Level up your accounting game with the mobile app for Wave accounting! This ain’t your grandma’s accounting software. Get ready to conquer invoices, expenses, and everything in between, all from your phone. Imagine effortlessly tracking income and expenses, managing customer accounts, and generating reports—all on the go. It’s like having a personal financial wizard in your pocket!

This comprehensive guide dives deep into the features, design, security, and integration of the mobile app for Wave accounting. We’ll explore everything from the user interface to future updates, providing a complete picture of this revolutionary tool. Get ready to see how this app can transform your workflow!

Introduction to Wave Accounting

Wave Accounting empowers small businesses with streamlined financial management, making complex tasks simple and accessible. Its intuitive design and affordable pricing model allow entrepreneurs to focus on growing their ventures rather than getting bogged down in tedious paperwork.

Wave Accounting’s core strength lies in its user-friendly interface and comprehensive suite of tools, designed specifically for the needs of small businesses. This enables business owners to track income, expenses, and manage their finances efficiently.

Core Features of Wave Accounting

Wave Accounting offers a suite of essential tools for small business accounting. These include invoicing, expense tracking, bank reconciliation, and reporting, all designed to simplify financial management. The platform also integrates with various other applications to further enhance its functionality and efficiency.

Target Audience for Wave Accounting

Wave Accounting caters to a wide range of small business owners, including freelancers, sole proprietors, consultants, and small business startups. Its affordability and user-friendliness make it accessible to individuals and teams with limited accounting experience. The platform is particularly well-suited for those seeking a cost-effective solution for managing their finances without the need for specialized accounting staff.

Benefits of Using Wave Accounting

Wave Accounting provides numerous benefits to small business owners. These include time savings through automated processes, reduced administrative overhead, improved financial visibility, and enhanced decision-making capabilities. By streamlining financial tasks, Wave Accounting allows entrepreneurs to dedicate more time to growing their business.

Typical Use Cases for Wave Accounting

Wave Accounting finds diverse applications in the realm of small business operations. It is often utilized for invoicing clients, tracking expenses, preparing financial reports, and managing payroll. For example, a freelance graphic designer might use Wave Accounting to send invoices, track client payments, and generate financial reports to assess their profitability.

Advantages of a Mobile App for Wave Accounting

A mobile app for Wave Accounting offers unparalleled convenience and accessibility. Small business owners can manage their finances on the go, anytime, anywhere, providing enhanced flexibility and control over their business operations. This is particularly valuable for those who work remotely or have a dynamic schedule.

Current Mobile App Landscape for Accounting Software

The mobile app landscape for accounting software is rapidly evolving. Many established players and new entrants are offering user-friendly mobile apps that provide on-the-go access to crucial financial data. These apps typically allow users to view transactions, create invoices, and track expenses in real-time, enabling real-time visibility into financial performance. This evolving landscape is driving innovation and making accounting more accessible and convenient for businesses of all sizes.

Mobile App Features for Wave Accounting

A robust mobile app for Wave Accounting empowers users to manage their finances seamlessly from anywhere, anytime. This empowers entrepreneurs and small business owners to stay on top of their financial picture, fostering efficiency and growth. The app’s design prioritizes ease of use and intuitive navigation, ensuring a positive user experience.

This section Artikels the key features of a Wave Accounting mobile app, focusing on essential functionalities for invoice and expense management, customer account creation, income/expense tracking, and comprehensive reporting and analysis. These features are designed to streamline the financial processes of small businesses, allowing for greater control and insight.

Invoice and Expense Management

Efficient invoice and expense management is crucial for small businesses. The mobile app should offer intuitive tools for creating, sending, and tracking invoices. This includes features for attaching documents, setting due dates, and receiving payments. Expense tracking should be equally straightforward, enabling users to capture receipts digitally, categorize expenses, and automatically sync with their Wave account.

Customer Account Management

Managing customer accounts effectively is vital for business success. The mobile app should allow users to view and update customer information, including contact details, billing addresses, and payment history. This streamlined approach allows for quick access to crucial customer data, facilitating personalized communication and efficient service.

