Level up your financial game with Smione’s new mobile app! Imagine effortlessly managing your finances, from checking balances to making investments, all from your phone. This isn’t your grandma’s banking app; it’s a sleek, user-friendly platform designed to make your life easier and more convenient. Get ready to experience the future of finance, right at your fingertips!

This comprehensive Artikel details the development of a cutting-edge mobile app for Smione Financial Services. We’ll cover everything from defining Smione’s services and target audience to crafting a seamless user experience, incorporating top-tier security measures, and devising a killer marketing strategy. Get ready to dive deep into the world of mobile financial innovation!

Defining Smione Financial Services

Smione Financial Services is poised to revolutionize the mobile financial landscape, empowering individuals with seamless and intuitive access to a suite of essential financial tools. It’s designed to be more than just a platform; it’s a companion, guiding users through the complexities of personal finance and fostering financial literacy.

Smione understands the evolving needs of modern consumers in the digital age. The mobile financial services market is rapidly expanding, with increasing user demand for convenient, accessible, and secure financial solutions. Smione is strategically positioned to capitalize on this trend by offering comprehensive financial services directly on a user’s mobile device, removing geographical limitations and fostering greater financial inclusion.

Key Offerings and Target Audience

Smione caters to a broad spectrum of users, from young professionals navigating their first financial steps to seasoned investors seeking sophisticated investment strategies. Its focus on accessibility and user-friendliness makes it an ideal solution for both novice and experienced users. Smione’s target audience encompasses anyone seeking to manage their finances efficiently, whether for budgeting, saving, investing, or paying bills.

Current State of the Mobile Financial Services Market

The mobile financial services market is experiencing significant growth, driven by the increasing adoption of smartphones and the desire for convenient and accessible financial solutions. This trend is particularly pronounced in emerging markets where mobile penetration is high and traditional banking infrastructure may be limited. Smione recognizes this dynamic and strives to deliver a compelling experience that meets the evolving needs of this growing user base.

Smione’s Differentiators

Smione distinguishes itself through a unique combination of features. Its intuitive interface is designed to simplify complex financial tasks, making them easily understandable and actionable. A key differentiator is its emphasis on personalized financial guidance, using advanced algorithms to provide tailored recommendations and insights. Furthermore, Smione prioritizes security and data privacy, employing industry-leading encryption and security protocols to protect user information.

Financial Products and Services

Smione offers a diverse range of financial products and services, all accessible through its user-friendly mobile application. These include:

- Budgeting and Expense Tracking: Smione provides tools for creating personalized budgets, tracking expenses, and visualizing spending patterns. This empowers users to gain greater control over their finances and identify areas for improvement.

- Savings and Investment Options: Smione offers various savings plans and investment options, catering to different risk tolerances and financial goals. These include options ranging from high-yield savings accounts to diversified investment portfolios.

- Bill Payment and Recurring Payments: Smione streamlines the bill payment process, allowing users to pay multiple bills in a single platform and schedule recurring payments. This reduces the administrative burden and ensures timely payments.

- Financial Literacy Resources: Smione provides educational resources, such as articles, tutorials, and interactive tools, to promote financial literacy and empower users to make informed financial decisions.

Smione aims to provide a comprehensive suite of financial tools in a single platform, fostering greater financial empowerment and ease of use.

Mobile App Functionality

Igniting financial freedom, Smione’s mobile app is meticulously designed to empower users with seamless access to a world of financial possibilities. This intuitive platform seamlessly integrates core financial services, facilitating effortless transactions and providing a comprehensive user experience. It’s not just another app; it’s a personalized financial companion.

The app is engineered to cater to diverse needs, from everyday transactions to sophisticated investment strategies. A user-friendly interface ensures that navigating the app is a straightforward and satisfying experience.

User Flow Diagram for Transactions

A well-defined user flow diagram is crucial for a smooth transaction process. A typical fund transfer, for example, should begin with a clear selection of the recipient and the desired amount. This step is followed by a confirmation screen that displays all relevant details. Finally, a successful transaction is confirmed through a receipt. Bill payments follow a similar structure, with the user selecting the bill and payment details, followed by confirmation and receipt. This clear structure streamlines the transaction process, minimizing errors and maximizing user satisfaction.

