Mobile payments, once a niche technology, are rapidly transforming how we interact with commerce. This comprehensive analysis delves into the burgeoning market for mobile payment applications specifically designed for tablet devices. The increasing prevalence of tablets in various sectors, from retail to healthcare, necessitates a dedicated mobile payment solution that addresses the unique characteristics of these devices. This paper will examine the technical, design, and market considerations behind the development of a successful mobile app for tab mobile payments.

The landscape of tablet-based mobile payments is characterized by a blend of emerging technologies and established industry standards. Understanding the nuanced interplay between user experience, security protocols, and market trends is critical to creating a successful application. The paper will navigate these complexities by exploring the current market, competitive landscape, and potential for innovation in this rapidly evolving domain.

Introduction to Mobile App for Tab Mobile Payments

Mobile payments on tablets are rapidly gaining traction as a convenient and efficient method of transacting. This trend is fueled by the increasing prevalence of tablets in everyday life, particularly in retail and hospitality settings. The convenience of a contactless payment system integrated into a familiar device like a tablet has become a significant driver in the market.

Tablet-based mobile payment systems are evolving to meet the demands of a dynamic marketplace. This includes enhancements in security protocols, improved user interfaces, and expanding integration with existing payment networks. The growth of mobile payments is being further accelerated by the adoption of newer technologies like near-field communication (NFC) and biometric authentication.

Overview of Mobile Payments on Tablets

Tablet mobile payments offer a flexible alternative to traditional payment methods, enabling users to make purchases using their tablet devices. The primary benefit lies in the potential for increased speed and efficiency in transactions. This convenience is particularly attractive in situations where multiple transactions are involved, like in retail environments or within large organizations.

Market Trends for Mobile Payment Apps on Tablets

The market for tablet mobile payment apps is experiencing significant growth, driven by the rising adoption of tablets in business and consumer settings. Retailers are increasingly integrating tablet payment systems to streamline checkout processes and improve customer service. Moreover, the rising use of tablets in hospitality, education, and other sectors is boosting demand for mobile payment solutions specifically designed for tablets. A key trend involves the convergence of tablet payment systems with other technologies, such as loyalty programs and inventory management.

Types of Mobile Payment Systems for Tablets

Several mobile payment systems are available for tablets. These systems can be broadly categorized into those based on NFC technology, which allows for contactless transactions, and those using barcode scanning for payments. Examples include Apple Pay, Google Pay, and Samsung Pay, which are all compatible with certain tablets.

Benefits of Using Mobile Payment Apps on Tablets

Tablet mobile payment apps offer several benefits. These include increased speed and efficiency in transactions, reduced risk of fraud compared to traditional methods, and enhanced security features, such as encryption and tokenization. Furthermore, the ability to track transactions and manage finances directly on the tablet device is a significant advantage for users.

Drawbacks of Using Mobile Payment Apps on Tablets

While tablet mobile payment apps provide significant benefits, certain drawbacks exist. One major concern is the potential for security breaches if the tablet device is lost or stolen. Furthermore, issues with network connectivity can disrupt transactions, particularly in areas with limited or unreliable internet access. The reliance on the tablet’s battery life can also pose a constraint.

Security Concerns Associated with Mobile Payments on Tablets

Security is a paramount concern for mobile payments on tablets. Risks include the potential for data breaches if the device is compromised. Implementing strong encryption and multi-factor authentication protocols are crucial to mitigate these risks. Users should also exercise caution regarding public Wi-Fi usage and take measures to safeguard their devices from theft or unauthorized access. Protecting personal information is crucial, and users should avoid storing sensitive data on the device unnecessarily.