Income and Expense Tracking

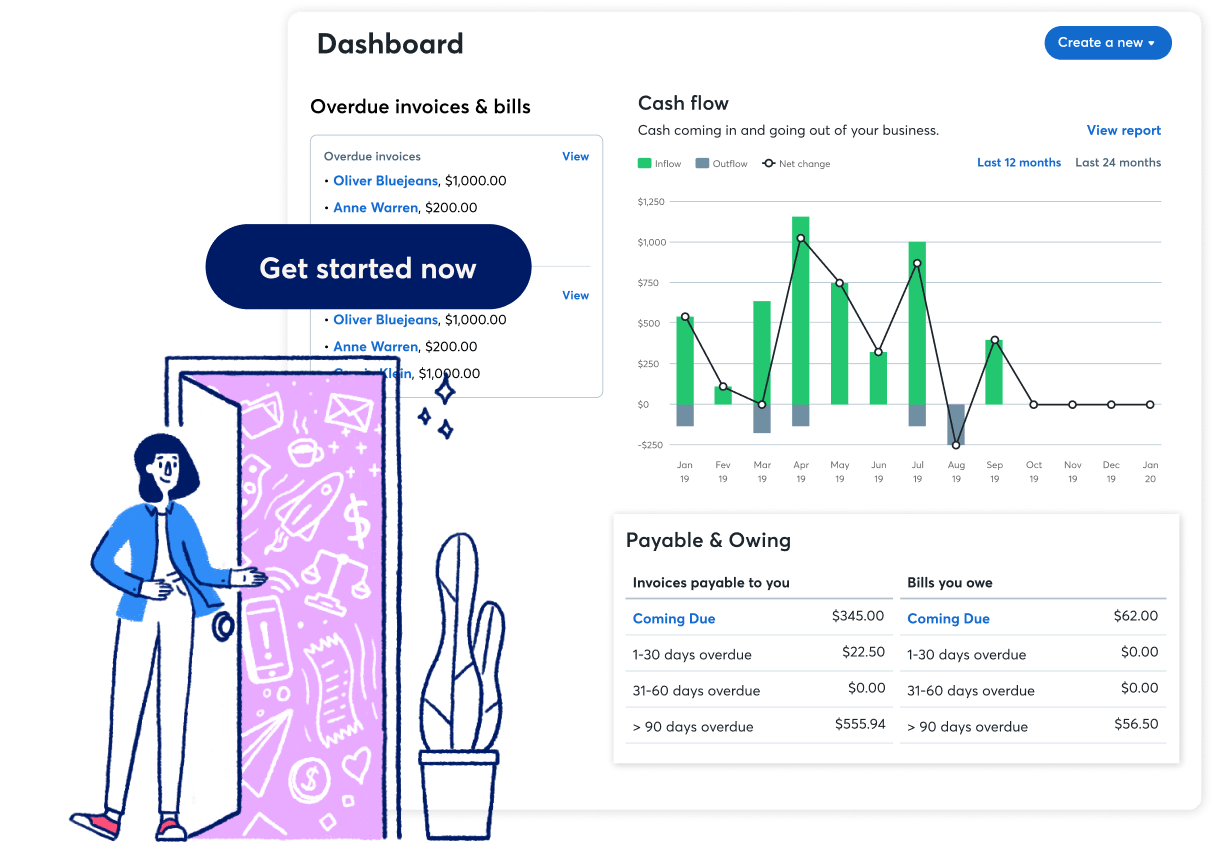

Accurate income and expense tracking is fundamental to financial health. The app should offer real-time updates on income and expenses, allowing users to monitor their financial performance at a glance. Categorization options should be readily available, enabling users to understand their spending patterns and revenue sources more effectively. Integration with bank accounts and credit cards will automatically update income and expense data, minimizing manual entry.

Reporting and Analysis

Comprehensive reporting and analysis are essential for informed decision-making. The mobile app should provide customizable reports, including profit and loss statements, balance sheets, and cash flow reports. Visualizations, like charts and graphs, should help users quickly grasp key financial trends and patterns. These insights can be used to identify areas for improvement, adjust strategies, and plan for future growth.