Essential Features for Smione Financial Services

The Smione mobile app must incorporate essential features that go beyond basic transactions. Robust account management tools are paramount, allowing users to view account balances, transaction histories, and set up alerts for critical events. Investment options, including diversified portfolios and educational resources, are vital for empowering users to make informed financial decisions. A responsive and knowledgeable customer support system, accessible via chat, email, or phone, ensures users receive prompt assistance when needed.

Security Measures

Robust security measures are indispensable for safeguarding user data and transactions. Multi-factor authentication (MFA) is critical, adding an extra layer of protection beyond passwords. Data encryption ensures sensitive information remains confidential during transmission and storage. Regular security audits and updates are essential for maintaining a secure platform. Smione must adhere to the highest industry standards and regulations to maintain user trust and protect their financial well-being.

Comparative Analysis of Existing Mobile Banking Apps

Numerous mobile banking apps are currently available, each offering varying features and user experiences. Some prioritize simplicity for everyday transactions, while others excel in providing comprehensive investment tools. Smione should analyze successful features of leading apps, while simultaneously addressing any perceived shortcomings. Features like intuitive navigation, personalized recommendations, and seamless integration with other financial services can elevate the user experience, ensuring Smione stands out from the competition. A thorough analysis of the competitive landscape is essential to develop a robust and user-centric app.

User Interface and Experience (UI/UX)