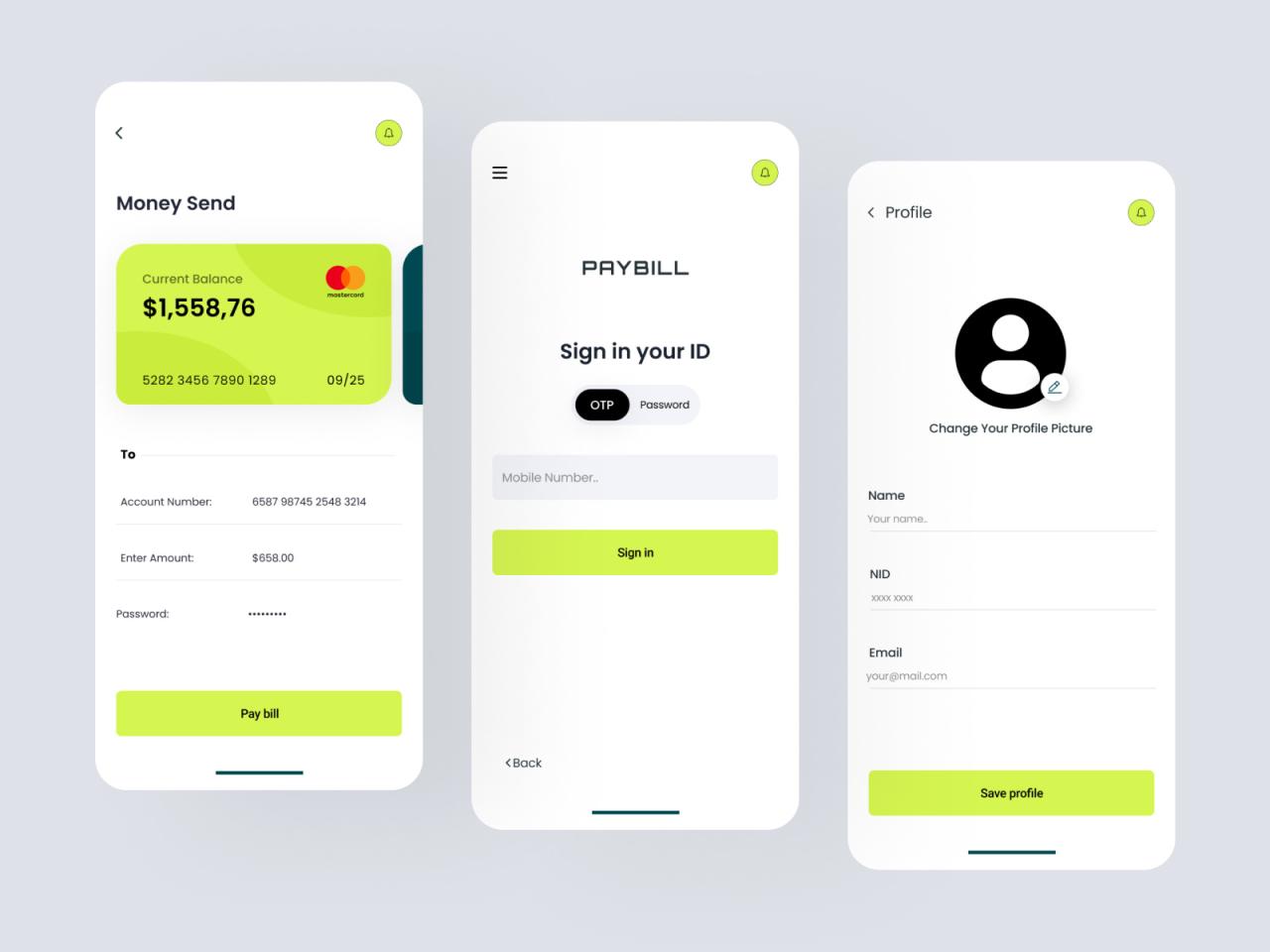

User Experience (UX) Design for the App

The user experience (UX) design for a mobile payment app on a tablet must prioritize ease of use and intuitive navigation, particularly given the larger screen real estate. This design must accommodate the unique needs and expectations of tablet users, who may be engaging with the app for more complex transactions or extended periods. A well-designed UX ensures a positive user experience, promoting adoption and satisfaction.

The design should focus on a seamless user flow, clear visual cues, and efficient task completion. Careful consideration must be given to the various user personas and their individual needs and expectations. Furthermore, the UI design should be adaptable and responsive to different tablet sizes and screen resolutions.

User Flow Diagram for a Typical Transaction

A user flow diagram visually represents the steps a user takes during a mobile payment transaction. This diagram is crucial for ensuring a smooth and logical progression through the payment process. The diagram should depict each interaction point, such as selecting a payment method, entering payment details, confirming the transaction, and receiving transaction confirmation. The diagram will help to identify potential bottlenecks or areas needing improvement in the transaction flow.

Example: The user flow diagram will depict a typical transaction starting with selecting the recipient, then selecting the payment method, followed by entering the amount, and concluding with confirmation and receipt.