Features, Functionalities, and Importance

| Feature | Functionality | Importance |

|---|---|---|

| Invoice Creation & Tracking | Create, send, track invoices, attach documents, set due dates, receive payments | Streamlines invoicing process, ensures timely payments, and improves cash flow. |

| Expense Tracking | Capture receipts digitally, categorize expenses, sync with Wave account | Provides accurate expense records, aids in expense management, and improves financial reporting. |

| Customer Account Management | View and update customer information, contact details, billing addresses, payment history | Facilitates personalized communication and efficient service, enhances customer relationship management. |

| Income/Expense Tracking | Real-time updates, categorization options, integration with bank accounts/credit cards | Provides a clear view of financial performance, helps understand spending patterns, and minimizes manual data entry. |

| Reporting & Analysis | Customizable reports (profit/loss, balance sheet, cash flow), visualizations (charts/graphs) | Supports informed decision-making, identifies trends and patterns, facilitates strategic planning. |

User Experience and Interface Design

Empowering users with a seamless and intuitive mobile accounting experience is paramount. A well-designed Wave Accounting mobile app fosters financial confidence and efficiency, making complex tasks straightforward. This focus on user-friendliness translates directly to increased user satisfaction and engagement.

A meticulously crafted user interface (UI) and user experience (UX) are essential for a successful mobile app. This section delves into the ideal user experience for the Wave Accounting mobile app, highlighting key design principles and practical navigation strategies. We will also explore how the app can be made accessible to a diverse range of users, including those with disabilities.

Ideal User Experience

The ideal user experience for the Wave Accounting mobile app centers on intuitive navigation, quick access to crucial information, and a visually appealing design. Users should be able to effortlessly manage their finances, from recording transactions to generating reports, all within the app’s secure and user-friendly environment. The experience should be positive, encouraging users to adopt the app for their daily financial management needs.

UI/UX Design Principles

A strong foundation in UI/UX principles is crucial for creating a valuable and impactful mobile app. These principles guide the design process, ensuring a seamless and enjoyable user journey.

- Intuitive Navigation: Navigation should be straightforward and predictable, allowing users to quickly locate the functions they need. Clear labeling and consistent placement of buttons and menus are key.

- Visual Appeal: The app’s visual design should be aesthetically pleasing and easy on the eyes. Consistent color schemes, fonts, and imagery create a cohesive and professional feel.

- Accessibility: The app must be accessible to users with disabilities. This includes providing sufficient color contrast, alternative text for images, and support for screen readers.

- Efficiency: The app should streamline tasks, minimizing steps required for common actions. This reduces user frustration and promotes efficiency.

- Security: Ensuring the security of financial data is paramount. Robust security measures should be implemented to protect sensitive information.

Navigation

The app’s navigation should be logically structured, guiding users effortlessly through various functionalities. Clear labels and intuitive icons are crucial for seamless navigation.

- Homepage: The homepage should provide a quick overview of key financial information, such as recent transactions, upcoming payments, and balances. This dashboard should be highly customizable to tailor the information presented to each user’s needs.

- Transaction Recording: The transaction recording process should be straightforward, allowing users to quickly enter details, including date, description, amount, and category. Smart suggestions and auto-fill features are recommended to reduce input time.

- Reporting: The app should offer various reporting options, allowing users to generate customized reports on income, expenses, and other financial metrics. Clear filters and sorting options should be available.

Comparison with Similar Apps

Examining existing mobile accounting apps reveals a variety of approaches to UI and UX. Some apps prioritize simplicity, while others offer extensive customization. Analyzing these different styles provides insights into optimal design choices for the Wave Accounting mobile app.

| App | Navigation Menu | Strengths | Weaknesses |

|---|---|---|---|

| App A | Tab-based menu | Intuitive and easy to navigate | Limited customization options |

| App B | Hierarchical menu | Extensive reporting options | Steeper learning curve |

| App C | Combination of tab and hierarchical menu | Good balance of simplicity and customization | Potentially more complex navigation |

Accessibility Considerations

A key aspect of the Wave Accounting app is ensuring accessibility for users with diverse needs. Features like screen reader compatibility and high color contrast are essential to provide a positive experience for all users.