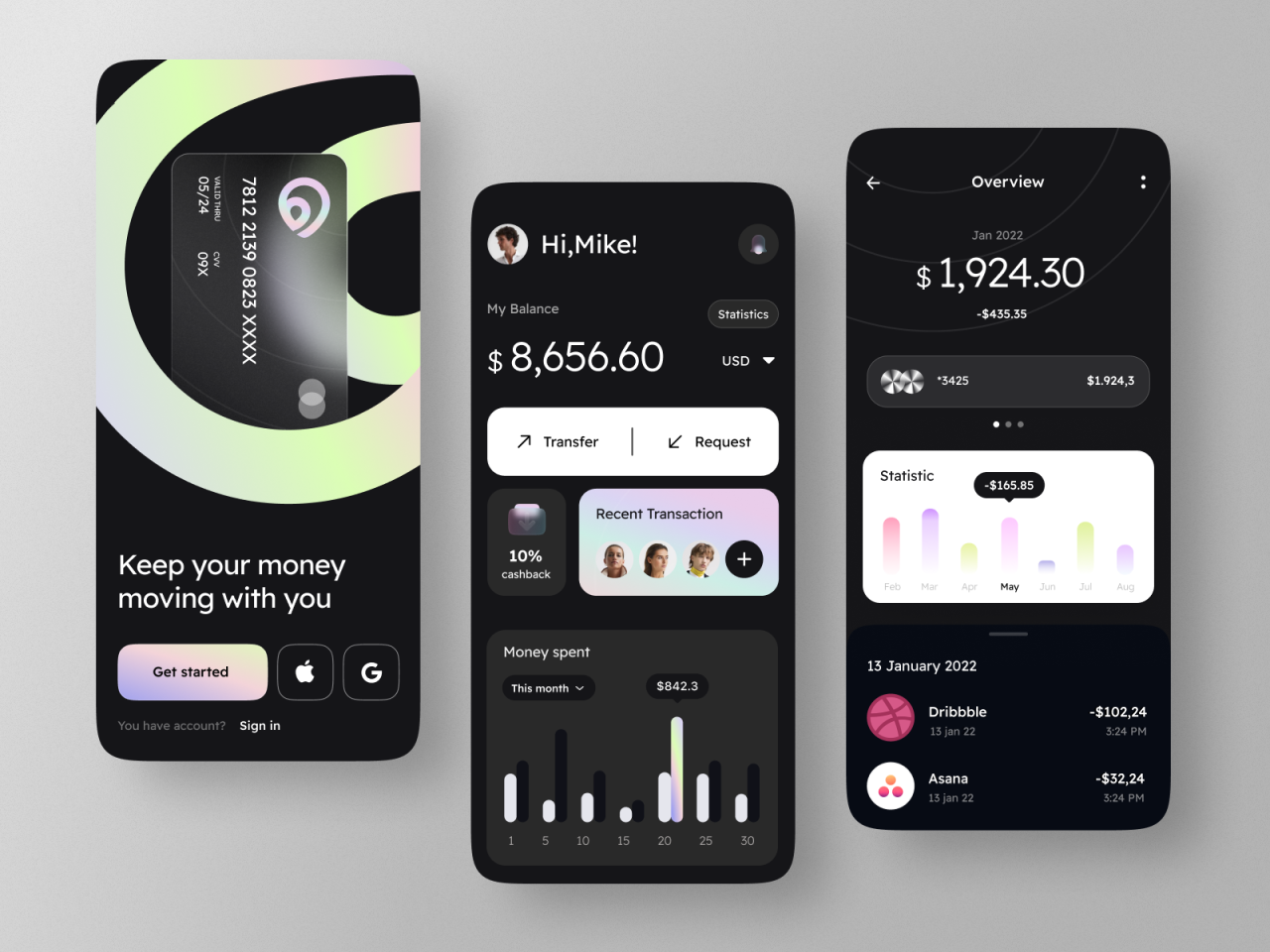

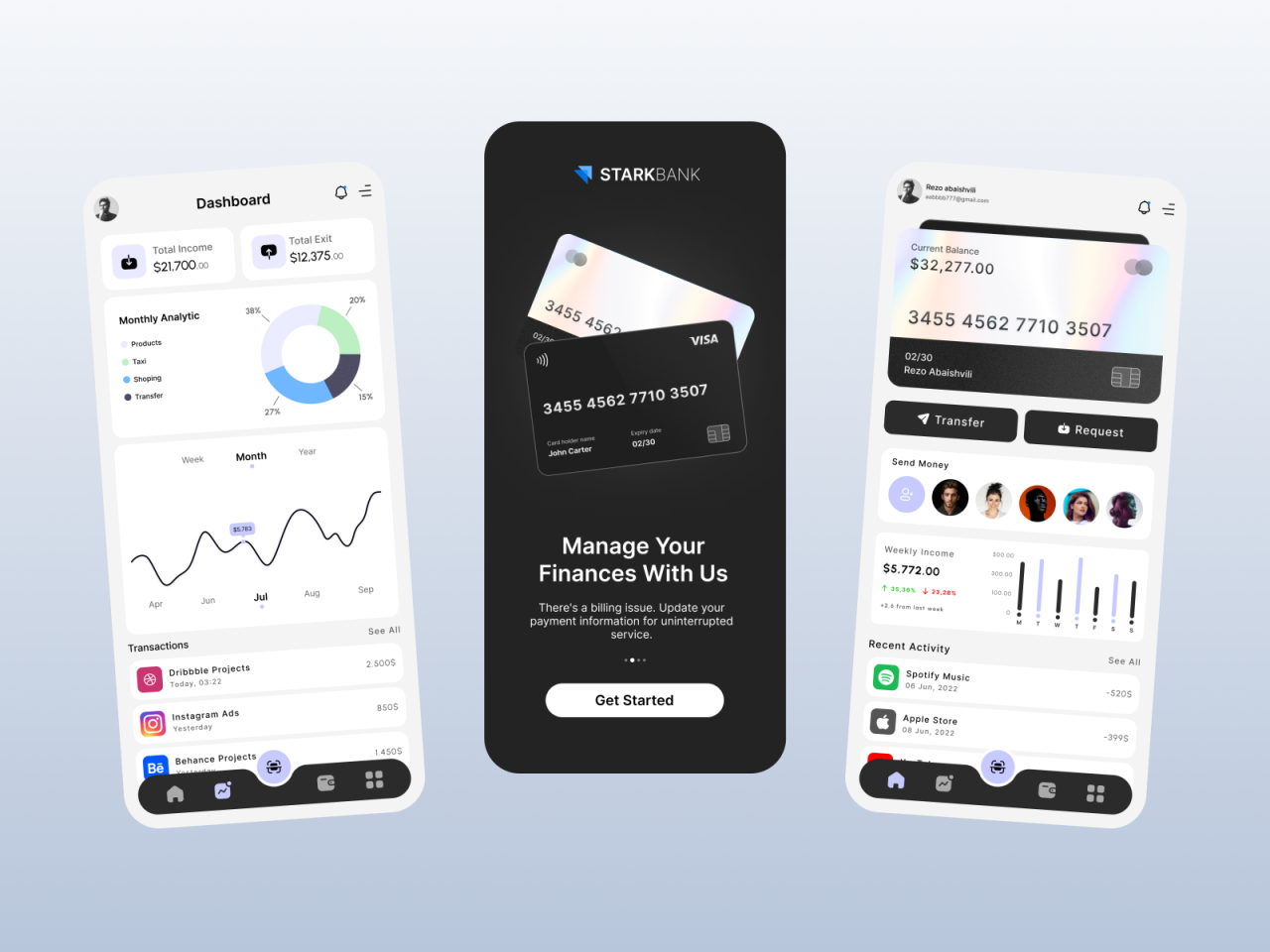

Unveiling a digital sanctuary for financial empowerment, Smione’s mobile app prioritizes a seamless and intuitive user experience. This journey through the digital realm should be captivating, guiding users effortlessly towards their financial aspirations. The design philosophy should emphasize clarity, simplicity, and an engaging aesthetic that fosters trust and encourages active participation.

The UI/UX design will be the cornerstone of the app’s success, shaping how users perceive and interact with Smione’s financial services. A well-crafted interface is paramount, translating complex financial concepts into easily digestible information. This design strategy will create a lasting impression and build a loyal user base.

User-Friendly Interface Design

A user-friendly interface is essential for mobile financial apps, particularly for Smione’s target audience. The design must prioritize simplicity and intuitive navigation. This translates into a visually appealing and easily understandable layout, minimizing the cognitive load on the user. The focus should be on delivering valuable information and functionalities quickly and effectively.

- Navigation: A well-structured navigation system is crucial for easy access to all functionalities. Clear, concise labels and icons should guide users intuitively. Consider using a bottom navigation bar for quick access to core features like accounts, transactions, and investments. Progressive disclosure is essential, revealing more complex options only when needed.

- Visual Hierarchy: Prioritize visual hierarchy to guide users’ attention to the most important information. Use contrasting colors, appropriate font sizes, and clear spacing to emphasize key elements such as account balances, transaction details, and upcoming payments. This visual hierarchy will streamline the user’s experience.

- Accessibility: The app should be accessible to all users, including those with disabilities. Ensure compliance with accessibility guidelines to provide a consistent and inclusive experience. Consider features like adjustable font sizes, high contrast modes, and alternative text for images.

Improving User Engagement and Satisfaction

Enhancing user engagement and satisfaction in a mobile banking app goes beyond a functional interface. It involves understanding user behavior and tailoring the experience to meet their specific needs.