Essential Features and Functionalities

To enhance user experience and adoption, the app must incorporate essential features. These features are crucial for a functional and efficient mobile payment system. Such features include secure payment processing, support for various payment methods (e.g., credit cards, debit cards, bank accounts), transaction history, and detailed reporting, along with a secure login system. Moreover, the app should support multiple currencies for global transactions.

- Secure Payment Processing: This involves employing encryption protocols and secure transaction channels to protect user data during the entire transaction process. Security is paramount to user trust and acceptance of the mobile payment app.

- Multiple Payment Methods: Offering options such as credit cards, debit cards, and bank accounts enhances user flexibility and convenience, enabling users to choose their preferred payment method.

- Transaction History: Providing detailed transaction history with clear visibility of date, time, amount, recipient, and other relevant details facilitates user account management and helps in resolving any disputes or errors.

- Detailed Reporting: This involves generating comprehensive reports on transaction activity, allowing users to track their spending patterns and manage their accounts effectively.

- Secure Login System: A robust login system with multi-factor authentication and secure password management is essential for protecting user accounts and sensitive data.

- Multi-Currency Support: Enabling transactions in multiple currencies expands the app’s global reach and caters to a wider range of users, particularly in international transactions.

Design Principles for Intuitive UI

The UI design should prioritize simplicity, clarity, and accessibility for tablet users. Key principles include using clear visual hierarchy, employing intuitive navigation, and incorporating accessibility features.

- Clear Visual Hierarchy: Using visual cues like size, color, and spacing to guide the user’s eye and highlight important elements.

- Intuitive Navigation: Employing a logical and consistent navigation structure to enable users to easily find the information they need and complete their tasks.

- Accessibility Features: Incorporating features such as adjustable text sizes, high contrast modes, and voiceover support to ensure the app is usable for users with disabilities.

User Personas

Identifying and understanding user personas is crucial for creating a user-centered design. Different user groups may have varied needs and expectations for the mobile payment app. Defining these personas will enable tailoring the design and functionality to best meet their specific requirements.

| Persona | Description | Needs |

|---|---|---|

| Business Professional | Busy executive frequently making payments. | Speed, efficiency, security. |

| Student | Student making everyday purchases. | Simplicity, affordability, clear transaction details. |

| Senior Citizen | User accustomed to traditional methods. | Clear instructions, large fonts, simple interface. |

Comparison of UI Design Patterns

Different UI design patterns exist for mobile payments. Comparing these patterns helps in selecting the most suitable approach for a tablet app. These patterns include the use of cards, grids, and lists for displaying information, and the use of icons and visual cues for actions. The chosen pattern must be intuitive and allow for efficient data input and processing.

- Card-based UI: Organizing information in cards facilitates a clear and concise display, especially beneficial for visually separating different transaction details or payment options.

- Grid-based UI: Presenting information in a grid format allows for organized and easy navigation and selection of various options.

- List-based UI: Lists are helpful for presenting a series of items, such as transaction history or a list of payment methods.

Technical Aspects of the App

The technical architecture of the mobile payment app for tablets dictates its performance, security, and scalability. Careful consideration of these aspects ensures a robust and user-friendly application. A well-designed architecture allows for seamless transactions and protects sensitive user data.

The core components of the app’s architecture, including data storage, communication protocols, and user interface elements, are crucial to the overall functionality. Effective integration with existing payment gateways is also essential.

Technical Architecture

The application will utilize a client-server model. The tablet (client) interacts with a secure server to process transactions and access user data. The server will be hosted on a cloud platform for scalability and reliability. A microservices architecture will be employed to allow for independent scaling of different functionalities.

Technologies Required

To ensure a smooth and efficient development process, a range of technologies will be implemented. These technologies are selected based on their proven reliability and security features. This approach guarantees a stable and reliable payment system.

- Programming Languages: Java (or Kotlin) for Android development and a server-side language like Node.js or Python for backend services. These languages are commonly used in mobile and web development, respectively, and provide ample support resources and libraries.

- Database Management System: A relational database (like PostgreSQL or MySQL) will be employed to store user data and transaction records. Relational databases provide structured data management, which is crucial for maintaining data integrity and enabling efficient queries.

- Mobile Development Frameworks: The Android SDK will be used for building the tablet application. This provides access to the necessary tools and APIs for mobile development.

