ensure seamless transactions across borders, facilitating global financial connectivity.

- International Fee Structure: Displaying clear and transparent information about international transaction fees. This feature enhances transparency and user confidence.

Roadmap for Future Development

The following table Artikels the potential roadmap for future development, focusing on key milestones and projected timelines.

| Feature | Phase | Estimated Timeline |

|---|---|---|

| Enhanced Reporting and Analytics | Phase 1 | Q3 2024 |

| Linking with Bank Accounts | Phase 2 | Q4 2024 |

| Mobile Wallets Integration | Phase 2 | Q4 2024 |

| Personalized Recommendations | Phase 3 | Q1 2025 |

| International Transaction Support | Phase 3 | Q2 2025 |

Last Point

In conclusion, the mobile app for Prepaid CardConnect is poised to redefine the prepaid card experience. Its intuitive design, robust security features, and future-proof architecture make it a compelling choice for users seeking a streamlined and secure financial management tool. Prepare to experience a new era of financial ease, where your prepaid card is as accessible and functional as your favorite smartphone app.