- Personalized Experiences: Implement personalized features such as tailored recommendations, targeted financial advice, and customized dashboards. For example, if a user frequently invests in a specific sector, the app can highlight related investment opportunities or suggest relevant educational resources. This personal touch creates a unique experience.

- Interactive Features: Incorporate interactive elements like educational videos, progress trackers, and gamified elements to make the app more engaging. These elements transform a simple banking app into an interactive platform for financial learning and progress tracking. For instance, a progress tracker for saving goals can motivate users and make the process more enjoyable.

- Seamless Integration: Integrate with other popular financial tools or platforms to provide a holistic financial management experience. This integration streamlines tasks and improves the user experience by connecting the app to other financial tools and platforms.

Different UI/UX Design Approaches

Various approaches exist for designing mobile financial apps. Smione can learn from the successes and shortcomings of competitors to create a unique and effective design.

- Material Design: Leveraging Google’s Material Design principles, Smione can create a visually appealing and consistent user interface. This approach is popular due to its clean lines, intuitive controls, and modern aesthetic.

- Flat Design: This approach emphasizes clean lines and minimal visual elements. Flat design can create a modern and minimalist aesthetic. Smione should adapt it to their target audience’s preference and brand identity.

- Minimalist Design: This approach prioritizes simplicity and functionality. It focuses on displaying only essential information to avoid overwhelming users. Smione should incorporate it to make the app easy to navigate and understand.

Technical Considerations

Crafting a robust and user-friendly mobile application for Smione Financial Services necessitates careful consideration of the technical underpinnings. This section delves into the critical technology stack, secure data handling, potential challenges, and the crucial aspects of scalability and maintenance. The aim is to ensure a seamless and secure user experience, while also anticipating future growth and operational needs.