- Screen Reader Compatibility: The app should be fully compatible with screen readers, allowing users with visual impairments to navigate and interact with the app effectively.

- Color Contrast: Ensure sufficient color contrast between text and background elements to support users with low vision.

- Keyboard Navigation: The app should be fully navigable using a keyboard, providing an alternative input method for users with limited mobility.

Security and Data Management

Protecting your financial data is paramount. Wave Accounting’s mobile app prioritizes robust security measures to safeguard your sensitive information, ensuring peace of mind as you manage your business on the go. This comprehensive approach combines advanced encryption techniques with user-friendly controls, providing a secure and reliable platform for all your accounting needs.

Our commitment to your data security goes beyond simply meeting industry standards. We proactively implement and maintain the latest security protocols to protect your valuable financial information from unauthorized access, misuse, and data breaches.

Security Measures for Mobile App Data

The Wave Accounting mobile app employs a multi-layered security architecture. This architecture incorporates encryption at rest and in transit, ensuring your data remains confidential throughout its lifecycle. Access control mechanisms are implemented to restrict unauthorized access to sensitive information, and regular security audits are conducted to identify and address potential vulnerabilities. These proactive measures ensure the integrity and confidentiality of your data.

Data Privacy and Security

Data privacy and security are paramount. The app adheres to stringent data privacy regulations, such as GDPR and CCPA, ensuring compliance with global standards. Transparent data handling policies are clearly communicated to users, outlining how their information is collected, used, and protected. User consent is obtained for all data processing activities, empowering users with control over their information.

Importance of Data Backups

Regular data backups are crucial for business continuity. The app features automatic, encrypted backups, providing a safety net against data loss due to device malfunctions, software errors, or accidental deletions. These backups are stored securely, providing a readily accessible copy of your financial data, minimizing disruption and ensuring your business can recover quickly from unforeseen circumstances.

Handling Sensitive Financial Information

The app utilizes industry-standard encryption methods to safeguard sensitive financial information, such as transaction details, account balances, and tax data. All data transmission between the app and the Wave Accounting servers is encrypted, preventing unauthorized interception. Access to sensitive data is restricted to authorized personnel, with stringent authentication protocols in place to protect against unauthorized access.

Data Protection and Encryption Procedures

Robust data protection and encryption procedures are fundamental to the app’s security. All data is encrypted both at rest and in transit, using industry-leading encryption algorithms. Data access is restricted based on user roles and permissions, ensuring only authorized personnel can access specific information. Regular security updates are deployed to address any potential vulnerabilities and maintain the highest level of protection.

Security Protocols and Their Benefits

| Security Protocol | Benefit |

|---|---|

| End-to-End Encryption | Guarantees that only the intended recipient can access the data, even if intercepted. |

| Multi-Factor Authentication (MFA) | Adds an extra layer of security by requiring multiple forms of verification, significantly reducing the risk of unauthorized access. |

| Regular Security Audits | Proactively identifies and mitigates potential vulnerabilities, ensuring the ongoing protection of sensitive data. |

| Data Loss Prevention (DLP) | Prevents sensitive data from leaving the system or being accessed inappropriately, further enhancing security. |

Integration with Other Services

Unlocking the full potential of your Wave accounting experience hinges on seamless integration with other vital services. By connecting Wave to your existing tools, you streamline your workflow, minimize manual data entry, and gain a comprehensive view of your financial picture. This interconnected approach fosters efficiency, saving you valuable time and resources.

Importance of Integration

Integration with other services is crucial for a modern, efficient accounting process. It allows for automated data exchange, reducing the risk of errors and freeing up your time for more strategic tasks. Real-time data updates across platforms offer a more accurate and up-to-date financial overview. This improved visibility empowers informed decision-making.

Potential Integrations for the Wave Mobile App

The Wave mobile app can seamlessly integrate with various services to enhance your accounting experience. Potential integrations include popular payment processors, bank accounts, inventory management systems, and CRM platforms. These integrations streamline workflows and provide a more comprehensive financial picture.