- Payment Gateway Integration: A secure payment gateway (e.g., Stripe, PayPal) will be integrated to handle transaction processing. The gateway will handle security protocols and authorization to protect financial information.

Security Protocols

Protecting sensitive user data is paramount. Robust security protocols will be implemented to ensure data encryption and confidentiality. This is achieved through a layered approach.

- Data Encryption: Data encryption techniques (e.g., AES-256) will be implemented to protect user data during transmission and storage. This ensures that even if a breach occurs, sensitive information remains unreadable.

- Secure Communication Channels: HTTPS will be used for all communication between the tablet application and the server. This protocol ensures data encryption during transmission and verification of the server’s identity.

- Authentication and Authorization: Strong authentication mechanisms (e.g., multi-factor authentication) will be used to verify user identity. This prevents unauthorized access to sensitive information.

Payment Gateway Integration

The payment gateway integration process will follow a standardized procedure. This approach ensures the integrity of the transaction process.

- API Integration: The chosen payment gateway’s API will be integrated into the application’s backend. This enables the app to communicate with the gateway to initiate and complete transactions.

- Security Measures: Strict adherence to the payment gateway’s security guidelines is paramount. This will involve validating all responses and verifying transaction details to prevent fraudulent activity.

- Transaction Monitoring: Real-time monitoring of transactions is crucial. This helps to detect and prevent potential fraudulent activities, ensuring the security of the entire system.

Testing Procedures

Thorough testing procedures will be implemented to ensure the app’s functionality and security. Testing will encompass various scenarios to identify and resolve potential issues.

- Functional Testing: Testing will involve verifying the app’s core functionalities, including transaction initiation, payment processing, and data retrieval. Specific test cases will cover different user scenarios, including valid and invalid inputs.

- Security Testing: Penetration testing will be conducted to identify vulnerabilities in the app and its integration with the payment gateway. This ensures the app meets the highest security standards and prevents potential attacks.

- Performance Testing: Performance testing will evaluate the app’s responsiveness and efficiency under various load conditions. This will help ensure the app can handle peak transaction volumes and maintain a positive user experience.

Market Analysis and Competition

The mobile payment app market for tablets is a burgeoning sector, with significant potential for growth. Understanding the competitive landscape is crucial for developing a successful app. Analysis of existing competitors, their features, pricing, and market share provides insights into the opportunities and challenges within this space. This section details the key competitors, their strengths and weaknesses, and the overall market dynamics.

Key Competitors

The mobile payment app market for tablets is currently characterized by a mix of established players and emerging startups. Several well-known mobile payment platforms have begun to incorporate tablet support, while some companies are exclusively focused on tablet-based payments. Identifying these competitors is crucial to understanding the competitive landscape.

- Apple Pay, integrated into Apple’s ecosystem, offers a secure and convenient payment solution. Its strength lies in its seamless integration with Apple devices and established user base.

- Google Pay, another major player, provides similar functionality, leveraging its vast reach within the Android ecosystem.

- Samsung Pay is tailored to Samsung devices and provides similar features to the above, demonstrating the integration of mobile payments within the overall device experience.

- Square, while primarily known for point-of-sale systems, offers a mobile payment app that can be used on tablets.

- PayPal, a global payment giant, provides a broad range of mobile payment services and options, including tablet integration, often with a focus on facilitating peer-to-peer (P2P) transactions.

Feature Comparison

A comparative analysis of the features and functionalities of these apps reveals significant overlap and subtle differences. Key aspects to consider include transaction types (credit/debit, mobile wallets, etc.), security protocols, merchant support, and the level of integration with existing tablet operating systems.

| Feature | Apple Pay | Google Pay | Samsung Pay | Square | PayPal |

|---|---|---|---|---|---|

| Transaction Types | Credit/Debit, Apple Pay Cash | Credit/Debit, Google Pay Cash | Credit/Debit, Samsung Pay Cash | Credit/Debit, Cash | Credit/Debit, PayPal Cash, P2P |

| Security | High, with Touch ID/Face ID | High, with device security measures | High, with device security measures | High, with security protocols | High, with authentication measures |

| Merchant Support | Wide range of merchants | Wide range of merchants | Wide range of merchants | Wide range of merchants | Wide range of merchants |

Pricing Strategies

The pricing strategies of mobile payment apps for tablets vary. Some apps may be free to use with a small transaction fee for each payment, while others might have a subscription-based model or a tiered pricing system. This pricing structure impacts the profitability and user experience of the apps.