The development of a high-performing mobile application requires a comprehensive understanding of the technical landscape. This includes selecting appropriate programming languages, frameworks, and databases, as well as addressing security concerns and potential scalability issues. A well-structured architecture is essential to support Smione’s evolving needs and maintain a high level of performance and reliability.

Technology Stack

Choosing the right technology stack is fundamental to the success of the mobile application. This involves selecting programming languages, frameworks, and databases that align with the project’s requirements and ensure optimal performance. Consideration should be given to the maintainability, scalability, and security of the chosen technologies.

- Programming Languages: Swift for iOS and Kotlin for Android are preferred for their performance, safety, and extensive community support. These languages allow for the creation of high-quality, reliable applications.

- Mobile Frameworks: For iOS, consider using SwiftUI for its declarative approach and streamlined development process. For Android, the robust and widely used Android Jetpack Compose framework offers a similar advantage in terms of efficiency and developer experience.

- Database: A relational database like PostgreSQL or MySQL, combined with a NoSQL database like MongoDB for specific use cases, can provide a flexible and scalable data storage solution. The choice depends on the complexity of the application’s data model and the anticipated volume of data.

Secure Data Transmission and Storage

Ensuring the security of user data is paramount. Robust encryption methods must be implemented to protect sensitive information during transmission and storage. This includes leveraging industry-standard protocols and secure storage solutions.

- Data Encryption: Employ end-to-end encryption for all data transmission between the mobile application and Smione’s servers. This method ensures that only the user and Smione have access to the data. Protocols like TLS/SSL should be implemented for secure communication.

- Data Storage: Employ robust security measures, such as encryption at rest, to protect data stored within the application’s database. Regular security audits and updates should be part of the maintenance strategy.

Potential Challenges and Solutions

Developing a mobile application inevitably presents challenges. Careful planning and proactive solutions are crucial to mitigate potential issues and ensure a smooth launch.

- Scalability: Anticipate future growth and data volume by selecting scalable technologies and cloud services. Cloud platforms offer flexible infrastructure and scalable resources to handle increased user traffic and data volumes. Consider serverless functions for specific operations to enhance responsiveness.

- Maintenance: Implement a clear maintenance strategy to address bugs, security vulnerabilities, and updates. Regular testing and code reviews will help identify and fix potential issues proactively.

- Integration with Existing Systems: Thoroughly plan the integration of the mobile application with Smione’s existing financial systems. Ensure smooth data exchange and compatibility with other systems, using established APIs and data transfer protocols.

Scalability and Maintenance

A robust application must be designed with future scalability and maintenance in mind. This involves anticipating growth and implementing solutions for efficient updates and maintenance.

- Scalable Architecture: Employ microservices architecture, which allows for independent scaling of individual components, to address future demands. This modular design ensures that the application can accommodate increased user traffic and data volume without significant performance degradation.

- Regular Updates: Implement a schedule for regular updates to address security vulnerabilities, bugs, and enhance functionality. This is crucial to maintaining a stable and secure platform.

Marketing and Promotion

Igniting a financial revolution requires a strategic marketing campaign that resonates with target customers. Smione Financial Services’ mobile app, with its streamlined functionality and intuitive design, is poised to transform how individuals manage their finances. A well-defined marketing strategy, coupled with a compelling brand narrative, will be instrumental in driving downloads and fostering a loyal user base.

A successful marketing approach must go beyond simply promoting the app. It must cultivate an understanding of the value proposition, emphasizing the app’s unique features and benefits. This involves a comprehensive approach, encompassing various channels and targeting specific customer segments.

Target Audience Segmentation

Identifying and segmenting the target audience is crucial for effective marketing. Smione Financial Services should categorize users based on demographics, financial goals, and technological familiarity. This allows for tailored messaging and campaigns that resonate with each segment’s unique needs and motivations. For example, a campaign targeting young professionals might focus on building credit and budgeting tools, while a campaign aimed at retirees could highlight secure investment options and retirement planning resources.

Social Media Engagement Strategies

Social media platforms are powerful tools for building brand awareness and driving app downloads. Engaging content, interactive polls, and targeted advertising campaigns on platforms like Instagram, Facebook, and TikTok can create a vibrant online presence. Utilizing influencers in the financial space can amplify the message and build trust among potential users. Running contests or giveaways related to financial literacy can attract and engage the target audience while promoting the app’s functionalities.