Integrating with Payment Processors

The app should offer a secure and straightforward process for connecting with your payment processors. This will enable automatic syncing of transaction data, eliminating manual entry and ensuring accuracy. A user-friendly interface will guide users through the integration process, minimizing any friction. For example, connecting to Stripe or PayPal would automatically import transactions into the Wave app.

Connecting to Bank Accounts

The app will offer secure bank account connection options. This will allow for automatic syncing of transactions, reducing manual data entry and increasing accuracy. The app should adhere to industry-standard security protocols to protect sensitive financial information. A step-by-step guide and clear instructions will help users connect their accounts with ease. Consider providing different options for bank account connection, such as direct connection through APIs or manual import via file upload.

Syncing Data from Other Platforms

The Wave app should handle data syncing from other platforms efficiently and reliably. This will maintain a unified view of your financial information, reducing the risk of discrepancies and facilitating comprehensive financial reporting. This data syncing will ensure all financial data is up-to-date across platforms. For example, if a user is using a project management tool that also tracks expenses, the Wave app can pull this expense data to automatically update the accounting records.

Integration Options and Benefits

| Integration Option | Benefits |

|---|---|

| Payment Processors (Stripe, PayPal, Square) | Automated transaction import, reduced manual entry, real-time transaction updates. |

| Bank Accounts (Various Banks) | Automatic transaction import, improved accuracy, real-time financial updates. |

| Inventory Management Systems (e.g., Shopify, WooCommerce) | Automated inventory tracking, simplified cost accounting, real-time inventory updates. |

| CRM Platforms (e.g., Salesforce, HubSpot) | Automated customer data integration, enhanced customer relationship management, real-time customer insights. |

Mobile App Performance and Optimization

Unlocking a superior mobile experience for Wave Accounting requires a laser focus on performance and optimization. A fast, responsive, and intuitive app builds user trust and fosters a positive relationship with the platform, ultimately driving engagement and adoption. A well-optimized app seamlessly integrates into users’ workflows, allowing them to manage their finances effortlessly.

A streamlined and efficient mobile app enhances the user experience, allowing users to access critical information and complete tasks quickly and reliably. This translates to greater user satisfaction and a stronger brand image.

Optimizing for Speed and Responsiveness

Ensuring swift loading times and smooth interactions is paramount. This is achieved through careful code optimization, strategic caching techniques, and efficient data handling. Employing appropriate algorithms and data structures can significantly impact performance. For instance, pre-fetching frequently accessed data can reduce latency and improve the overall user experience.

Seamless User Experience

A seamless user experience is critical to maintaining user engagement. This encompasses intuitive navigation, clear visual design, and consistent feedback mechanisms. A well-designed app should guide users effortlessly through tasks, providing a clear path to achieve their financial goals.

Ensuring App Functionality Across Devices

To reach a broad user base, the app must be compatible with various devices and operating systems. Comprehensive testing across different screen sizes, resolutions, and operating systems is crucial. This ensures that the app functions flawlessly on a wide array of devices, providing a consistent user experience.

Handling Large Datasets Efficiently

Managing large datasets in a mobile environment requires careful consideration. Efficient database querying and data compression techniques are vital. This includes using appropriate data structures, optimizing database queries, and utilizing effective caching strategies. These measures ensure that users can access and process large amounts of data without experiencing lag or slowdowns. The app should be designed to handle data volumes realistically expected in the user’s environment. For example, an app for a small business might not need the same level of sophistication in data handling as an app for a large enterprise.

Reducing Loading Times

Minimizing loading times enhances the user experience significantly. Employing techniques such as asynchronous loading, efficient image compression, and intelligent caching can significantly reduce the time it takes for the app to load. For example, images can be pre-loaded or compressed to reduce their size, minimizing the time it takes for the app to display them. Using a content delivery network (CDN) can help serve content from servers closer to the user, further reducing loading times.

Intuitive Design for Diverse Devices and Operating Systems

Designing an intuitive mobile app that is easily accessible on various devices and operating systems requires careful consideration of user needs and accessibility standards. This includes using consistent design elements, clear labeling, and intuitive controls. This approach fosters ease of use across a variety of devices and operating systems. Ensuring compatibility across platforms, like iOS and Android, is critical.