Market Share

The market share of various mobile payment platforms is subject to change. Data from reputable market research firms, like eMarketer, provide insights into the distribution of mobile payment usage across different platforms and devices.

SWOT Analysis

A SWOT analysis of the mobile payment app market for tablets considers the Strengths, Weaknesses, Opportunities, and Threats to the industry. The tablet market is relatively smaller compared to smartphones, presenting both challenges and unique opportunities.

- Strengths: The potential for innovative tablet-specific features, like interactive payment methods, is significant. Strong security protocols are essential in this market.

- Weaknesses: The tablet market’s lower penetration rate compared to smartphones could limit market size.

- Opportunities: Emerging tablet markets in developing countries represent significant opportunities for growth. Enhanced user experience, including personalization and ease of use, is crucial for attracting users.

- Threats: Competition from existing mobile payment platforms and the potential for security breaches are key threats to consider.

Future Trends and Innovations

The mobile payment landscape is constantly evolving, with new technologies and trends shaping the user experience. This section explores potential future developments in mobile payments on tablets, including emerging technologies, the impact of innovations, and the role of artificial intelligence. Understanding these trends is crucial for the successful design and implementation of a competitive mobile payment app.

Technological advancements are rapidly changing the way transactions are conducted, and this necessitates a proactive approach to incorporating future-proof features. Forecasting these developments enables the app to adapt and remain relevant in the dynamic market.

Potential Future Trends in Mobile Payments

Mobile payments on tablets are poised for significant growth. Enhanced security measures, such as biometric authentication and secure tokenization, will likely become standard. Furthermore, the integration of contactless payments with other digital services, such as loyalty programs and online shopping, is anticipated. Finally, personalized payment experiences tailored to individual user preferences and spending habits are expected to become more prevalent.

Emerging Technologies Impacting Mobile Payments

Several emerging technologies are poised to transform mobile payments. Near-field communication (NFC) technology, already prevalent in smartphones, will likely expand its role in tablet-based payments, enabling faster and more secure transactions. The development of more sophisticated and secure payment protocols, including blockchain-based systems, is also expected to impact the industry. Finally, advancements in artificial intelligence (AI) will likely lead to more intelligent and personalized payment experiences.

Impact of Innovations on the Mobile Payment App Industry

Innovations in mobile payment technology will fundamentally reshape the mobile payment app industry. The integration of AI will enable more personalized and efficient payment processes, streamlining transactions and enhancing the user experience. The implementation of secure tokenization will boost user trust and confidence in the platform, fostering wider adoption. Furthermore, the integration of blockchain technology will likely lead to greater transparency and security in transactions, especially with the rise of decentralized payment systems.

Role of Artificial Intelligence in Mobile Payments

Artificial intelligence (AI) is poised to play a crucial role in the future of mobile payments. AI algorithms can analyze user spending patterns to provide personalized recommendations and offers, leading to a more engaging and tailored payment experience. AI-powered fraud detection systems can identify and mitigate fraudulent activities in real time, ensuring the security of transactions. Furthermore, AI can optimize payment processes, reducing processing times and improving efficiency.

Possible Future Features for the App

The following list Artikels potential features for the app to enhance the user experience and keep pace with future trends:

- Biometric Authentication: Implementing fingerprint or facial recognition for secure login and transaction authorization would enhance security and user convenience.

- AI-Powered Fraud Detection: Integrating AI algorithms to detect and prevent fraudulent activities in real-time would safeguard user funds and maintain trust in the platform.

- Personalized Recommendations: Leveraging AI to provide personalized recommendations based on user spending patterns would enhance the user experience and promote targeted offers.

- Seamless Integration with Other Services: Creating seamless integration with existing digital services, such as loyalty programs and online shopping platforms, would provide a comprehensive payment ecosystem.

- Decentralized Payment System (Blockchain): Integrating blockchain technology for enhanced security, transparency, and transaction speed would potentially create a more robust and trustworthy payment system.

App Monetization Strategies

Monetization strategies are crucial for the long-term sustainability and growth of any mobile application. A well-defined strategy ensures the app can cover development costs, ongoing maintenance, and provide a return on investment for stakeholders. Effective monetization strategies not only generate revenue but also enhance user experience and satisfaction, encouraging long-term engagement and positive word-of-mouth.