App Store Optimization (ASO) Techniques

Optimizing the app listing in app stores is essential for visibility. Comprehensive research, compelling app descriptions, and visually appealing screenshots are crucial for attracting potential users. Reviews and ratings play a significant role in influencing download decisions. Encouraging positive reviews and responding to user feedback can bolster the app’s reputation and enhance its ranking in search results. A strong app store presence is a vital component of a successful marketing strategy.

Influencer Marketing Strategies

Leveraging the reach and influence of key figures in the financial community can be a potent strategy. Partnering with financial advisors, bloggers, or social media personalities can extend the brand’s visibility and credibility. Authentic endorsements from trusted voices can significantly increase user trust and encourage downloads. For example, collaborating with a renowned financial advisor who promotes financial literacy can lead to a considerable increase in app downloads.

Examples of Successful Financial App Campaigns

Several successful financial apps have employed innovative marketing campaigns. Mint, for instance, leveraged social media and educational content to establish itself as a trusted resource for personal finance. Other apps, like Chime, have effectively utilized targeted advertising and user-generated content campaigns to build a strong user base. Analyzing successful strategies of similar apps can provide valuable insights into effective marketing techniques.

Encouraging App Downloads and User Engagement

A multi-faceted approach is crucial for encouraging app downloads and fostering user engagement. Offering incentives like exclusive discounts or early access to features can motivate potential users to download and explore the app. Providing informative tutorials and onboarding guides can ease the user experience and encourage consistent use. Implementing a reward system for achieving financial milestones can create a sense of accomplishment and encourage long-term engagement.

Future Development and Updates

The Smione Financial Services mobile app, poised for continued success, must evolve with the ever-changing landscape of mobile finance. Anticipating user needs and embracing innovation will be key to maintaining a competitive edge and fostering a thriving user base. This section details the future roadmap, highlighting opportunities for growth and adaptation.

Embracing a forward-thinking approach, Smione Financial Services will continuously refine the mobile app to meet the evolving financial needs of users. This involves incorporating emerging trends, ensuring seamless functionality, and providing a secure and intuitive experience. Regular updates and proactive bug fixes are crucial to maintain a high level of user satisfaction and trust.

Future Features

The Smione app will be more than just a transactional tool. It will be a comprehensive financial management hub. This involves adding new features that enhance user experience, streamline operations, and provide insights into financial well-being.

- Personalized Financial Planning: The app will integrate sophisticated algorithms to provide tailored financial planning advice, encompassing budgeting, investment strategies, and retirement planning, based on individual user data and goals. This will allow users to visualize their financial progress and adjust strategies proactively.

- AI-Powered Chatbot: A robust AI-powered chatbot will provide instant support and answer common questions in real-time, resolving issues efficiently and offering 24/7 assistance, effectively extending customer service hours and minimizing wait times.

- Integration with Third-Party Services: The app will seamlessly integrate with popular third-party services like payment gateways, banking platforms, and investment platforms, streamlining financial transactions and offering a more comprehensive financial ecosystem.

- Enhanced Security Measures: The app will incorporate advanced security protocols, including biometric authentication and multi-factor authentication, to safeguard user data and financial transactions. This proactive approach ensures the security and privacy of user information.

Adapting to Emerging Trends

The mobile financial services sector is dynamic. Smione Financial Services will monitor and adapt to new trends in mobile banking, including innovative payment methods, such as contactless payments and digital wallets. This ensures the app remains relevant and competitive.

- Mobile-First Approach: Smione will continue to prioritize a mobile-first design, ensuring a seamless experience across different devices and operating systems. This will maintain a consistent and intuitive interface, enhancing user experience across various platforms.

- Biometric Authentication: The app will adopt advanced biometric authentication methods to streamline user logins, further enhancing security and user convenience. Biometric authentication provides a fast and secure way to access accounts.

- Real-Time Transaction Tracking: Smione will integrate real-time transaction tracking capabilities, providing users with immediate visibility into their financial activities and enabling them to manage their finances efficiently.