Future Considerations

Wave’s mobile app has the potential to revolutionize small business accounting. By proactively considering future trends and user needs, Wave can continue to be a leader in this dynamic field. Embracing emerging technologies and adapting to evolving user expectations will ensure the app remains a valuable tool for entrepreneurs and small business owners.

Future development will focus on enhancing the user experience, expanding functionalities, and leveraging cutting-edge technologies. This will empower Wave users to manage their finances with greater efficiency and confidence. A commitment to innovation will solidify Wave’s position as a critical resource for small business success.

Potential Future Features

The Wave mobile app can be further enhanced by incorporating a wider range of features that address diverse business needs. Consideration of innovative functionalities is crucial for sustained user engagement and satisfaction.

- Automated Expense Categorization: A sophisticated AI-powered expense categorization system can automatically analyze transactions and categorize them based on predefined rules. This feature will save time and reduce manual data entry, increasing accuracy and efficiency.

- Advanced Reporting and Analytics: Enhanced reporting features with interactive dashboards and customizable visualizations will empower users to gain deeper insights into their financial performance. This will help them make data-driven decisions.

- Integrated Budgeting and Forecasting: The ability to create and track budgets, forecast future expenses and revenue, and compare actual results to projections will allow users to better manage their cash flow and financial stability. This will be a significant asset in their business planning.

- Collaboration Tools: Features that facilitate collaboration with accounting professionals or business partners, enabling secure file sharing and real-time updates, will significantly enhance teamwork and improve communication.

- Offline Functionality: Enabling offline access to key data and functions will ensure continued usability in areas with limited or no internet connectivity, enhancing accessibility and convenience.

Adapting to Emerging Technologies

Keeping pace with technological advancements is crucial for the app’s long-term viability. Integrating innovative technologies will enhance user experience and improve the app’s functionality.

- Blockchain Technology: Exploring the potential of blockchain for secure and transparent financial transactions, while maintaining user privacy, could be a game-changer for accounting. This would add an extra layer of security and transparency to the accounting process.

- Artificial Intelligence (AI): Continued development of AI-powered features can further automate tasks, improve data accuracy, and provide personalized financial insights. This will allow the app to proactively identify trends and patterns within the user’s financial data.

- Machine Learning (ML): ML algorithms can analyze user data to predict future financial needs, suggesting optimal strategies for growth and expansion. This can help users proactively manage their finances and stay ahead of potential issues.

Evolving with Industry Trends

The accounting industry is constantly evolving, requiring the app to adapt to changing demands. Understanding and responding to these trends will be essential for success.

- Cloud Computing: Wave’s app should continue to leverage cloud computing to ensure seamless access to data and efficient updates. The app should leverage cloud storage and scalability to accommodate growing user bases and expanding data volumes.

- Mobile-First Approach: The mobile-first approach should remain a priority, ensuring a seamless and intuitive user experience across various mobile devices. This ensures the app remains easily accessible and adaptable to the increasing use of mobile devices in the accounting industry.

- Focus on User Experience (UX): Continual improvements to the user interface (UI) and user experience (UX) are crucial for user satisfaction and adoption. This should prioritize intuitive navigation and clear information presentation.

Future Feature Considerations

A detailed list of potential future features, categorized for clarity, will aid in strategic planning.

| Feature Category | Feature | Description |

|---|---|---|

| Financial Management | Automated Invoice Processing | Automating the process of receiving and processing invoices, significantly reducing manual effort and improving accuracy. |

| Collaboration | Secure File Sharing | Enabling secure sharing of financial documents and reports with other users. |

| Reporting and Analytics | Predictive Analytics | Utilizing ML algorithms to predict potential financial risks and opportunities, providing proactive insights for informed decision-making. |

| Security | Two-Factor Authentication | Implementing two-factor authentication for enhanced security and protection of user accounts. |

Closing Summary

So, ditch the clunky desktop software and embrace the future of accounting with the mobile app for Wave accounting. This app is designed to be intuitive, secure, and packed with features that will make your financial life easier. From managing invoices to generating reports, this app is your one-stop shop for all things accounting. Ready to experience the next level of financial freedom?