A successful mobile payment app requires a robust monetization strategy that balances user value with revenue generation. Different approaches can be employed, including direct transaction fees, subscription models, and other revenue streams. Understanding these options allows developers to select a strategy aligned with their app’s unique features and target market.

Transaction-Based Fees

Transaction-based fees represent a common monetization method for payment apps. These fees are directly tied to the volume of transactions processed through the platform. The app can charge a small percentage of each transaction, regardless of the amount. This model is often favoured when the primary function of the app is to facilitate payments. A well-defined tiered fee structure can encourage a larger transaction volume.

Subscription Models

Subscription models offer a recurring revenue stream for the app. This approach can provide a predictable revenue flow and allow users to access premium features or services. Different subscription tiers with varying benefits can cater to diverse user needs and preferences. This allows developers to provide enhanced services or features for a recurring fee.

Premium Features

Offering premium features for a fee can be another effective monetization strategy. A freemium model allows users to access basic features for free, with premium features unlocked via a purchase. This approach caters to a broader user base while attracting those who require advanced functionality. Premium features can include enhanced security protocols, higher transaction limits, or exclusive services.

In-App Purchases

In-app purchases (IAPs) can generate revenue from optional content or features. This strategy allows users to enhance their experience by purchasing additional tools, customization options, or premium content. IAPs can be especially effective for apps offering diverse functionalities and options.

Advertising

Advertising can be integrated into the app, generating revenue from displaying advertisements to users. This model can be used to supplement other revenue streams. Contextual advertising, aligning ads with app content, can improve user experience and potentially increase ad effectiveness. It is essential to balance user experience with ad revenue generation.

Data Analytics and Premium Services

Offering data analytics services or specialized services tied to user transactions can generate significant revenue. The app can collect data about user spending habits and preferences, and provide insights or reports to users for a fee. This strategy can attract businesses and professionals seeking financial insights.

Comparison of Monetization Models

| Model | Description | Pros | Cons |

|---|---|---|---|

| Transaction-Based Fees | Charging a percentage of each transaction | High volume potential, direct correlation with usage | Potential for low revenue per transaction, user perception of cost |

| Subscription Models | Recurring fees for access to premium features | Predictable revenue stream, potential for high average revenue per user (ARPU) | Requires strong value proposition, churn risk |

| Premium Features | Unlocking advanced functionality for a fee | Attract users seeking specific functionalities, potential for high-value transactions | Can alienate users who don’t need advanced features, potential for lower volume compared to transaction fees |

| In-App Purchases | Selling optional content or features | Offers diverse options for users, potential for high-value purchases | Can lead to fragmented user experience if not implemented strategically |

| Advertising | Displaying ads to generate revenue | Low initial cost, potentially broad reach | Can negatively impact user experience, potential for low revenue per user |

| Data Analytics/Premium Services | Providing financial insights and specialized services | Potential for high ARPU, high value to specific user segments | Requires substantial data collection and analysis, complex implementation |

Security and Privacy Considerations

Ensuring the security and privacy of user data is paramount for the success and trustworthiness of any mobile payment application. Robust security measures are essential to protect sensitive financial information and build user confidence. This section details the critical aspects of safeguarding user data and adhering to relevant regulations.

Implementing comprehensive security protocols and transparent privacy policies are crucial to mitigate risks and maintain user trust. A strong focus on security and privacy will foster user adoption and ultimately contribute to the app’s long-term viability.

Data Security Measures

Protecting user data from unauthorized access, use, disclosure, alteration, or destruction requires a multi-layered approach. This includes technical safeguards and administrative controls.

- Encryption: All sensitive data, including transaction details and user credentials, should be encrypted both in transit and at rest. This ensures that even if data is intercepted, it remains unreadable without the appropriate decryption key. Advanced encryption standards, like AES-256, should be employed.

- Authentication Mechanisms: Multi-factor authentication (MFA) is vital to verify user identity. This involves requiring more than one form of verification, such as a password and a one-time code sent to a registered device. Strong password policies, including complexity requirements and regular password changes, are also essential.

- Data Validation and Sanitization: Input validation is critical to prevent malicious code injection. Data should be sanitized to remove potentially harmful characters or commands. This helps protect against attacks like SQL injection and cross-site scripting (XSS).

- Regular Security Audits and Penetration Testing: Independent security audits and penetration testing are crucial to identify vulnerabilities and weaknesses in the application’s security posture. This ensures that the application is continuously assessed and strengthened against emerging threats.