Importance of Updates and Bug Fixes

Regular updates and bug fixes are essential for maintaining a reliable and user-friendly mobile experience. This involves a continuous cycle of improvement, ensuring a secure and stable platform.

- Enhanced User Experience: Updates will address user feedback and implement enhancements to the user interface and experience, enhancing usability and improving user satisfaction. This proactive approach ensures user satisfaction with the product.

- Improved Performance: Bug fixes will improve app performance, stability, and responsiveness, ensuring smooth and uninterrupted operations. This focus on performance ensures users can utilize the app seamlessly without interruptions.

- Security Enhancements: Regular updates will incorporate security patches to mitigate vulnerabilities and safeguard user data, ensuring data protection against evolving threats. This approach safeguards user data and financial security.

Mobile App Structure and Design

Igniting financial empowerment, Smione’s mobile app will be a meticulously crafted portal to prosperity. Its structure and design will seamlessly integrate intuitive navigation with robust security, ensuring a user experience that inspires confidence and encourages engagement.

The mobile app’s design will mirror the financial landscape, providing clarity and control to empower users in managing their finances. Each element, from the login screen to the investment tracking module, will be meticulously crafted to foster a smooth and secure user journey.

Mobile App Structure

This structured approach ensures users can navigate effortlessly to the desired functionality, promoting a sense of control and understanding.

| Screens | Functionalities | Access Levels |

|---|---|---|

| Dashboard | Overview of accounts, recent transactions, and key financial metrics | All users |

| Investment Tracking | Detailed view of investment portfolios, performance analysis, and transaction history | Users with investment accounts |

| Budgeting Tools | Creation and management of budgets, expense tracking, and goal setting | All users |

| Bill Payments | Scheduling and managing bill payments, generating payment history | All users |

| Account Management | Viewing account details, updating personal information, and managing security settings | All users |

| Support | Accessing help documentation, contacting customer support | All users |

Login Screen Design Options

The login screen is the gateway to the app, requiring a balance between security and ease of use.

| Design Option | Description | Pros | Cons |

|---|---|---|---|

| Option 1: Simplified Approach | Clean, minimalist design with clear input fields and a single login button. | Intuitive and fast | Potentially less secure due to lack of multi-factor authentication options |

| Option 2: Enhanced Security | Includes a multi-factor authentication option (e.g., SMS code, biometric scan). | Highly secure | May require more user input and potentially more technical infrastructure |

| Option 3: Personalized Design | Incorporates user’s preferred color scheme and branding for a more personalized feel. | Increases user engagement | May require more development time and potentially more complex integration |

Smione Mobile App Features

These features will equip users with the tools they need to effectively manage their financial lives.

| Feature | Description |

|---|---|

| Budgeting Tools | Allow users to create and manage budgets, track expenses, and set financial goals. |

| Investment Tracking | Provide detailed insights into investment portfolios, performance analysis, and transaction history. |

| Bill Payments | Enable users to schedule and manage bill payments, and view payment history. |

| Alerts and Notifications | Inform users about important financial events, such as account activity or upcoming bill payments. |

| Security Features | Implement robust security measures, such as multi-factor authentication and encryption, to safeguard user data. |

Secure Data Input and Output

Protecting user data is paramount. Implementing secure data input and output is crucial to maintain trust and confidentiality.

- Encryption: Encrypting sensitive data during transmission and storage is essential. Advanced encryption protocols, like AES-256, will be used to ensure data confidentiality. For example, when users enter their credit card details for bill payments, the data is encrypted using a secure communication channel.

- Multi-factor Authentication: Implementing multi-factor authentication (MFA) adds an extra layer of security, making it harder for unauthorized access. A user entering their account details on the mobile app could also be required to enter a one-time password sent to their phone number.

- Regular Security Audits: Regularly assessing and updating security protocols is essential to keep up with evolving threats. The Smione team will perform periodic security audits to identify vulnerabilities and enhance security measures.

Wrap-Up

From the core functionality of the app to its sleek design and robust security, this Artikel paints a picture of a mobile app that’s not just functional but also enjoyable to use. Smione’s app is poised to revolutionize the way people interact with their finances, offering a user-friendly experience that’s second to none. We’ve laid out a roadmap for a successful launch, ensuring that Smione’s app not only meets but exceeds user expectations.