Privacy Policies

A clear and concise privacy policy is essential to inform users about how their data is collected, used, and protected. This policy should be easily accessible and understandable.

- Data Minimization: Only collect and store the minimum amount of data necessary for the application’s functionality. Avoid collecting unnecessary or sensitive information.

- Data Retention: Establish clear data retention policies. Data should be retained only for the period necessary to fulfill the purpose for which it was collected. After that period, data should be securely deleted or anonymized.

- Transparency and User Control: Provide users with clear and concise information on their rights regarding their data, including access, correction, and deletion. Allow users to control their data through settings options.

- Data Subject Access Requests (DSAR): Establish a process to handle data subject access requests, ensuring compliance with data protection regulations. This process should be efficient and transparent.

Security Breaches in Mobile Payment Apps

Past incidents highlight the importance of robust security measures.

- Phishing and Malware Attacks: Malicious actors can attempt to gain access to user accounts through phishing scams or by distributing malware disguised as legitimate applications. Users should be wary of suspicious links or downloads.

- Data Breaches: Compromised databases containing sensitive user information can lead to significant financial losses and reputational damage for the application and its users. This emphasizes the importance of strong encryption and secure storage.

- Insider Threats: Unauthorized access by employees or contractors with access to sensitive data can pose a serious risk. Access controls and regular security awareness training are vital.

Compliance with Regulations

Adherence to relevant regulations is critical to ensure the app’s legitimacy and avoid legal issues.

- Payment Card Industry Data Security Standard (PCI DSS): If handling payment card information, compliance with PCI DSS is mandatory. This standard Artikels specific security requirements for handling credit card data.

- General Data Protection Regulation (GDPR): Compliance with GDPR is crucial for handling user data within the European Union. This includes specific provisions regarding user consent, data minimization, and data security.

- Other Applicable Regulations: Other relevant regulations, such as those specific to the target market, may apply. Understanding and complying with these regulations is vital.

Building User Trust

Establishing user trust is essential for long-term success.

- Transparency: Clear communication about data handling practices builds trust. Provide users with straightforward explanations and demonstrate a commitment to protecting their data.

- Security Certifications: Obtaining relevant security certifications and displaying them prominently can build user trust.

- Customer Support: Provide responsive and helpful customer support for addressing security concerns and inquiries. This demonstrates a commitment to user safety and well-being.

Development Process and Timeline

The development of a mobile payment app requires a meticulous and phased approach, ensuring each stage is completed effectively and efficiently before proceeding to the next. A well-defined timeline, coupled with appropriate resource allocation, is crucial for successful project completion. This section Artikels the stages involved, the associated timelines, and the necessary resources.

Stages of Mobile App Development

The mobile payment app development process typically involves several key stages, from initial planning to final deployment and maintenance. These stages are interconnected and require careful coordination among various teams. Successful completion of each stage is essential for the smooth progression of the entire project.

- Planning and Design: This initial stage encompasses market research, competitor analysis, and the creation of detailed specifications for the app’s functionality, user interface (UI), and user experience (UX). A comprehensive understanding of the target audience, their needs, and technological constraints is critical to establishing a solid foundation for the development process.

- Development: This stage involves the actual coding and programming of the app based on the defined specifications. This phase requires skilled developers with expertise in mobile app development frameworks, programming languages, and database management systems. Thorough testing and debugging are essential at this stage to ensure the app’s functionality and stability.

- Testing: Comprehensive testing is crucial to identify and resolve any bugs or issues within the app. This stage involves various types of testing, including unit testing, integration testing, system testing, and user acceptance testing. Thorough testing helps ensure a high-quality user experience and avoids major problems after launch.

- Deployment: This stage involves releasing the app to the relevant app stores (e.g., Google Play Store, Apple App Store). Deployment procedures must be carefully planned and executed to ensure the app is accessible to users and that the process is seamless. Careful attention must be paid to compliance with app store guidelines.

- Maintenance and Updates: This stage encompasses ongoing maintenance of the app, including bug fixes, performance enhancements, and feature updates. User feedback and market trends should inform the content of updates and ensure the app remains relevant and useful.

Timeline for Development Stages

A realistic timeline is essential for managing expectations and ensuring the project is completed on time. The timeline should be adaptable to accommodate unforeseen challenges and potential delays. The exact duration for each stage will vary based on the complexity of the app and the resources available.

| Stage | Description | Timeline (Months) | Resources |

|---|---|---|---|

| Planning and Design | Market research, UI/UX design, specifications | 2 | Project Manager, UI/UX designers, Market Researchers, Business Analysts |

| Development | Coding, programming, API integrations | 4 | Mobile App Developers, Backend Developers, Quality Assurance (QA) Engineers |

| Testing | Unit, integration, system, and user acceptance testing | 2 | QA Engineers, Testers, User Groups |

| Deployment | App store submission, release | 1 | App Store Liaison, Marketing Team |

| Maintenance and Updates | Bug fixes, performance enhancements, feature updates | Ongoing | Developers, QA Engineers, Support Team |

Resource Requirements

The success of the project depends on the availability and allocation of appropriate resources. The key resources required for each stage are listed in the table above.

Support and Maintenance

Effective support and maintenance are crucial for the success of any mobile application. Robust mechanisms for addressing user issues, providing timely updates, and ensuring ongoing functionality are essential to maintain user satisfaction and achieve high user retention rates. This section Artikels the strategies for providing support and maintenance for the Tab mobile payment app.

Support Channels

The app will utilize a multi-faceted approach to support user queries. This comprehensive strategy aims to provide accessible and efficient solutions to diverse user needs.

- Dedicated Support Email Address: A dedicated email address will allow users to submit detailed inquiries regarding app functionality, troubleshooting, and account management.

- In-App Support Chat: A live chat feature within the app will enable users to interact directly with support agents, facilitating real-time assistance for resolving immediate problems.

- Frequently Asked Questions (FAQ) Section: A comprehensive FAQ section will address common user queries, offering readily available answers to frequently encountered issues.

- Social Media Support Channels: Active engagement on social media platforms will enable users to seek support and engage in discussions related to the app.

Maintenance Procedures

The maintenance of the Tab mobile payment app will follow a systematic process. This ensures the application remains stable, secure, and functional for all users.

- Regular Testing: Rigorous testing will be performed on a regular basis to identify and resolve any bugs or issues before they affect users.

- Security Audits: Periodic security audits will be conducted to ensure the app remains secure against potential vulnerabilities.

- Performance Monitoring: Performance monitoring tools will track app usage and identify potential bottlenecks or performance issues.

- Data Backups: Regular data backups will be taken to protect user data in case of system failures or unforeseen circumstances.

Update Process and Release Cycles

The app will follow a phased release approach for updates, mitigating potential risks to user experience.

- Phased Rollouts: Updates will be deployed in phases, allowing for thorough testing and identification of any issues before a complete rollout.

- Beta Testing: A beta testing program will be implemented to gather feedback from a select group of users before official releases.

- Version Control: Version control systems will be used to track changes and manage different versions of the app.

- Release Schedule: A clearly defined release schedule will ensure timely updates and maintain a consistent user experience.

User Issue Resolution

Effective issue resolution strategies are essential for maintaining user satisfaction. A multi-tiered approach will be implemented for diverse issues.

- Issue Tracking System: A centralized issue tracking system will log and categorize user reports, facilitating efficient prioritization and resolution.

- Priority Assignment: Priority levels will be assigned to user issues based on their severity and impact on users.

- Escalation Procedures: A clear escalation procedure will be defined for handling complex or critical issues that require higher-level intervention.

- Feedback Mechanisms: Users will be encouraged to provide feedback regarding their experience with the app, allowing for continuous improvement.

Frequently Asked Questions (FAQ)

This section provides answers to commonly asked questions about the app.

| Question | Answer |

|---|---|

| How do I reset my password? | Visit the ‘Account Settings’ section within the app and follow the on-screen instructions. |

| What are the supported payment methods? | The app supports various payment methods, including [list supported methods]. |

| How can I contact support? | You can contact support via email at [email address] or through the in-app chat feature. |

| How do I update the app? | App updates will be automatically downloaded and installed when available. |

Conclusive Thoughts

In conclusion, the development of a mobile payment app for tablets presents a unique opportunity to enhance the mobile payment experience, but also a set of considerable challenges. This paper has presented a comprehensive overview of the factors influencing the design, implementation, and future of such an application. A successful app must balance intuitive user experience with robust security measures, while effectively navigating the competitive market landscape. The future of tablet-based mobile payments hinges on the ability to meet these diverse demands.